The BFSI or Banking and Financial Services Industry is one of the most highly regulated and monitored sectors in the world. The fact that money and other financial instruments are involved means that security, accuracy, and efficiency are at the forefront in terms of basic requirements for any tool to qualify for this industry. Unfortunately, efficiency has always taken a back seat to accuracy and security. The accuracy part comes from the accounting aspect of the work that banks and financial institutions do on a daily basis, while the security part comes from dealing with the personal financial information of millions of people. Therefore, it's understandable that efficiency has been pushed to the background.

That being said, in our current era of digital transformation, efficiency has quickly gained importance and is now possibly equal to all other considerations. With the emergence of non-banking financial institutions, microfinancing, online payment platforms, and other innovations, competition is tight, and it is rapidly becoming crucial for the finance world to be as efficient as possible. Part of this efficiency drive is now being accomplished through the digitization of paper workflows. This article looks at a specific niche area within this transformational scenario, it's called OCR or Optical Character Recognition and OCR is critical for BFSI.

But first, we need to understand what OCR actually is and how it works, along with a brief history of how OCR was developed and evolved through time.

What is OCR or Optical Character Recognition?

The concept behind OCR is very simple, but the process itself is quite complex. In essence, OCR works by recognizing patterns of light and dark backgrounds that are represented by characters printed on paper using ink and other mediums. But that's oversimplifying the process. OCR goes well beyond that by stringing together these recognized patterns and reproducing them in an electronic format that can then be edited and manipulated in other ways.

OCR has evolved a lot over the past century (yes, a whole century - you'll read about it in the next section!) It went from a simple analyzer that could recognize just a handful of fonts to becoming a powerful conversion tool that can read virtually anything that's printed on paper. This evolution has allowed it to serve other purposes as well, such as being used for text-to-speech or TTS applications for the visually impaired.

Today, it is at the forefront of digitization and moving to a paperless environment, helping innumerable industries do away with physical paper by converting everything into their electronic equivalents. OCR today is highly accurate and dependable, with very little need for human intervention.

A Brief History of OCR

Interestingly, OCR is not a newly developed technology. In fact, it's been around for more than 100 years! Emanuel Goldberg was the man who first thought of the idea. His implementation was crude but highly advanced for its time. The gist of his "Statistical Machine" was that it could recognize characters on rolls of microfilm and convert them into telegraphic code. In fact, he went a step further and created a document retrieval system for electronic use. It was the first of its kind at the time.

Incidentally, around the same time, banks and businesses were using microfilm to digitize financial records for their clients, customers, vendors, and suppliers. However, fetching old records was a time-consuming process that required intense manual effort. Goldberg solved this problem using a movie projector that he repurposed as a search tool. OCR was finally born! IBM later bought his U.S. patent for this technology, and the rest, as they say, is history.

Why is OCR a Critical Component of Banking and Financial Services?

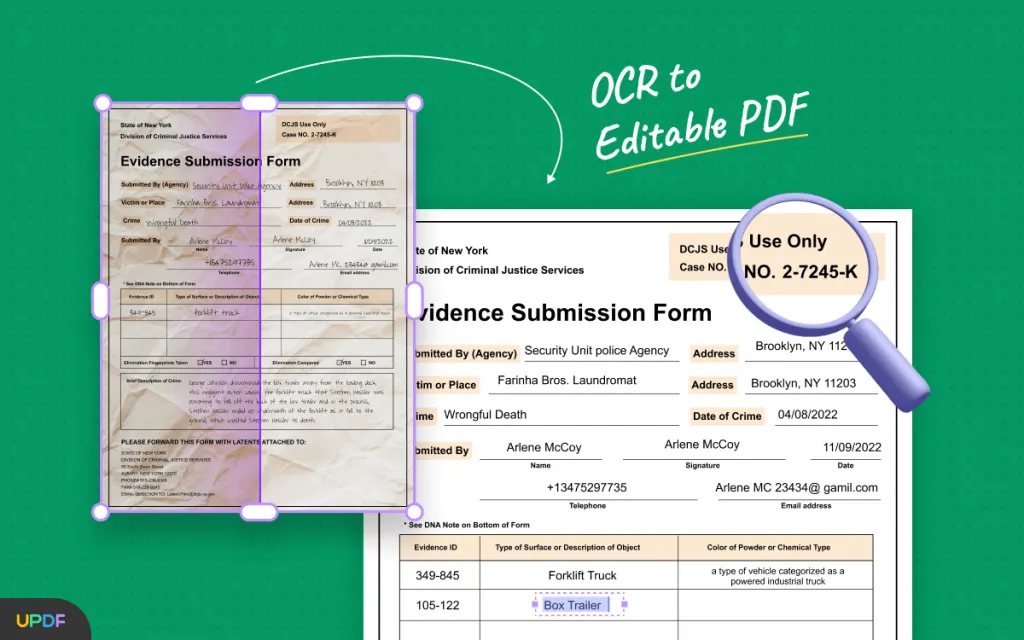

OCR is simply a way to convert non-digital documents into digital ones that can be manipulated by software. The upstream aspect of this is scanning to PDF, where physical documents are captured as electronic versions so they can be stored more efficiently, shared securely, and made available to a number of users who have the appropriate rights and permissions. Physical documents can be secured, obviously, but it is far more efficient (in terms of money and effort) to secure digital files. But there's also a challenge here. The content inside a scanned PDF file cannot be controlled in any way. And that's where OCR plays a very important role.

How OCR Transformed Banking and Finance

OCR doesn't get much credit for what it does, but it is an integral and indispensable part of the banking and financial system of the world. It is used for several purposes:

- Document Retrieval Systems - OCR can convert scanned or photographed (image-based) documents into a machine-readable format that can be used to search for specific content within those files. This is essential to document archives where thousands or even millions of records are stored in a way that makes them searchable using keywords or keyphrases. Financial records are now just a few clicks and keyboard strokes away, making the entire system more efficient and fully transparent - while helping to maintain and comply with the intense security levels demanded by regulatory authorities.

- Modifying Scanned Files - OCR is the first step to editing such documents. Once they are converted into a format that can be read by software applications, it's easier to modify the underlying data. There are several PDF editors that can do this, such as UPDF, a PDF editor, which can not only edit PDFs but also be used to annotate them and organize a document's pages (add, remove, replace, rotate, reorder, and extract.)

Windows • macOS • iOS • Android 100% secure

These activities are now a standard part of any banking or business document workflow and serve various purposes such as record-keeping, digitization, etc. But the most important consideration is that it is increasingly leading us to a paperless world by forming a bridge between physical documentation and electronic records management. As such, OCR has been among the most revolutionary technologies that have helped digital transformation long before "the new normal" made this a crucial consideration.

OCR Today

Modern OCR and ICR (Intelligent Character Recognition, which uses Artificial Intelligence algorithms to recognize complex patterns) are critical components in the world of banking and finance in today's era. Physical document workflows are periodically (sometimes daily or even several times a day) converted into electronic equivalents that are more suitable for long-term archival. There's also the added benefit of such converted documents being editable, which means you can modify the information on a file that has gone through the OCR process. Let's look at some of the scenarios where OCR is most prominently used in today's world of finance and banking.

- Big Data - Modeling large amounts of data requires everything to be in an electronic format so various software applications can read and organize them according to complex algorithms. None of this is impossible with the use of OCR, so it serves as a necessary first step for the purpose of data mining and management.

- Regulatory Compliance - The banking and financial services industry is one of the most highly regulated sectors in the world, as we mentioned earlier. In order for regulators to work efficiently with millions upon millions of data points, digitization is mission-critical. Manually reviewing image-based files is no longer an option because of the sheer manpower that would be required to do this. OCR makes it easy for documents to be managed, archived, and audited.

- Standardization - Since financial records come in a variety of forms, it's not always easy to categorize them or organize them in a way that makes data retrieval easy. OCR helps create a standard format where data can be electronically analyzed, organized, and indexed. This makes it much easier for different document types to be compared. For example, comparing data from tax forms against bank records is much more efficient and simpler once they have been processed with an OCR application.

After OCR - What Then?

Once documents are digitized and converted into searchable or editable forms, they can be further manipulated using a PDF editor such as UPDF or Acrobat. UPDF handles BFSI PDF workflows in the cost effective price - US$39.99 for annual fee, and US59.99 for perpetual plan. Documents can be organized, annotated, and edited with UPDF, making it worth the effort to convert scanned documents into editable ones. Here's an overview of what UPDF currently offers:

Windows • macOS • iOS • Android 100% secure

- PDF Editing: Control the elements of any editable PDF file using the UPDF PDF editor for Windows and Mac. You can edit text, images and links within a PDF file, and all it takes to complete any action is a few clicks of your mouse.

- Annotations: Financial documents are often marked up for various purposes before being shared with authorized personnel. UPDF offers a full range of annotation tools such as text markups (highlighting, underlining, etc.), shapes, freehand drawing, stamps, and much more.

- PDF Organizing: You can easily extract pages, reorder them, replace them, add or delete them, and perform other actions that make it easy to handle PDF files.

Final Thoughts

OCR is undoubtedly the unsung hero of modern digital transformation. Without it, millions of businesses, including banks and other financial institutions will still be struggling with paper workflows and massive archival rooms to store physical documents. But in the banking world, it has revolutionized document-based processes by making workers more productive and systems more efficient overall. Thanks to OCR and AI, and applications such as UPDF, banks can now streamline their workflows and process documents much faster than before, and added benefits include document security, user authentication, faster communication, and overall a much more efficient banking system are far more better than the one with our parents and grandparents were used to.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF Scholar Research

Scholar Research Paper Search

Paper Search AI Proofreader

AI Proofreader AI Writer

AI Writer AI Homework Helper

AI Homework Helper AI Quiz Generator

AI Quiz Generator AI Math Solver

AI Math Solver PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Lizzy Lozano

Lizzy Lozano

Enya Moore

Enya Moore

Delia Meyer

Delia Meyer

Engelbert White

Engelbert White

Enola Davis

Enola Davis