Taxpayers constitute a vital sector of a country's economy. Likewise, the US government has different instruments for ensuring in-time ITR filing from its taxpaying community. The W-9 form extends great help in keeping a track of the taxpayers' information. This document is a formal tool for gathering and transmitting personal information to the concerned authorities. Taxpayers are required to fill out the form with the correct details and certify the same. The following article throws light on how to fill out a W-9 form with utmost convenience.

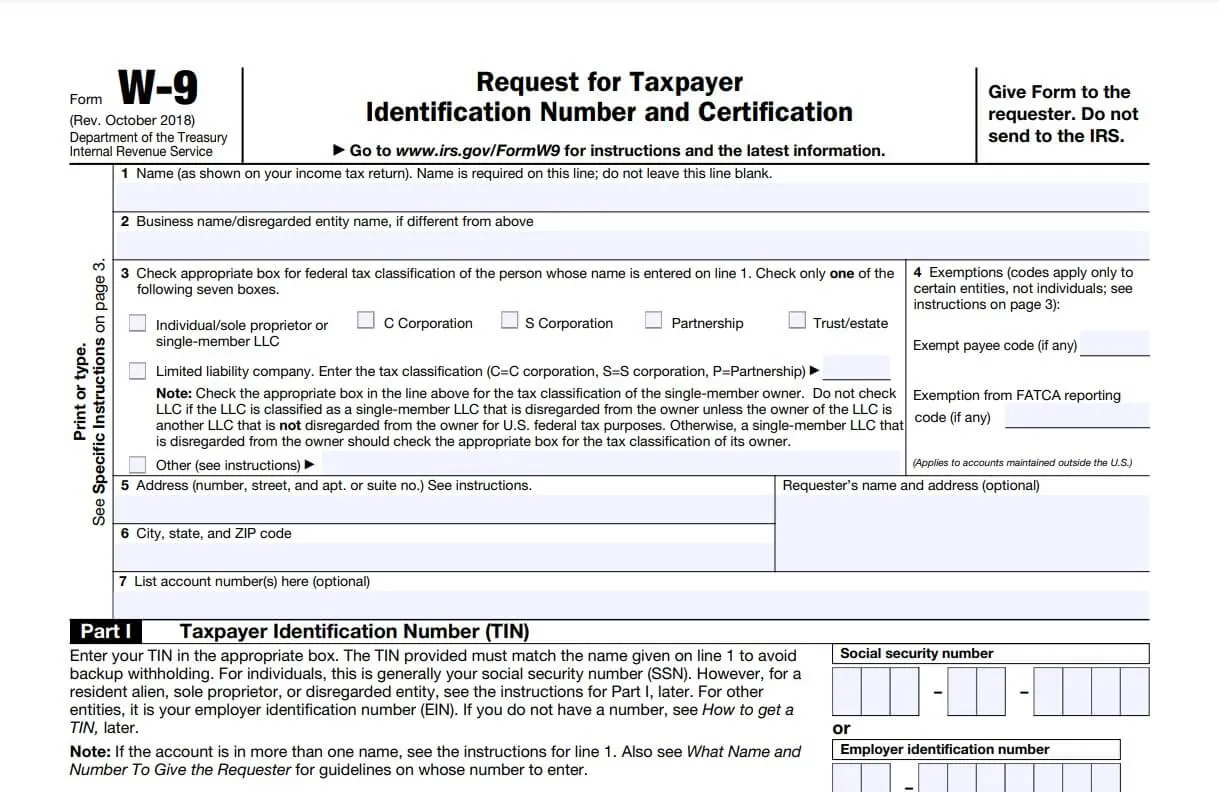

What is Form W-9 - Request for Taxpayer Identification Number and Certification

Form W-9 is a legal instrument of the US government to maintain a record of taxpayers' details. The form is officially addressed as 'Request for Taxpayer Identification Number and Certification'. It is used in the US Income Tax system by some third party for filing a request for information return with the IRS.

The W-9 form requests important taxpayer details like name, and address, along with information regarding the taxpayers' identification. This generally includes an Employer Identification Number or Social Security Number. There's no requirement of sending the form to the Internal Revenue Service.

Instead, the person filing for the information return keeps it as a record for verification needs in the future. The details mentioned in the Form W-9 and their payment records are stated in Form 1099. The form comes in handy for a variety of legal, financial, and professional verification requirements.

Form W-9 for Individual vs for Business

As already stated, there are several use scenarios for W-9 forms. The most common situations are individual requests and business arrangements. You can fill out W-9 forms as an individual to avoid backup withholding and making customer arrangements with a financial institution.

Your payer is required to collect withholding taxes for the Internal Revenue Service on some specified reportable payments. As a payee, you can fill out the W-9 to certify your non-liability to backup withholding. You will then be entitled to get the full payment from your payer. The IRS website has detailed instructions on how to fill out a w9 form for individuals.

The W-9 form has enough credibility for businesses as well. Business-contractor arrangements are largely dependent on these forms for the verification of party information. Business organizations generally use the W-9 form for requesting necessary information from the hired contractors. Details like contractor addresses and TIN mentioned in W-9 forms are used by businesses to fill out forms 1099 and 1099-MISC.

How to Download Form W-9?

You can request W-9 forms in physical as well as electronic copies. Modern-day businesses arrange a system for fax-based and electronic submission of W-9 forms for their payees. For filling out the form through the electronic system, the requester needs to download it from the official IRS website.

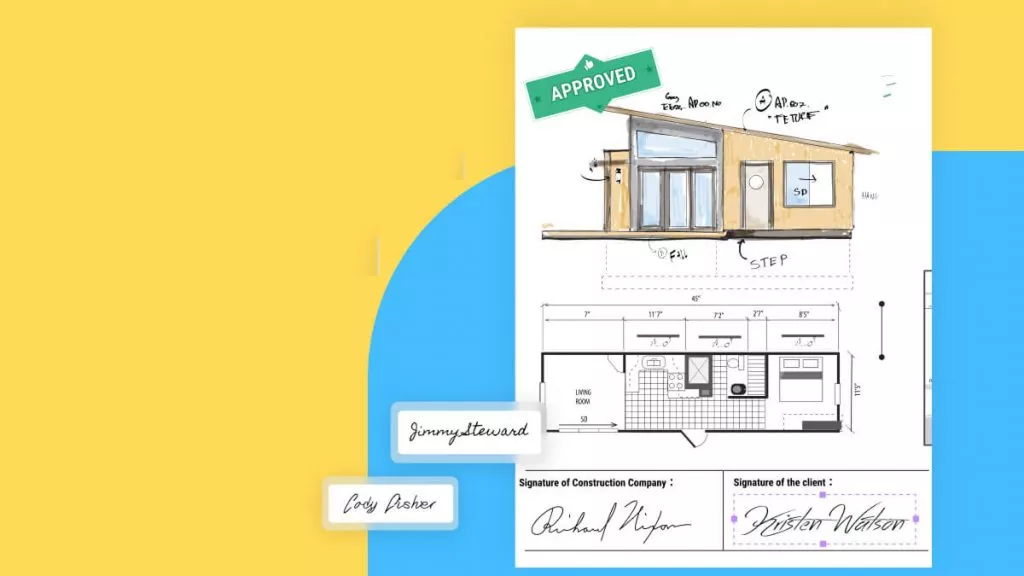

The IRS website provides W-9 forms in PDF format for free. Payees can fill out the form and add their electronic signatures using PDF editor programs. Some specific categories of W-9 forms don't require electronic signatures. Organizations relying on the electronic submission system should be careful regarding a few aspects.

IRS does not require the W-9 forms to be submitted on its official website. The electronic system must, however, be able to produce hard copies of the downloaded and filled-out W-9 forms. These may be requested by IRS under specific situations. It should also verify the added electronic signature with the payee's mentioned name in the form.

When Do I Need to Fill Out a Form W-9?

Your employer or business organization responsible for paying you may request to fill out W-9 forms. The IRS does not obligate your employer to file these forms. The information you provide is kept on record and used for preparing future returns. Major requirements include filling in entries on 1099 or 1098 forms. Another application of W-9 forms is the determination of federal tax upholding employee payments.

You may need to fill out W-9 forms for company engagements that consider it necessary to report employee information to the IRS. This includes the payments you get for providing independent contractor services, paying mortgage interests, sending finances to IRA accounts, etc.

There are some specific situations when you should request a fill out of W-9 forms. If you are an independent employer who works with freelancers and contractors, the W-9 form is a necessity. The concept applies to business units as well. You may work for an organization that pays more than $600 to small businesses and individuals for finished tasks.

If you have not hired these individuals, collecting a W-9 form from them is necessary for tax requirements. Your organization does not need to withhold income taxes or pay Medicare and Social Security taxes on independent contractor payments. This makes it necessary for IRS to have information on your payees.

The data helps IRS to keep a track of emerging taxpayers. You can fill out and keep the W-9 forms ready for sending payment reports to IRS at the end of the financial year. Before filing the information, you must ensure that your freelancer or contractor has provided the correct details.

Make sure that all the necessary information is present in the exact fields. This includes the payee's individual or business name, federal tax classification, complete mailing address, and TIN. You can also check the IRS website for instructions on how to fill out a W-9 for a business.

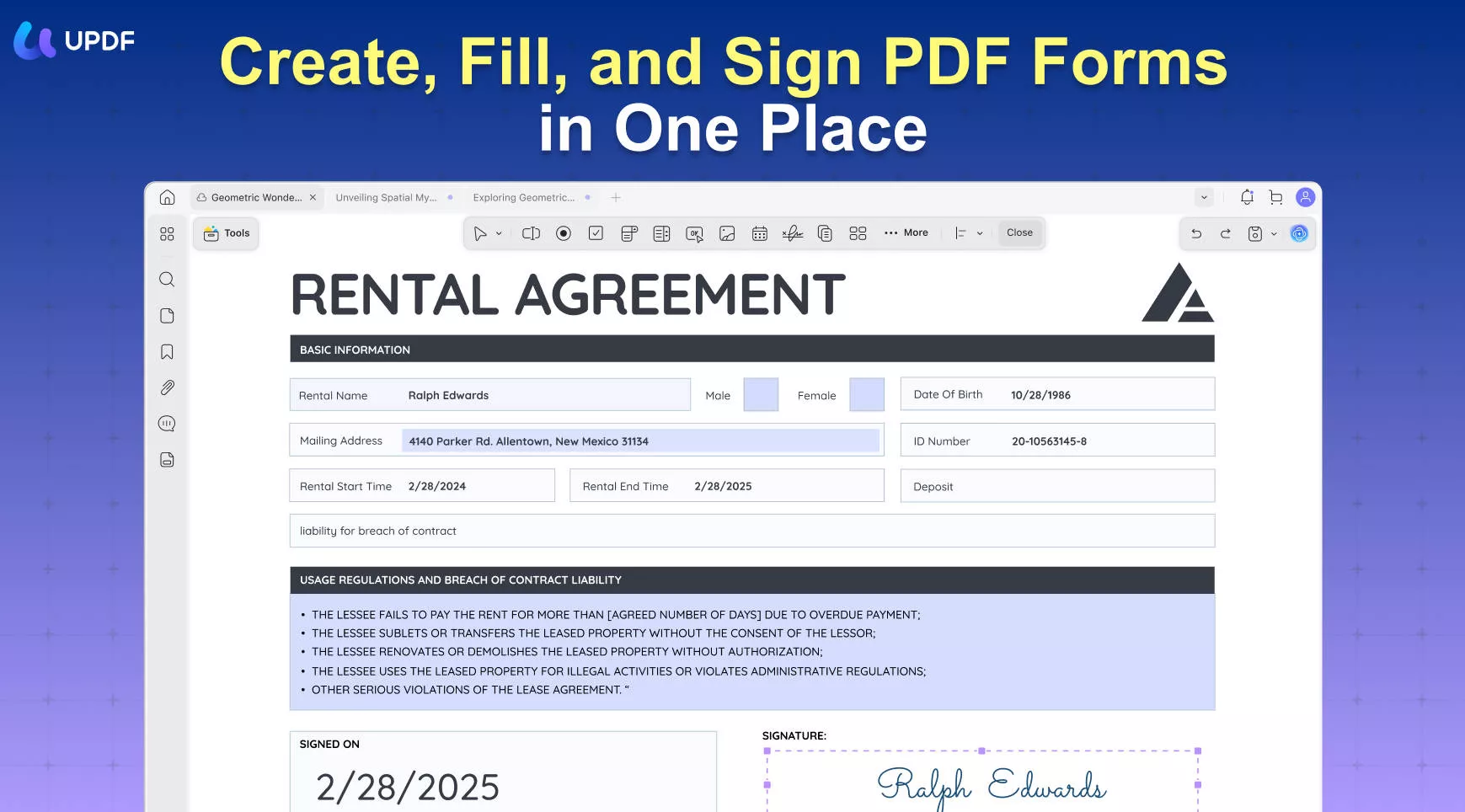

The Best all-in-one PDF Editor and Converter

You can fill out W-9 forms electronically by downloading their PDF versions from the official IRS website. The software market brings a host of PDF editor programs at your disposal for filling out and adding signatures to the downloaded forms. The UPDF, however, enjoys a widespread user preference in addressing the concern.

Windows • macOS • iOS • Android 100% secure

The software has an extensive library of PDF customization to facilitate high-quality and quick editing of W-9 forms. The flawless interface and advanced functionalities render a seamless editing experience as if you are modifying a normal Word document. The tool allows you to add and remove PDF text, and also adjust its properties.

There are options to change the font, font style, size, color, and typeface of the text. You won't have to leave the PDF as the software offers direct customization.

The program is an excellent PDF converter and supports all popular file formats for converting PDF files. You can convert PDF files into Word, Excel, RTF, PowerPoint, CSV, XML, Text, HTML, and other formats. It protects the layout and format of the converted PDF with 100% integrity for the best results.

You can fill out, highlight, underline, or add comments and digital signatures to W-9 forms.

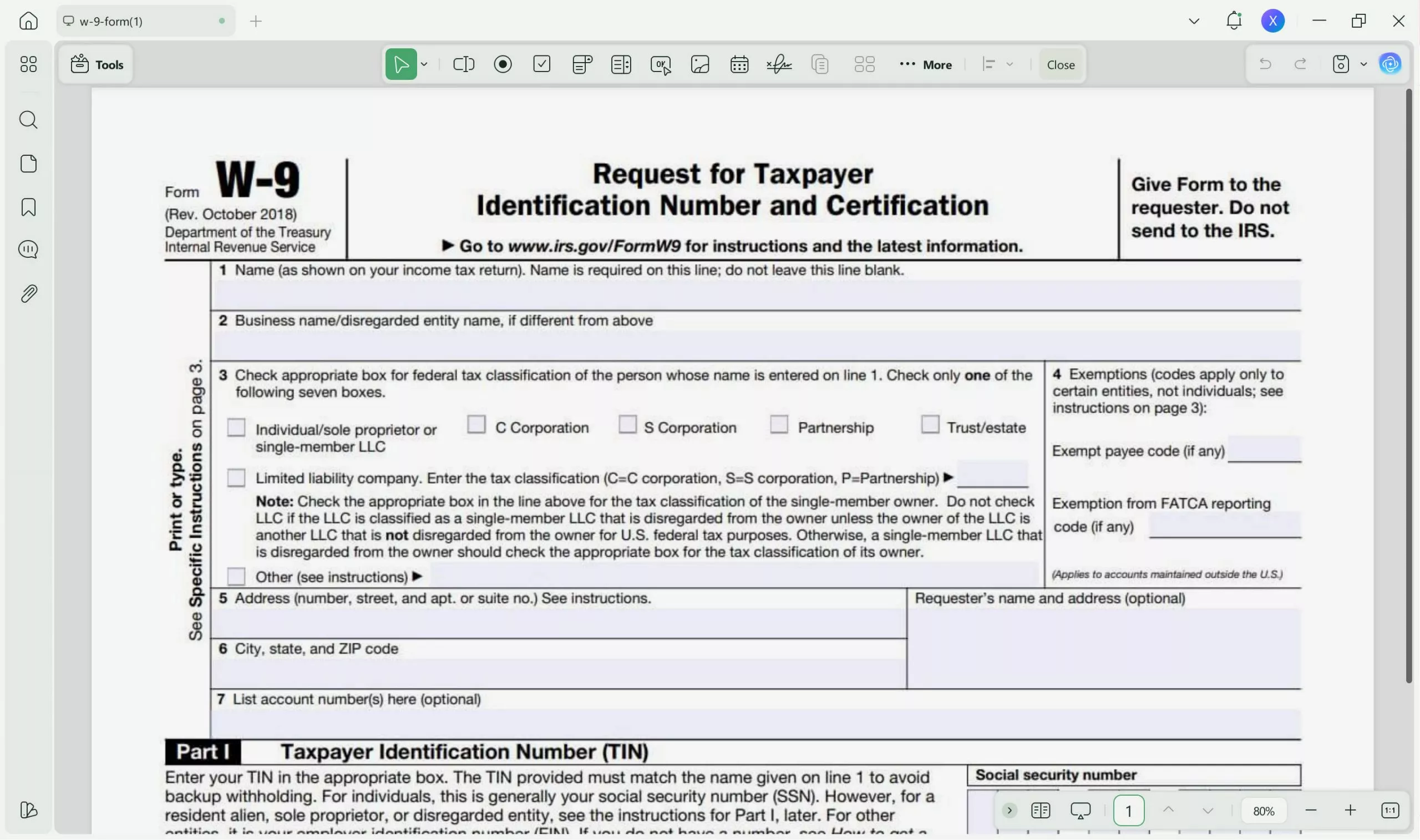

How to Fill out Form W-9 with UPDF?

UPDF allows you to fill out W-9 forms with saved information like names, addresses, payment details, etc. Here's how you can easily address the concern in a few quick steps:

- Step 1: Launch "UPDF" on your computer.

- Step 2: Open the W-9 form file by clicking "Open File".

- Step 3: When the W-9 form is opened in UPDF, start to fill in the form.

- Step 4: Click on "Save" on the right panel.

Note: UPDF not only lets you fill out the PDF form but also allows you to sign the form. To sign the W-9 form, you need to use UPDF to Help you.

Video Tutorial on How to Create an Fill Forms

Common Mistakes to Avoid when Filling Out Form W-9

It is necessary for businesses and individual employers to fill out W-9 forms for keeping a record of payee details. The information is required to generate tax returns in the future. The details may also be requested by the IRS for updating and maintaining the personal data of taxpayers.

Filling out the W-9 forms has a simple and quick process. Yet, some common mistakes are often encountered while addressing the concern. Let us have a look at the common errors you should avoid when filling out W-9 forms, in what follows next:

- Missing Out on the Basics

Filling out a W-9 form requires some basic details like name, address, and Taxpayer Identification Number. Make sure you have this information verified and ready before filling out the form. The absence of this data may lead to the form getting rejected. Remember to add the payee's digital signature in the appropriate field.

- Typing Errors

Typos are a common nuisance when filling out W-9 forms. Ensure that you enter names and addresses with their exact spellings. It would be better to verify these details with legal identification proof. Modifications in such errors may be difficult at later stages, causing the rejection of your W-9 form by the IRS.

- Misidentified Payee

This is a widely encountered error when filling out W-9 forms for LLCs. Most of us get confused with the information to be entered in the 'Full Name' field. Form fillers often provide their LLC, DBA, or trade names in this entry. The mistake generates a TIN mismatch notification and your W-9 form gets rejected. Reading the IRS guide on how to fill out a w9 for an LLC is helpful in this regard.

- Incorrect Placement of Entries

It is necessary to enter the correct details in the right places in your W-9 form. Ensure that the name, address, payment information, etc., are mentioned in their specified lines. You can take the help of tax software for accuracy in this regard.

Conclusion

W-9 forms play an important role in maintaining the information database of taxpayers in the US. The record-keeping helps to file future returns and avoid issues like upheld employee payments. The form is available in physical as well as digital copies for the filer's convenience. You can download the PDF version of the W-9 forms from the official IRS website. You should also take care to avoid common errors when filling out W-9 forms.

PDF editor tools are needed to fill out and add digital signatures to such forms. Looking at the current software market trends, the UPDF editor program dominates user preferences. The advanced feature library backs up the choice. Try it out now!

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF PDF AI Tools

PDF AI Tools Image AI Tools

Image AI Tools AI Chat Tools

AI Chat Tools AI Writing Tools

AI Writing Tools AI Study Tools

AI Study Tools AI Working Tools

AI Working Tools Other AI Tools

Other AI Tools PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Enola Davis

Enola Davis  Engelbert White

Engelbert White

Enrica Taylor

Enrica Taylor

Lizzy Lozano

Lizzy Lozano