The W-2 form is the "Wage and Tax Statement." It acts like a report card your employer sends to you and the IRS. The deadline to submit 2026 Forms to the Social Security Administration (SSA) is February 1, 2027—regardless of whether you file on paper or electronically.

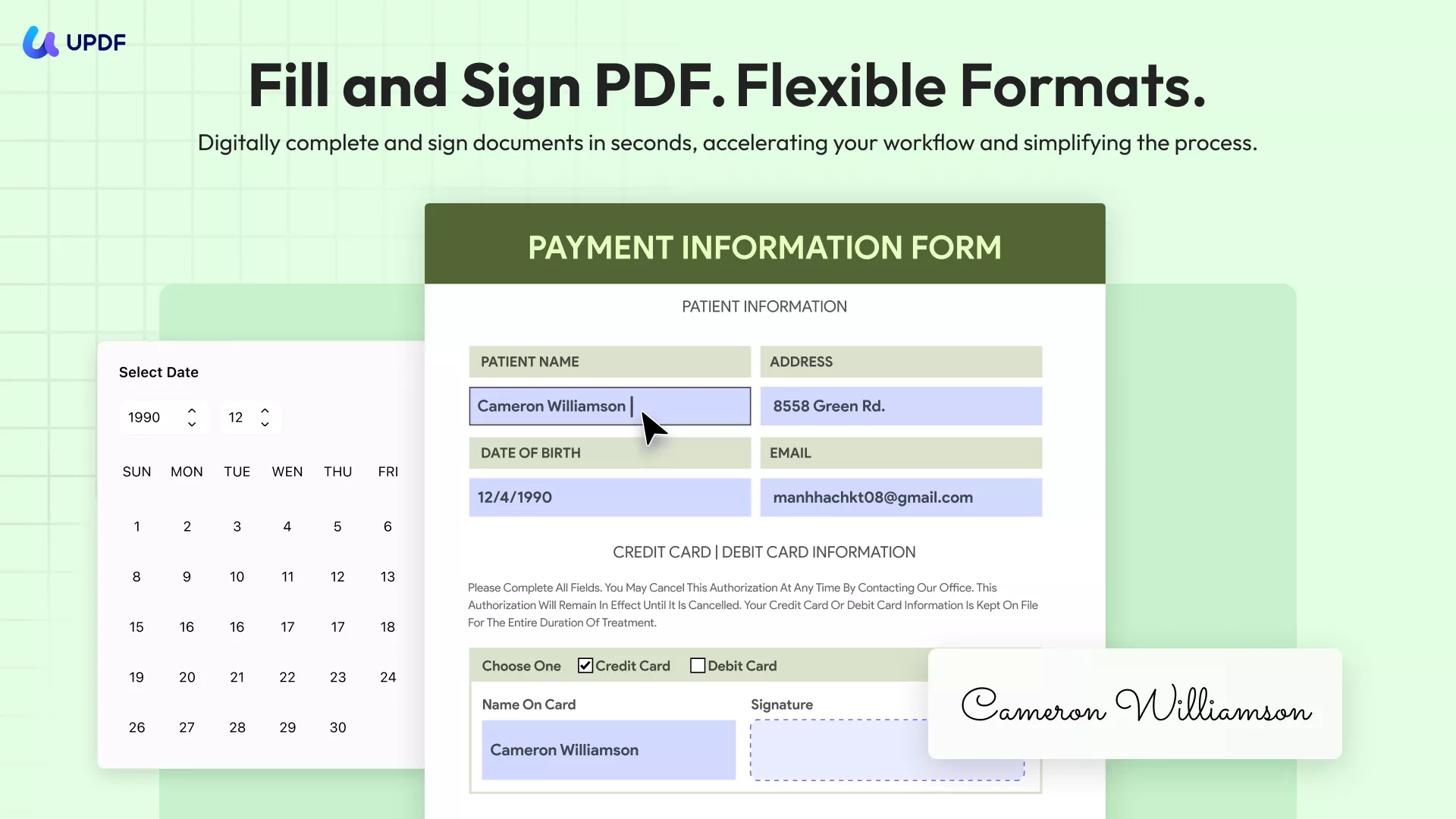

However, instead of filling out these necessary forms by hand, you should complete them digitally. It not only looks professional but also reduces the chances of many mistakes.

This article provides a concise, step-by-step guide on how to fill out W-2 forms digitally. We'll be using UPDF. It's an excellent PDF editor that lets you view, edit, and organize your W-2 and other tax forms in one place. Download UPDF now and use it to fill out your W-2 forms on your mobile and desktop!

Windows • macOS • iOS • Android 100% secure

Let’s start!

Part 1. Getting Ready to Complete the W-2 Form

Begin by gathering all your information and fully grasping what the IRS requires. Let's break down the essential details you'll need.

For Employers:

- EIN

It is your business's tax identification number. This information will be on the W-2 to help identify your business.

- Payroll documents

Collect all the payroll papers for the year. These include gross wages, tips if applicable, and withheld federal, Social Security, and Medicare taxes.

Take the time to go through the IRS's detailed instructions for each form box to avoid making mistakes.

- Deadlines

Mark your calendar for IRS deadlines to avoid penalties.

- Review Paystubs

Keep your paystubs organized yearly to cross-check earnings and tax withholdings against your W-2.

- Know Your Form

Familiarize yourself with each box on the W-2 and ensure your tax return is accurate.

Now, let's see how to fill out W-2 forms using UPDF.

Part 2. How to fill out a W-2 Form using UPDF

UPDF is a cross-platform, multi-faceted PDF editor that helps even with the mundane task of handling tax documents such as the W-2. It contains advanced editing features like viewing and annotating PDFs, creating advanced forms, OCR, and file conversion you’d expect from Acrobat Pro, but at a more affordable and cost-effective price. Moreover, UPDF is compatible with Windows, Mac, iOS, and Android. It also has an AI assistant for instant support, making it a helpful solution, especially during tax season. Both UPDF and UPDF AI can be used for free. Under the UPDF free version, all features are available with trial watermarks added. The UPDF AI free version allows you to ask up to 100 questions.

Step-by-Step Guide to Filling Out a W-2 with UPDF

Step1. Download and Launch UPDF

Download UPDF by clicking the button below and install it on your device.

Windows • macOS • iOS • Android 100% secure

Step 2. Open the W-2 Form

Get the latest version of IRS W-2. You can download it from the IRS website. Launch UPDF, click on “Open File,” and select the downloaded W-2 PDF form.

Note

Step 3. Prepare the Form

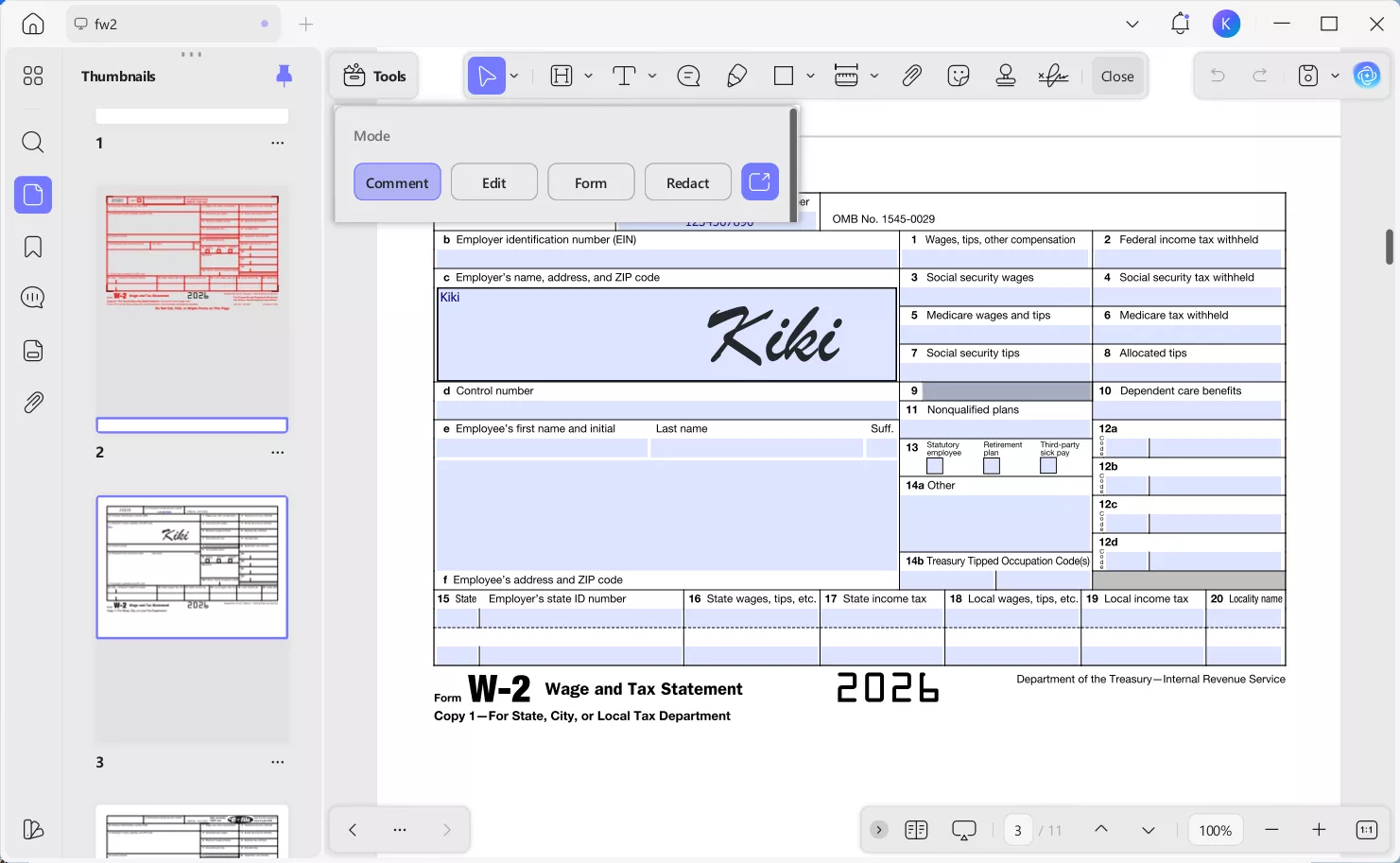

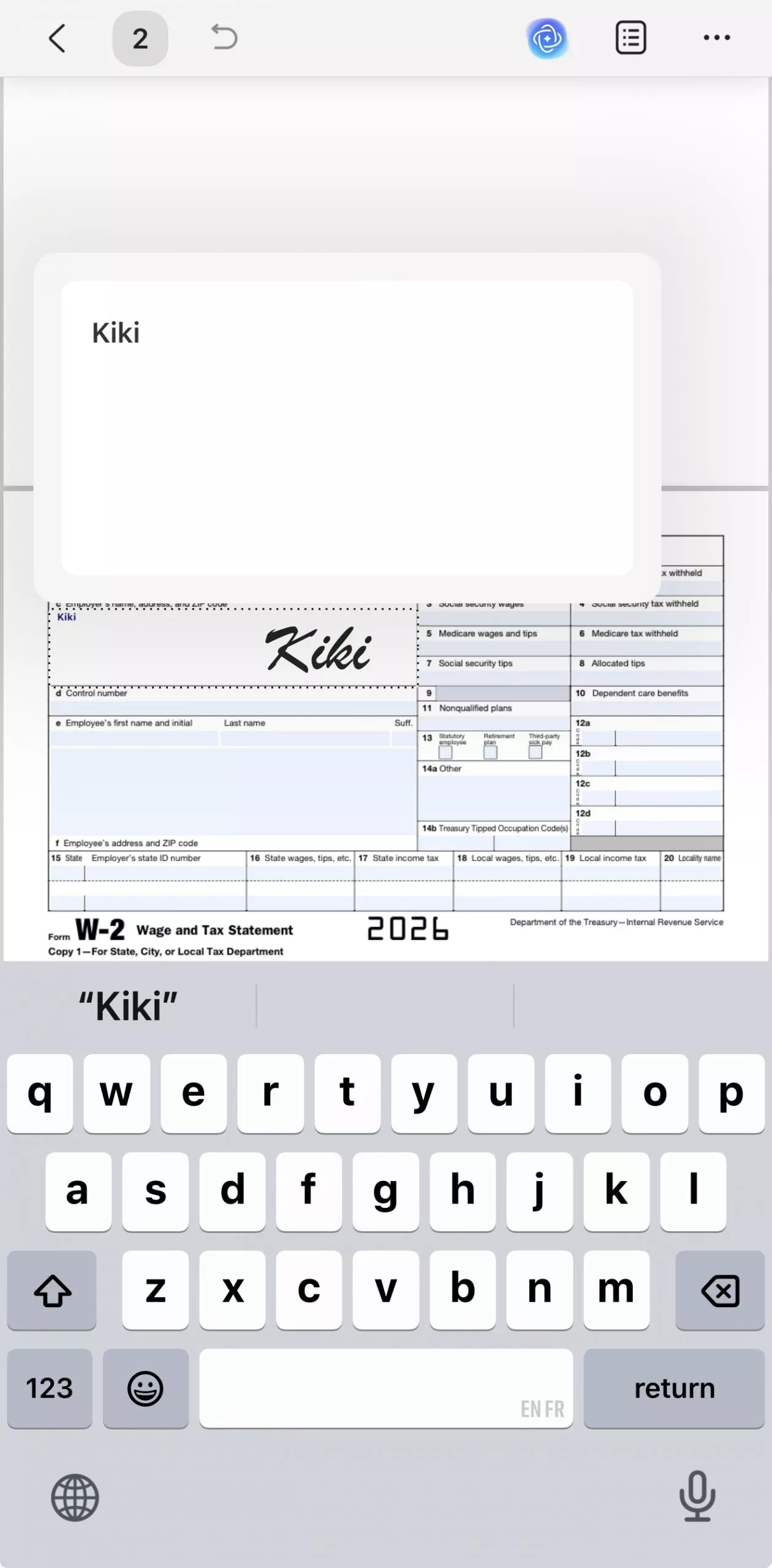

Select the Comment mode for an unobstructed view. Click on each highlighted box and fill in the information needed: employee name, Social Security number, wages, and tax withheld.

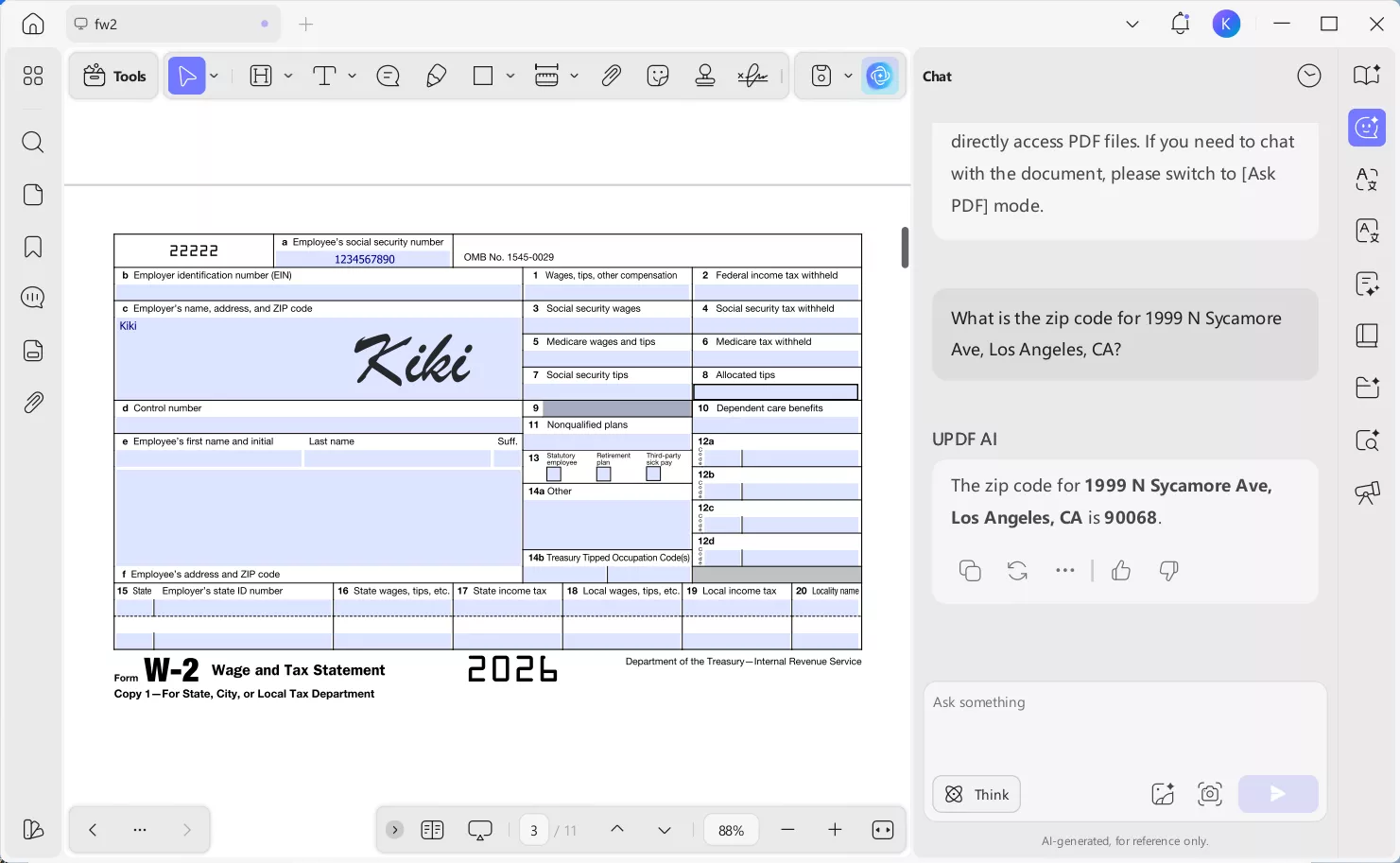

Step 4. Ask AI to Help

If any field is confusing, the AI assistant is ready to help. Click on the UPDF AI icon at the bottom right corner. Go to “Chat”, and enter the prompt to get the answer you need. For example, I do not know the zip code of my location, then, I entered “What is the zip code for 1999 N Sycamore Ave, Los Angeles, CA”. Then, I can get the answer immediately.

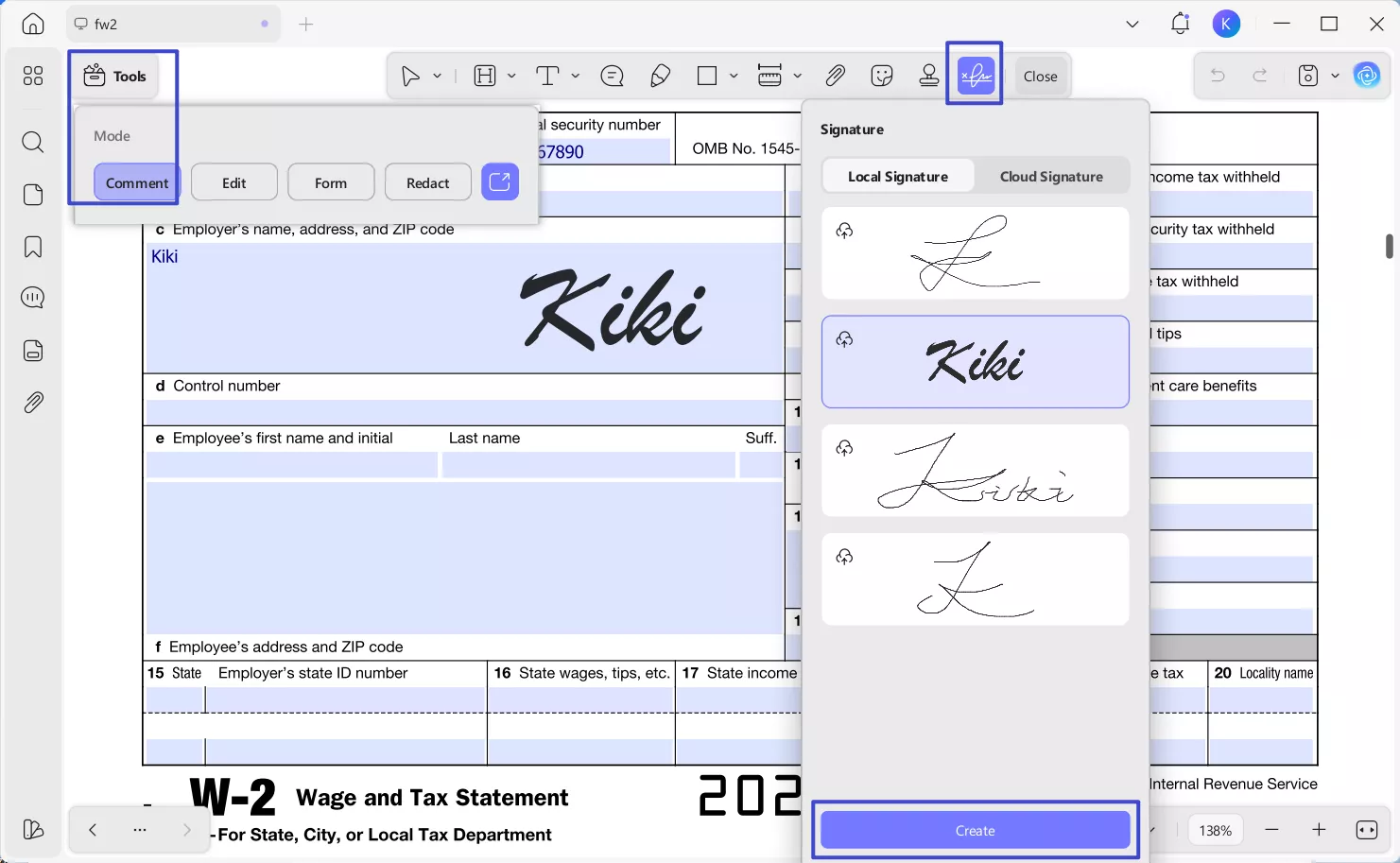

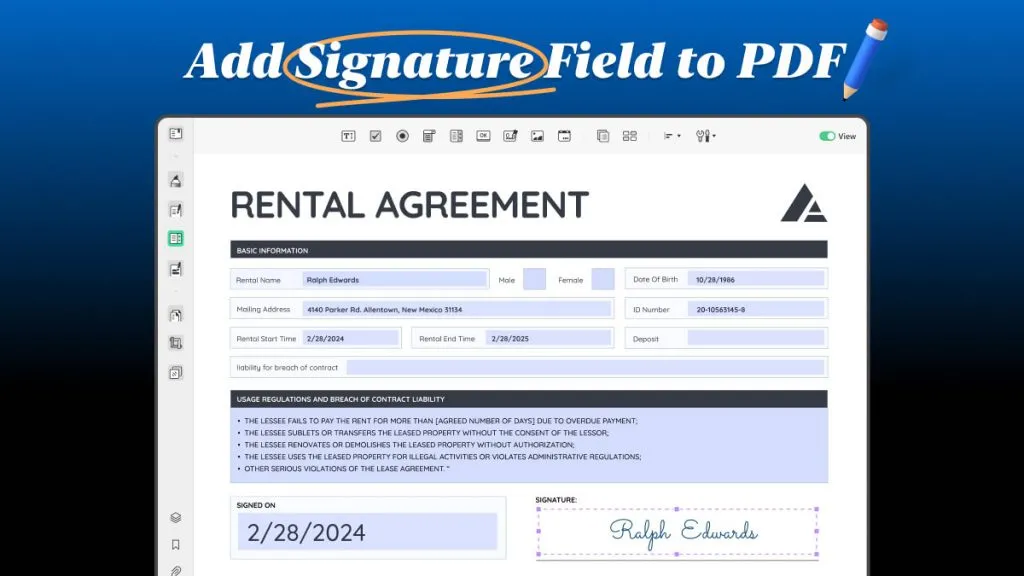

Step 5. Add Signature

If you want to add signature to the form, just click the "Signature" icon under "Comment" mode and select "Create" to create one.

Step 6. Save, Print, or Share

Once you finish filling everything, save the form in UPDF. If you want to make it non-fillable, you can go to print and print it as PDF. Now, you can send them to others.

You can also import the form W-2 into UPDF mobile app and click to fill the form easily. Start from downloading UPDF from App Store or Google Play!

You may feel confused about why to use UPDF to fill out the form. Here are the reasons.

Advantages of Using UPDF for W-2 Forms:

- AI Help: If you need help with a box, UPDF's AI assistant provides plain language explanations. You can get help understanding the content to be filled in each place.

- Compare PDF: Highlight differences by comparing two W-2 versions side-by-side.

- Search Function: Rapidly find and confirm specific information within the form.

- Send Emails: UPDF lets users send W-2 forms directly via email to the intended recipients.

- Advanced Security: Handling tax documents means dealing with confidential information. UPDF provides robust encryption and security features. Your data remains private and protected.

Download UPDF now and experience the convenience firsthand!

Windows • macOS • iOS • Android 100% secure

You have seen how to fill out W-2 forms with UPDF. Let’s look at common mistakes people make when filling out W-2 forms.

Also Read: XFA Form Cannot Be Edited? Here Are 3 FoolProof Solutions!

Part 3. Common Mistakes of W-2 Form Filling and How to Avoid Them

Filling out W-2 forms correctly is of much importance. Many common mistakes create problems for employers and employees. Let's look at these mistakes and see how UPDF helps solve them.

Most Common W-2 Mistakes

- Wrong Employee Information

Typos in names, Social Security numbers, or addresses are shared.

Tip: Always cross-check against employee records. UPDF's "Compare PDF" feature helps ensure consistency when updating forms. Also, you can use UPDF AI to help you check. Just copy the information to UPDF AI box and check the grammar to make sure they are correct.

- Incorrect Tax Withholdings

Errors in federal, Social Security or Medicare tax entries can cause mismatches.

Tip: Review payroll records carefully and consider using tax software or a professional's advice.

- Incorrect Wage/Tip Reporting

Mistakes here can impact tax liability.

Tip: Match payroll information with W-2 information carefully.

- Old Forms

Using last year's W-2 instead of this year's version causes problems.

Tip: Always download the latest form from the IRS website.

Conclusion

Every employee needs to understand and accurately fill out W-2 forms. It ensures that everyone pays their fair share and receives any due refunds. We have shown you how to fill out W-2 forms with UPDF.

With these steps, you can make the process smoother and reduce errors. UPDF has an intuitive interface, rich editing capabilities, and AI-powered chat. All these features help in making the tax preparation so much smoother. You can complete forms and compare documents to make it even easier. Download UPDF now to improve your tax workflow.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF Scholar Research

Scholar Research Paper Search

Paper Search AI Proofreader

AI Proofreader AI Writer

AI Writer AI Homework Helper

AI Homework Helper AI Quiz Generator

AI Quiz Generator AI Math Solver

AI Math Solver PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Lizzy Lozano

Lizzy Lozano

Enid Brown

Enid Brown

Enola Miller

Enola Miller