When you give someone a gift valued above the $18,000 annual exclusion limit in 2024, you must fill out IRS Form 709 for gift tax purposes. However, it does not mean you have to pay any actual gift tax right away, as you can adjust the excess amount to your lifetime gift and estate tax exemption.

The government asks you to fill out Form 709 mainly to keep a record and track lifetime gift exemptions. So, the real question is how to fill out Form 709. In this guide, we will present an IRS Form 709 filled out example and explain the process in detail.

Part 1. What Is an IRS Form 709?

IRS Form 709 is a United States gifts and generation-skipping transfer tax return form. It is filled by the gift giver if the person has given a gift worth over the annual exclusion amount, which is $18,000 in 2024 and $17,000 in 2023. The intent of this form is to give the Internal Revenue Service (IRS) information about the gifts that go beyond the annual exclusion amount.

The gifts can include:

- Real estate

- Digital assets

- Stocks

- Cryptocurrencies

- NFTs

- And many more

The form asks for details about the gift's value, the recipient, any applicable deductions/exclusions, and more. The form is due by April 15 of the year following the year in which the gift was made.

Part 2. IRS Form 709 Filled Out Example: How to Fill It?

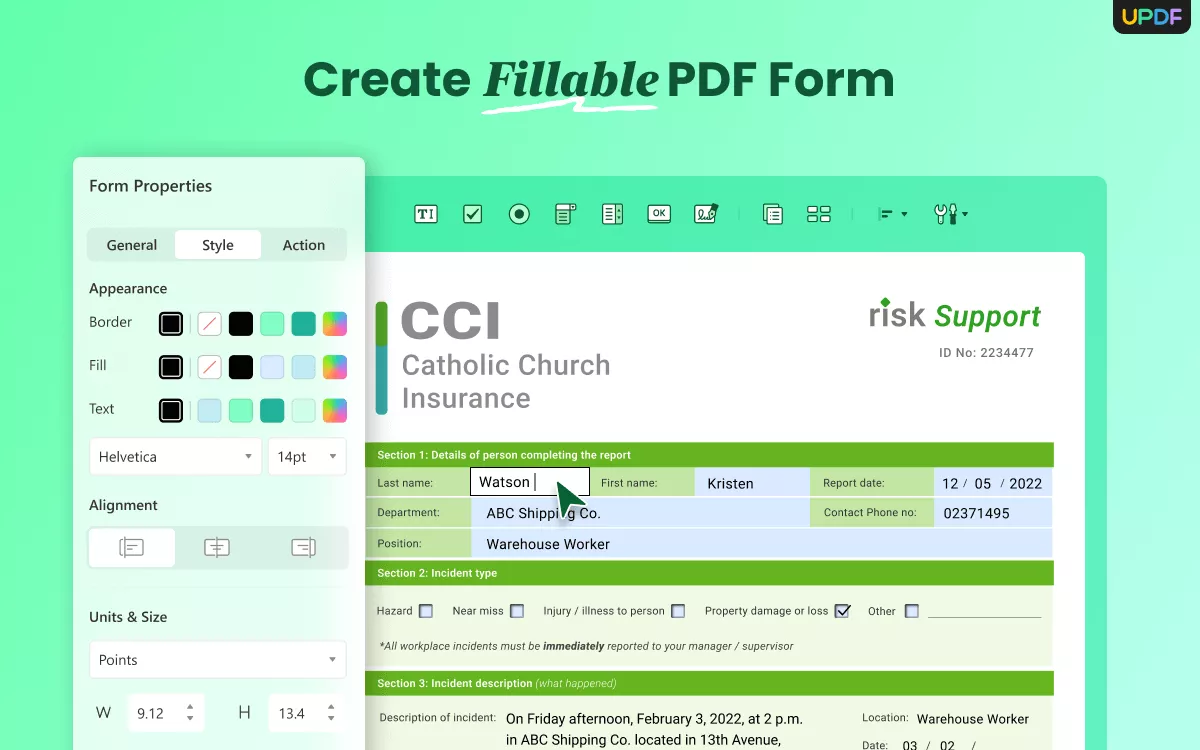

Check out the below IRS Form 709 filled out example:

The above example of Form 709 filled out shows that it is straightforward to fill this form. All you need to do is use a reliable PDF tool to access and fill in the form with required details. That's what UPDF offers with its intuitive and powerful functionality.

UPDF is an advanced and modernized PDF editor and filler tool that provides a convenient interface for filling out forms. It detects all the fillable form fields intelligently and then allows you to fill them out with simple clicks.

The key features of UPDF PDF form filling include:

- Effortless interface to fill Form 709.

- Identify all fillable boxes.

- Form field recognition to recognize static form fields and convert them to fillable text fields.

- Built-in AI assistant to provide help in filling forms, like clarifying specific fields, etc.

- Sign PDF forms digitally or electronically, if required.

- Support form filling on Windows, Mac, iOS, and Android.

In short, UPDF offers a convenient form-filling experience. So, why not try out UPDF yourself and test out its form-filling capabilities?

Windows • macOS • iOS • Android 100% secure

Now that we know what tool to use, let's discuss the steps to learn how to fill out Form 709:

Step 1. Collect The Necessary Data

To easily fill out the form, the first step is gathering all the necessary data. This includes:

- Personal Information: Name, address, date of birth, and social security number (SSN)

- Recipient Information: Name, relation, and SSN

- Information on gifted item(s)

- Gift date

- Fair market value of the gift at that time

Step 2. Download the Form and Install UPDF

Next, download the latest Form 709 from the IRS website. Besides that, install UPDF on your computer (Windows/Mac) to view and fill out the form.

Once UPDF is installed, launch the tool and open the latest Form 709.

Step 3. Fill Part 1 – General Information

The first section of the IRS Form 709 is about filling in the general information about the donor. To fill in the details, simply click on that field in UPDF and start typing. So, fill out all the details, including name, SSN, address, gift date, and all other information.

Step 4. Calculate Taxable Gifts

The next section is about the calculation of taxable gifts. Here, you have to input all financial information related to the total value of the gift(s) given and calculate the tax. So, fill out "Schedule A" with all the required information, such as gift description, the recipient, value, etc.

Step 5. Report Transfers Subject to Gift Tax

You can also report transfers that come under the gift tax or/and generation-skipping transfer tax. Besides that, you would also report transfers made to trusts.

If anyone applies to you, then fill out Schedule B, C, and D.

Step 6. Review and Finalize the Form

Once you have filled out the form, review it to fix mistakes. Make sure the gift valuation, taxable amount, and all other information are accurate. Sign the form by creating the signature using UPDF's built-in sign PDF feature and enter the date. Once you have done this, you can submit the form electronically or through mail.

Bonus Tip

In addition to using UPDF's built-in signing feature, you can also digitally sign the completed form online with UPDF Sign. It's an online e-sign platform that supports sending, signing, and tracking documents. UPDF Sign shares the same account as UPDF, so there's no need to register twice.

So, that's how to fill out Form 709 easily on your own with UPDF. At some point, if you feel confused, you can use UPDF's AI assistant to clarify any doubts. Therefore, keep UPDF as your companion in this journey and use the above example of Form 709 filled out to get your form filled.

Part 3. Common Mistakes to Avoid When Filling an IRS Form 709

Despite having an IRS Form 709 filled out example as a reference, there are many mistakes people make when filling out an IRS Form 709. Some of the common ones are as follows:

Not Filling the Form

Many don't fill out the form even when it is required. When gifts exceed the annual exclusion or the lifetime exemption amount, it becomes mandatory.

Incorrect Gift Valuation

The second most common mistake is incorrect gift valuation. When filling out Form 709, you have to value gifts at their fair market value at the time of giving the gift.

Incomplete Information

Form 709 needs you to provide complete details of the gift. However, some people are seen to fill out incomplete or inaccurate information, which can cause errors or audits.

Not Reporting Joint Gifts

When you and your spouse are giving a joint gift, you both have to fill out a separate Form 709. You only have to report the portion of the gift you contributed. This way, you can lower the gift amount you mention compared to if it were reported as a single gift.

Missing Deadline

You have to file Form 709 by April 15 of the year following the gift. Otherwise, you will have to pay additional penalties and interest charges. Alternatively, you can request an extension if you need more time.

Part 4. Bonus Tip: Why Should You Choose UPDF for Filling a 709 Form

As evident from above, you need a PDF tool to view and fill out IRS Form 709, and UPDF offers exactly that.

UPDF shines as an ideal tool that offers a modernized interface and advanced form-filling features to make it a hassle-free experience to fill out Form 709 or any other form. Below are some key reasons that make UPDF the best tax filling solution:

- Easy-to-use interface with no learning curve.

- A complete PDF form filler tool.

- Intelligent form field recognition to turn static form fields into editable ones.

- AI assistant to guide the whole form-filling process.

- 1 license, 4 devices compatibility: Windows, Mac, iOS, and Android.

- Supports sharing forms with others by generating a link, QR code, or sending via email.

- Both electronic and digital signatures are supported.

Simply put, UPDF offers the complete set of features needed to complete IRS Form 709. Install UPDF and complete your IRS Form 709 with the best PDF tool.

Windows • macOS • iOS • Android 100% secure

To learn more about UPDF's form features, watch this video.

Conclusion

IRS Form 709 becomes mandatory to fill when your gift amount exceeds the $18,000 annual exclusion limit. Therefore, if you are planning to fill OUT IRS Form 709, keep the IRS Form 709 filled out example as your reference, use UPDF, and follow the above steps to complete your Form 709 within minutes.

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Read PDF

Read PDF Annotate PDF

Annotate PDF Edit PDF

Edit PDF Convert PDF

Convert PDF Create PDF

Create PDF Compress PDF

Compress PDF Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Delete PDF pages

Delete PDF pages Rotate PDF

Rotate PDF Sign PDF

Sign PDF PDF Form

PDF Form Compare PDFs

Compare PDFs Protect PDF

Protect PDF Print PDF

Print PDF Batch Process

Batch Process OCR

OCR UPDF Cloud

UPDF Cloud About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Explain PDF

Explain PDF Chat with PDF

Chat with PDF Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Chat with AI

Chat with AI User Guide

User Guide Tech Spec

Tech Spec Updates

Updates FAQs

FAQs UPDF Tricks

UPDF Tricks Blog

Blog Newsroom

Newsroom UPDF Reviews

UPDF Reviews Download Center

Download Center Contact Us

Contact Us

Lizzy Lozano

Lizzy Lozano

Delia Meyer

Delia Meyer