Accountants who have been wishing for a tool that could make accounting easier and faster, well, their wish has just come true with ChatGPT for accounting. Saying that this innovative AI technology is set to revolutionize the accounting field, making it more productive than ever before. This tool combines the capabilities of AI and automation to assist accountants in their day-to-day tasks.

This enables accountants to streamline their workload more fluently. Here, in this detailed guide, we will explore various ways ChatGPT can simplify the often tedious accounting tasks. We will also jump into real-life examples to showcase how this technology can help with communication and strengthen the accountant-client relationship.

Part 1. 10 Ways You Can Use ChatGPT for Accounting

When accountants use ChatGPT in their work, they can take advantage of its abilities to help with tasks like looking at data, generating financial reports, and making decisions. Using ChatGPT in accounting has many advantages, and we will discuss some ways of using it.

1. Deal with Financial Documents Easily

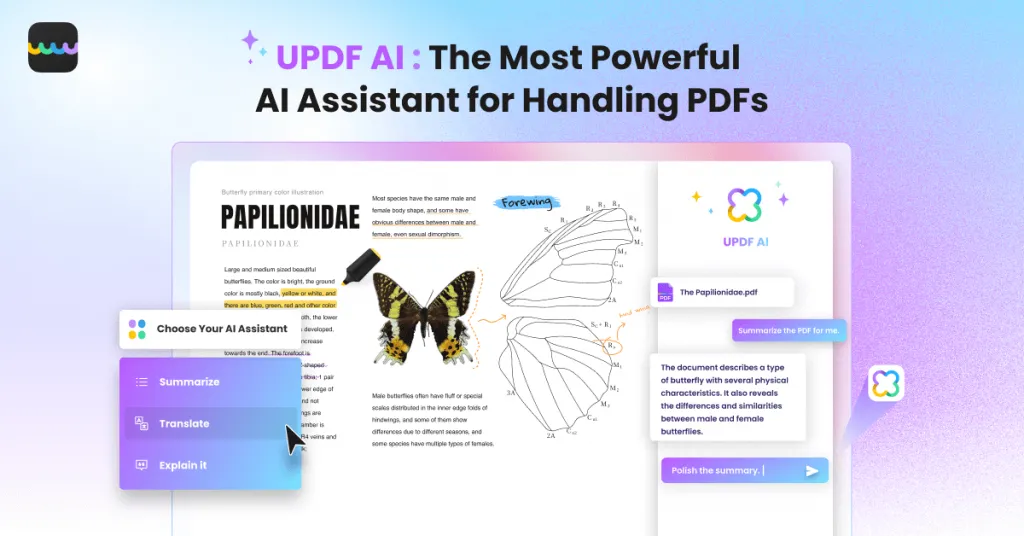

You can use ChatGPT to deal with financial documents easily and as most of accounting documents are in PDF format, it is better to have one PDF editor with ChatGPT integrated. For that case, you can have UPDF.

UPDF is a powerful tool that integrates ChatGPT to assist accountants in various ways. One useful feature of UPDF AI is the ability to translate PDFs that in a foreign language. Let's say you are working on a project with a client who has sent you a document in a language you need help understanding. With the integration of ChatGPT, you can ask ChatGPT to translate it for you.

Windows • macOS • iOS • Android 100% secure

Another advantage of using ChatGPT in UPDF is its ability to explain technical accounting terms. Sometimes, you may encounter complex financial jargon or unfamiliar concepts in your work. By utilizing ChatGPT, you can ask it to provide explanations. This feature ensures that you better understand the terminology and can confidently navigate through your accounting tasks.

In addition, UPDF PDF Editor allows you to summarize lengthy and detailed reports. Instead of spending hours reading through extensive documents, you can use ChatGPT to extract key information and generate concise summaries.

What's more? You can use UPDF in accounting for the following tasks:

- Save receipts in PDF/A format for long-term archive.

- Accountants usually need to print the invoice in daily work. UPDF offers the batch processing feature to batch print invoices at one time.

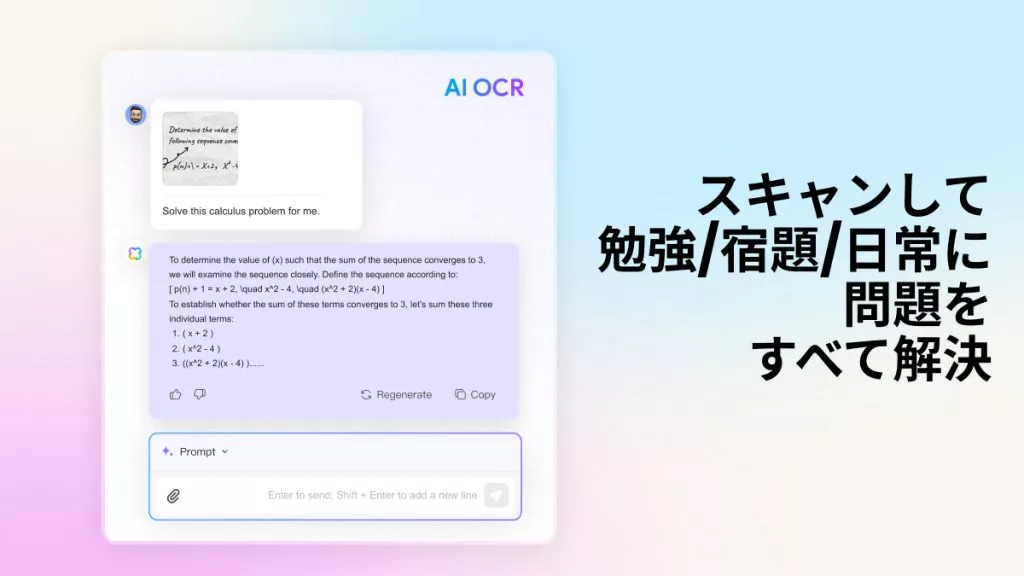

- The OCR feature is crucial for accountants, and you can convert scanned financial PDFs to Excel spreadsheets to get data easily.

2. Financial Data Analysis

ChatGPT can assist in analyzing financial data to evaluate a company's performance. For example, you can provide it with historical financial statements, and it can identify trends, calculate key financial ratios, and compare them to industry benchmarks. It can also highlight areas of concern or improvement, such as declining profit margins or increasing debt levels.

We can take an example of a business owner who wants to understand his company's financial health. He can provide ChatGPT with the past three years' financial statements, and GPT will generate a detailed analysis of key financial metrics, highlighting areas of strength and potential weaknesses.

3. Budgeting and Forecasting

This AI tool helps create forecasts by considering historical data, market conditions, and relevant factors. It can help you identify seasonality, predict future revenue and expenses, and recommend budget adjustments. By incorporating ChatGPT's insights, you can create more accurate budgets and make informed financial decisions.

A department manager needs to create a budget for the upcoming year. Provide ChatGPT with historical sales data, anticipated market conditions, and proposed initiatives. GPT will analyze the information, generate a forecast, and suggest appropriate budget allocations for various expense categories.

4. Transaction Classification and Recordkeeping

While classifying transactions, ChatGPT for accounting can assist in maintaining and organizing them. It can provide guidance on proper categorization and coding, ensuring accurate financial reporting and compliance with accounting standards. Additionally, ChatGPT can answer queries related to general ledger entries, account reconciliations, and other bookkeeping tasks.

Like, an accountant needs help to classify a particular transaction correctly. He should provide ChatGPT with details about the transaction, and ChatGPT guides the appropriate method to use based on its understanding of accounting principles.

5. Financial Reporting

This tool can help generate financial reports, such as profit and loss statements, balance sheets, and cash flow statements. When ChatGPT is fed with the necessary inputs, it can generate reports in predefined templates or formats, saving time and effort in manual report preparation. For example, your finance team must produce monthly financial reports for management.

Instead of manually compiling the data, they can fill ChatGPT with the required financial information, and it will generate the reports in the desired format, including charts and graphs for visual representation.

6. Tax Preparation Support

ChatGPT can assist in tax preparation by guiding tax regulations, deductions, and credits. It can help individuals or businesses identify potential tax-saving opportunities, review tax forms for accuracy, and ensure compliance with relevant tax laws. It turns out to be helpful if taxpayers want to ensure they are maximizing their deductions and credits while preparing tax returns.

They can use ChatGPT for accounting for their financial information, and it will suggest potential deductions and credits based on the situation, helping them optimize their tax position.

7. Reviewing and Analyzing Audit Trail

ChatGPT helps out auditors by reviewing audit trail data and performing preliminary analysis. It can identify unusual transactions, patterns, or anomalies, helping auditors focus on areas that may require further investigation. An internal auditor must review a large volume of transactional data for potential irregularities.

Simply, he can feed ChatGPT with the data, and this will analyze the information, highlighting transactions with potential red flags or abnormalities for the auditor's attention.

8. Analyzing Cost Structure

Assists in cost analysis by evaluating a company's cost structure, identifying cost drivers, and suggesting cost-saving opportunities. It can help analyze the profitability of products or services, identify areas of cost overruns, and recommend strategies for cost optimization. A manufacturing company wants to identify areas of inefficiency and reduce costs.

The responsible one can input ChatGPT with cost data for different production processes. Now, ChatGPT accounting will generate the data, highlight high-cost processes and provide recommendations to streamline operations and reduce expenses.

9. Evaluating Financial Risks

This robust AI tool assesses financial risks by analyzing market conditions, industry trends, and financial data. It can provide insights into potential risks, such as liquidity issues, market volatility, or credit risks. Thus, helping businesses make informed risk management decisions.

Suppose your boss wants to assess the risk of investing in a particular market or industry. He gently asks you to fill ChatGPT with relevant data and market information. ChatGPT analyzes the data, assessing the potential financial risks associated with the investment.

10. Financial Decision Support

It can assist in evaluating investment options by considering financial metrics, risk factors, and qualitative information. It can provide insights on potential returns, risks, and long-term viability, helping decision-makers make informed investment choices. In addition, an investor wants to evaluate two investment opportunities.

ChatGPT accepts both projects with financial projections, market analysis, and other relevant data. After that, ChatGPT compares the options, considers factors such as return on investment and risk, and provides an analysis to support the decision-making process.

Part 2. Benefits and Limitations of ChatGPT in Accounting

As it is important to recognize the benefits and limitations of ChatGPT for accounting. Even after it provides valuable assistance and support, human expertise and professional judgment remain crucial in complex accounting tasks. But still, let's look at some of the benefits and limitations of this AI tool.

Benefits

- Assistance with Accounting Tasks: Provides assistance with routine accounting tasks such as data entry, calculations, and generating financial reports. It can help save time and improve accuracy by automating repetitive tasks.

- Quick Access to Information: ChatGPT has been trained in vast accounting knowledge and can answer common accounting queries quickly. It can provide definitions, explanations, and guidance on various accounting principles and practices.

- Decision Support: The tool assists accountants in making informed decisions by analyzing financial data and providing insights. It can help identify trends, patterns, and potential risks by analyzing large sets of financial information.

- Enhanced Customer Service: Improves customer service by promptly answering queries and providing support. It can handle basic inquiries, such as account balances or transaction details, allowing accountants to focus on more complex tasks.

Limitations

- Lack of Industry-Specific Knowledge: You may need deep industry-specific knowledge or expertise. It may need help understanding complex accounting scenarios or regulations. That is specific to certain industries. Therefore, it is essential to use its responses as general guidance.

- Limited Contextual Understanding: Generates responses based on patterns learned from the training data, but it may only sometimes fulfill the full context of a conversation. It can sometimes provide inaccurate or misleading answers if the question is ambiguous or lacks necessary details.

- Risk of Incorrect Information: While ChatGPT strives to provide accurate information, it can occasionally generate incorrect or outdated responses. Its responses are based on patterns in the training data, and it may need to be made aware of recent changes in accounting standards or regulations.

- Ethical Considerations: This tool should differ from human judgment or ethical decision-making in accounting. It needs to have the ability to understand ethical implications. Accountants should maintain their ethical responsibilities and use ChatGPT for accounting as a supplementary resource.

Part 3. The Future of ChatGPT in Accounting

In the future, ChatGPT has the potential to make the lives of accountants easier. It can help with tasks like creating formulas for programs that can assist with accounting transactions and even basic coding. However, this means accountants can spend less time on routine tasks and more time on making important decisions. With accurate input, ChatGPT accounting can also simplify financial reporting.

It can predict sales and determine balances for specific periods. However, it is important to note that an expert should check any accounting data assembled by ChatGPT for accuracy. While GPT offers a useful dataset for tax research, it still needs comprehensive accounting information. Although ChatGPT is yet to be a rival to financial managers or accountants, it is a valuable tool that can simplify certain tasks.

Part 4. FAQs on ChatGPT for Accounting

1. Can you use ChatGPT for accounting?

You can absolutely use ChatGPT for accounting. It's a helpful tool that can assist you with various accounting tasks and provide valuable insights.

2. Did ChatGPT pass the accounting exam?

Initially, ChatGPT-3.5 didn't do well on the CPA exam, receiving an "F" grade. However, researchers have improved the AI model based on its previous failure, and it has now successfully passed the exam. So, the AI has learned from its mistakes and performed exceptionally well.

3. Can ChatGPT solve accounting questions?

Yes, ChatGPT is capable of solving accounting questions. It can assist you with a wide range of tasks, such as solving simple or complex accounting problems, answering questions about regulations, generating templates and invoices, and categorizing expenses.

4. Will ChatGPT replace human accountants?

AI technology like ChatGPT needs to be more advanced to replace the need for human accountants completely. There are a few reasons for this. First, ChatGPT still requires someone who knows how to ask it the right questions or give proper instructions. Additionally, while it can be very helpful in achieving specific goals or outcomes, it is not a substitute for the experience human accountants bring to the table.

Conclusion

In conclusion, using ChatGPT for accounting can provide valuable assistance and simplify various tasks. It is a powerful tool that can help users understand accounting concepts and provide general guidance. The purpose of this article was to highlight ten ways in which ChatGPT can be utilized effectively in accounting with its benefits and limitations, as mentioned above.

Additionally, we recommend using the UPDF to handle accounting-related documents efficiently. It offers a range of ChatGPT integrated features, such as translation, explanation, and summarization, which can be helpful when working with files from foreign clients.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Read PDF

Read PDF Annotate PDF

Annotate PDF Edit PDF

Edit PDF Convert PDF

Convert PDF Create PDF

Create PDF Compress PDF

Compress PDF Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Delete PDF pages

Delete PDF pages Rotate PDF

Rotate PDF Sign PDF

Sign PDF PDF Form

PDF Form Compare PDFs

Compare PDFs Protect PDF

Protect PDF Print PDF

Print PDF Batch Process

Batch Process OCR

OCR UPDF Cloud

UPDF Cloud About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Explain PDF

Explain PDF Chat with PDF

Chat with PDF Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Chat with AI

Chat with AI User Guide

User Guide Tech Spec

Tech Spec Updates

Updates FAQs

FAQs UPDF Tricks

UPDF Tricks Blog

Blog Newsroom

Newsroom UPDF Reviews

UPDF Reviews Download Center

Download Center Contact Us

Contact Us

Lizzy Lozano

Lizzy Lozano

Delia Meyer

Delia Meyer

Grace Curry

Grace Curry

Cathy Brown

Cathy Brown