In business transactions, invoices and receipts play a vital role in the buying and selling processes. Both of these documents mention the payment details that can be looked up to when needed in future. While keeping record of the total amount aided and returned, these pieces of information help in financial management. To elaborate on the uses of these documents, this article will uncover the discussion of invoice vs. receipt.

Part 1. A Comprehensive Overview of Invoice and Receipt

Receipts and invoices may sound the same, but they serve different purposes in transactions. The following discussion will help you get an idea of how similar or different these two documents are:

An Overview of Receipts

Receipts are proof that the payment has been done and are issued by the seller to the buyer. It includes the date and mode of payment and a complete detail of taxation and original price of the products. The purpose of a receipt is that it can be used to substantiate expenses for tax deductions or reimbursements.

Also Read: How to Edit a Receipt >>

An Overview of Invoices

As for an invoice, it is a formal request for payment issued by the seller to the buyer. It includes the entire breakdown of payment and the contact details of the two parties in contract. Invoices are legal evidence that can be of use in times of audit or disputes. Furthermore, they can be used as a reminder for payments and for managing accounts.

Also Read: How to Make an Invoice >>

Part 2. A Detailed Comparison Between Invoice and Receipt

When buying and selling in business, you must understand the difference between receipt vs. invoice to ensure accurate financial practices. The following discussion breaks down a detailed difference between the two documents to help you understand:

- Purpose and Timing: The purpose of an invoice is to demand payment for the products that have been sold and are given before the payment. Whereas a receipt is a proof that the payment has been made and is generated after the purchase.

- Content: An invoice is a list of services given to the buyers along with the terms and due date of the payment. Comparatively, a receipt is the confirmation of payment, the amount paid by the buyer, and the date of purchase.

- Tax Documentation: When you need to report tax payments, you will need the invoice of the purchase as a proof. As for the receipt, it will aid in substantiating expenses and income for tax purposes.

- Format: Invoices are a more formal document including a detailed breakdown of charges and the products bought. Having a simpler format, receipts just the basic payment details along with the tax deductions.

| Metrics | Receipt | Invoice |

| Purpose | Proof of payment | Request of payment |

| Timing | Generated after the payment | Generated before the payment |

| Content | List of services, prices, payment terms, and due date | Confirmation of payment, the amount paid, date, and mode of payment |

| Tax Documentation | Helps substantiate expenses and income for tax purposes | Assists in documenting sales for tax reporting |

| Format | Detailed breakdown of expected payment | Includes basic payment and tax details |

Part 3. Reviewing The Structure of Invoices

When in business with different clients, you must know the formal structure of an invoice to save yourself the embarrassment. After the information on sales receipt vs invoice, from the header to the footer, the following discussion is a complete guide on the structure of a formal invoice:

- Header Information: On the top of the page, mention the invoice title, number, and date. You may also include your company's logo on the top of the invoice.

- Seller and Buyer Information: The second thing to mention is your company's name, office address, contact information, or tax identification number. In addition, write similar details about the buyer's company.

- Details of Services Provided: Coming to the main part, write the details of goods or services you have provided to the buyer. Along with detailed description, quantity, price, and the total cost before taxes or discount for each item or service.

- Financial Details: After a complete breakdown of the services provided, you must mention the subtotal before taxes, and discounts, even though discounts applied to the total amount. Mention the applicable taxes and the total amount payable by the buyer.

- Footer and Additional Information: Before ending the invoice, mention the additional information like terms and conditions and some additional notes. End the invoice by adding your signatures and some legal disclaimers, as well as additional contact information.

Part 4. How to Manage Invoices Using UPDF AI?

Now that you know about the comparison of invoice vs receipt, you should know about an invoice parser that offers easy management. UPDF offers an AI assistant that helps you manage an invoice for business transactions. The features of this tool are not limited to file management only, as it allows users to add digital signatures at the end as an approval. Download it for a free trial!

Windows • macOS • iOS • Android 100% secure

Furthermore, the utility of the AI helps extract specific information over a single prompt. You can also utilize its services to sum up long invoices, which makes it easy for you to evaluate your tasks without any errors. In the following content, we will use the online version of UPDF's AI assistant for managing invoices.

A Guide on Invoice Management Using UPDF AI

With UPDF AI by your side, you can easily split files by page numbers or file sizes according to your choice. Let's uncover the method to manage an invoice using this high-end PDF management tool.

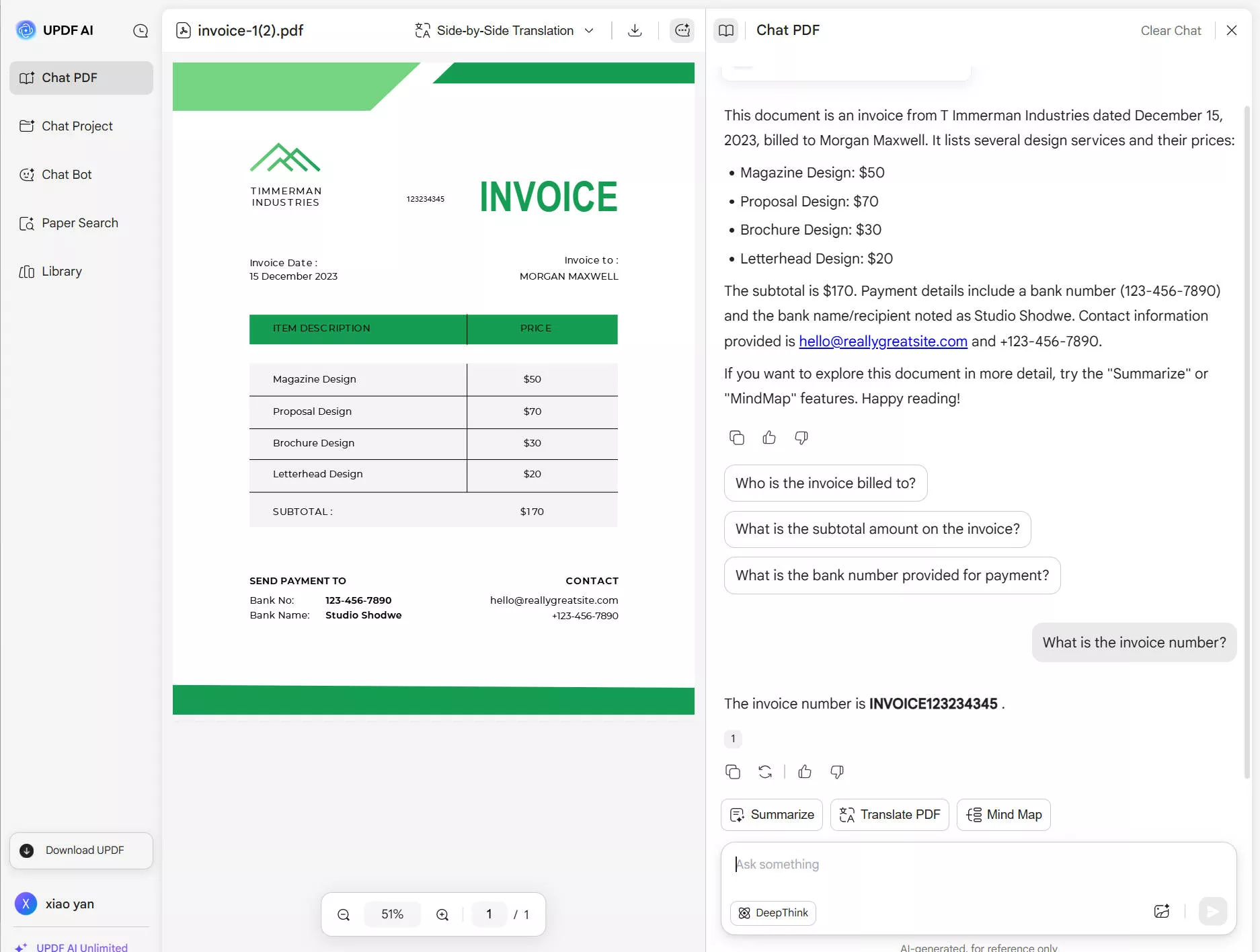

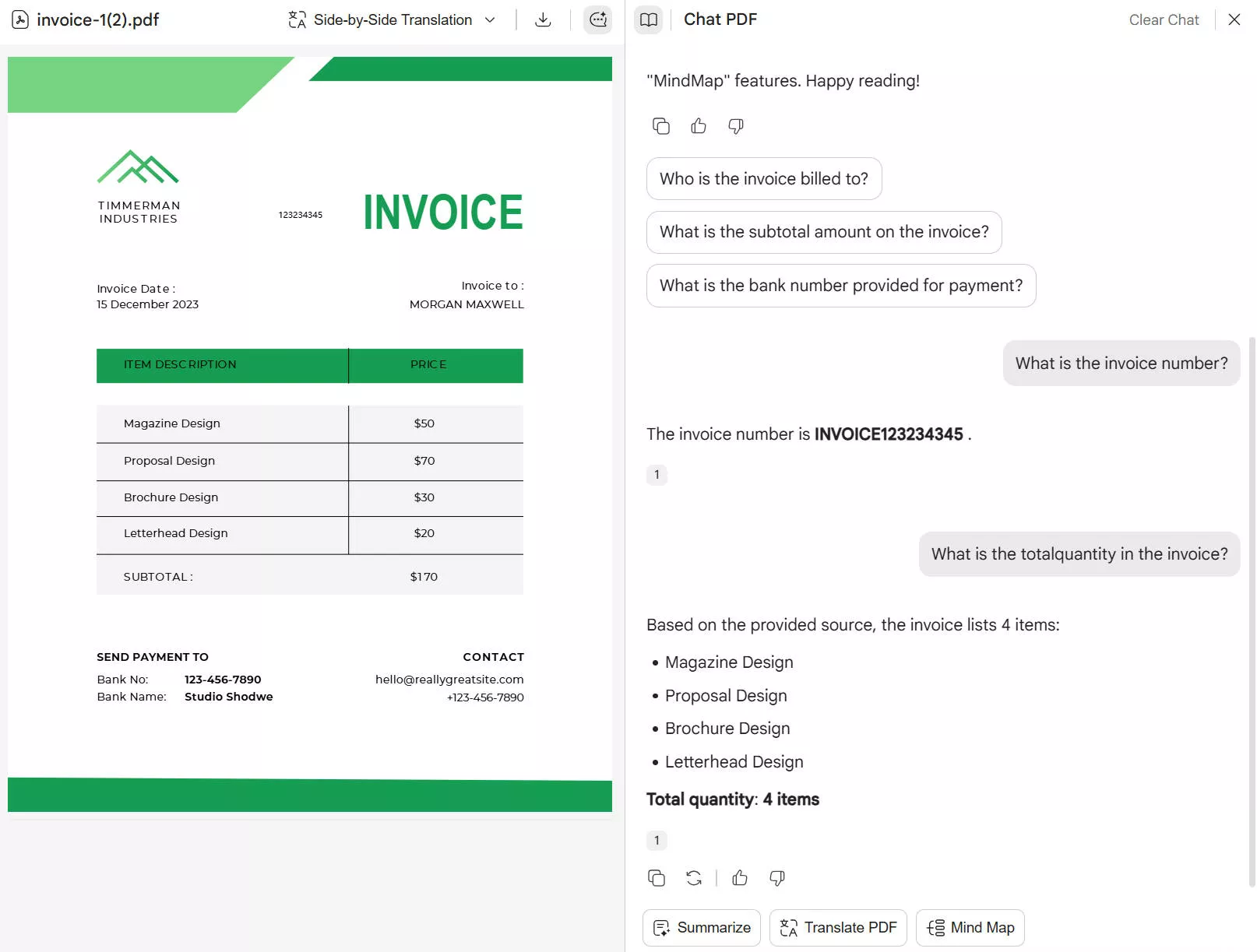

Step 1. Upload a PDF Invoice Using the Chatbot

First of all, click the button below to go to the UPDF AI online version and use the "Upload File" button to add an invoice in PDF, that will generate an auto summary of the invoice. As you navigate to the chat box at the bottom, you can type and ask the AI for specific information from the document.

Step 2. Manage an Invoice Image After Uploading it

Besides getting the basic information about the invoice, you can also ask the chatbot for the desired information, such as the total bill or tax calculation. In a similar manner, you can manage multiple invoices using the online UPDF version.

Part 5. Can You Count an Invoice as a Receipt?

While making transactions and payments, a paid receipt is proof that the seller's request for payment has been fulfilled by the buyer. It features a product description along with a detailed breakdown of the price per product and applicable tax. Invoices and a paid receipt have two different purposes and cannot be called by the same name.

Conclusion

To end the discussion, it can be said that invoice vs receipt is an important information to have while dealing with massive business transactions. UPDF is a high-end PDF management tool that simplifies the process of invoice organization using AI. It has many other functions besides file management that make it the go-to tool for all types of functions related to invoices.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF PDF AI Tools

PDF AI Tools Image AI Tools

Image AI Tools AI Chat Tools

AI Chat Tools AI Writing Tools

AI Writing Tools AI Study Tools

AI Study Tools AI Working Tools

AI Working Tools Other AI Tools

Other AI Tools PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Engelbert White

Engelbert White

Lizzy Lozano

Lizzy Lozano