Form 1099 is one of the many forms that you will have to fill out when doing your federal income taxes. Like most forms that you will have to fill out during tax season, form 1099 is meant to provide the government with information about your income so they can determine how much taxes to withhold.

In this guide, we will look at the 1099 form in greater detail; what it is, whether or not you need to fill it out and how to fill out a 1099 form electronically using an easy tool - UPDF. You can click the button below to download first.

Windows • macOS • iOS • Android 100% secure

What is Form 1099

Form 1099 is the tax document that you will have to fill out to report non-salary income to the IRS for federal tax purposes. There are more than 20 different variations of form 1099, but the most common is the 1099-NEC. The IRS requires all persons who pay independent contractors earning more than US$600 in a financial year to fill out form 1099-NEC.

A different variation of 1099 tax document is used to report money made from prize winnings, tax dividends, interest from investments, state tax refunds, sale of property, and even credit card debt forgiveness.

Form 1099-MISC vs. 1099-NEC

Form 1099-MISC is used to report trade or business payments that are unrelated to nonemployee compensation. These can include payments like at least $10 in royalties, rent, prizes and awards, medical and health card payments, payments to an attorney, and crop insurance proceeds.

Form 1099-NEC on the other hand is the form that you will fill out whenever you pay an independent contractor $600 or more in compensation. The IRS will use the information provided on this form to verify your income and therefore determine your tax levels.

Note

How to Download Form 1099

You can download a copy of form 1099 from the official IRS website or state tax website. There are also some third-party software and services that will allow you to download form 1099 directly if you choose to use a third-party service to fill out the form. Form 1099 can be downloaded in PDF format and you can choose to print it out or use a PDF program to fill out the form.

When Do I Need to Fill Out Form 1099?

Report payments on 1099-MISC Form or 1099-NEC Form only if they’re made as part of a trade or business; personal payments don’t count. A trade or business generally means operating for profit, but nonprofits are also treated as engaged in a trade or business for these purposes. The reporting rules also apply to certain trusts, tax-exempt organizations, some farmers’ cooperatives, widely held fixed investment trusts, and payments made by federal, state, or local government agencies.

If you pay an independent contractor $600 or more in a calendar year for services performed in the course of your trade or business, you generally must file Form 1099-NEC with the IRS and provide a copy to the contractor. The threshold applies per payee, and the payment must be for nonemployee compensation in your business (not personal expenses).

If you are an independent contractor (the recipient of the payment), you are not responsible for filing Form 1099-NEC yourself; instead, the payer should issue it to you. However, even if you do not receive a 1099-NEC, you must still report all your business income on your tax return.

For more 1099 miscellaneous information, please check Specific Instructions for Form 1099-MISC.

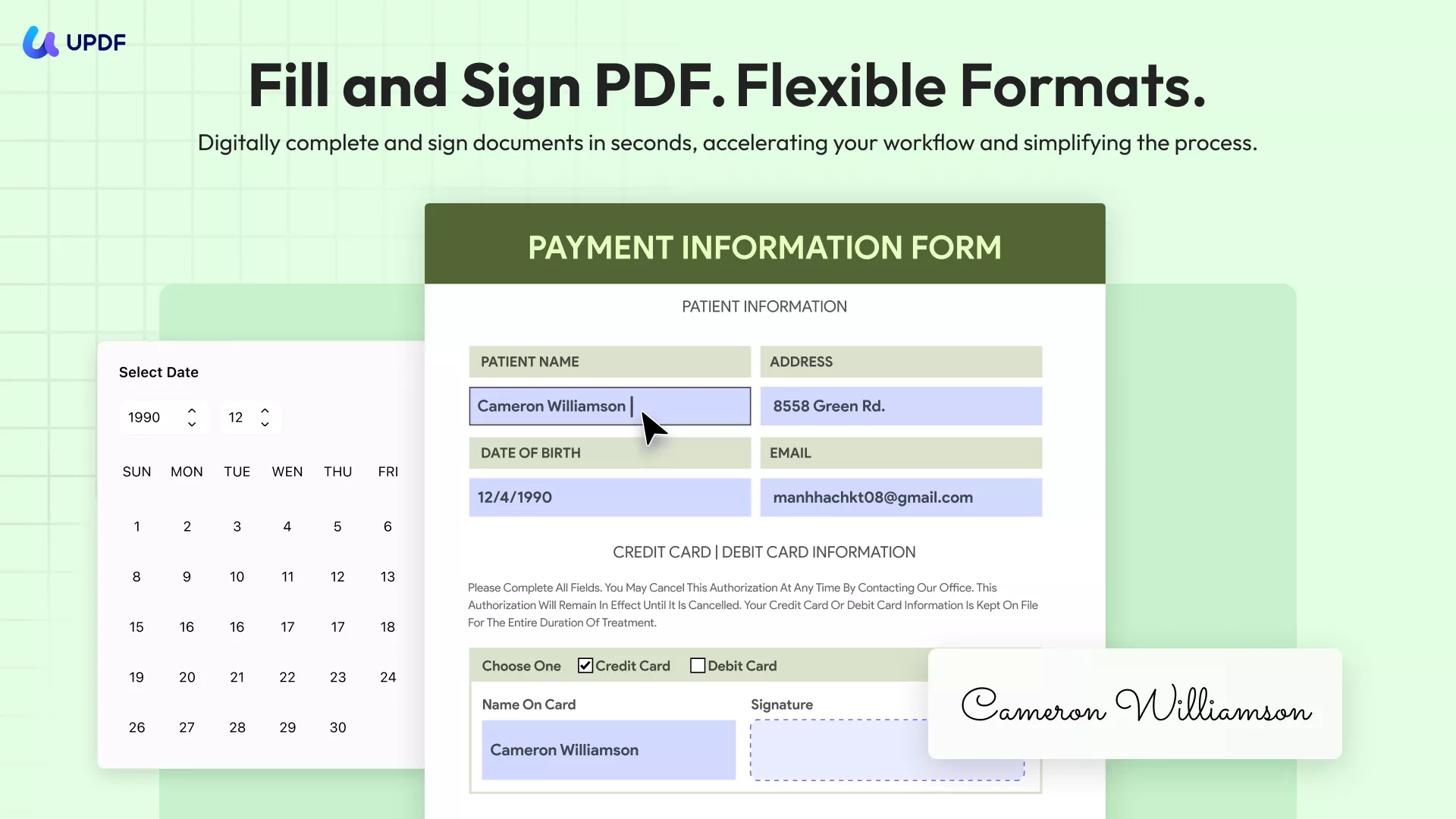

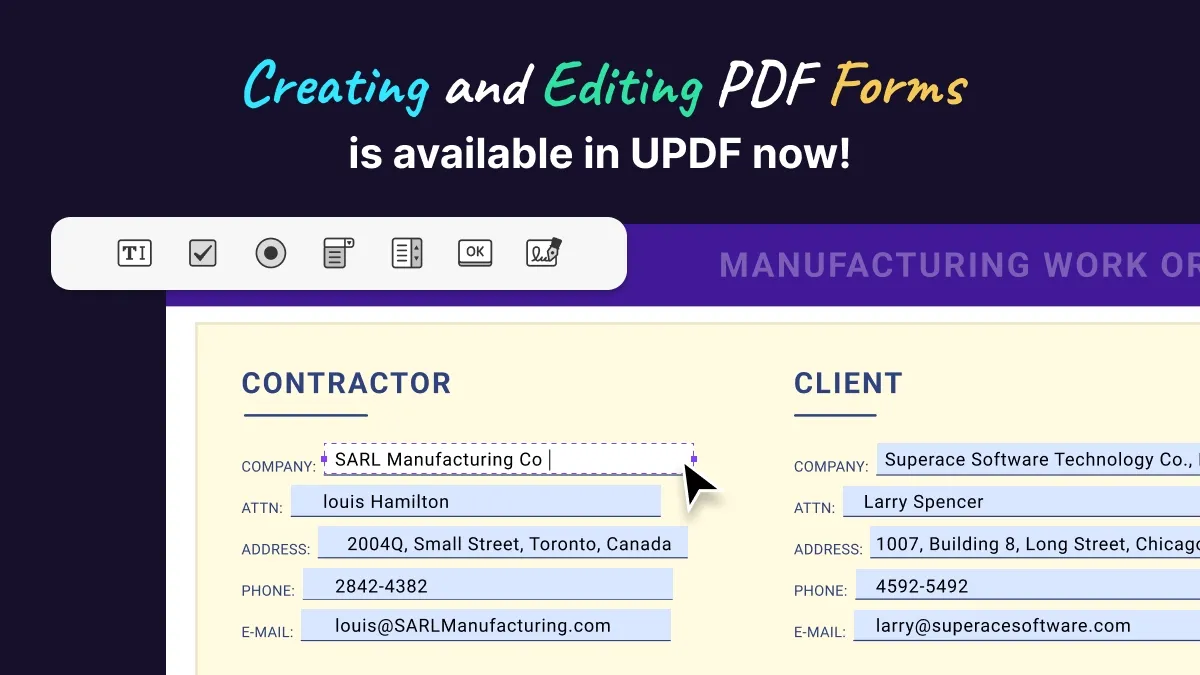

How to Fill Out IRS Form 1099

The most convenient way to fill out a form 1099 is to use a PDF form-filling solution like UPDF. UPDF is an AI-powered, all-in-one PDF editor designed to handle every PDF task with ease. Its comprehensive toolset covers nearly all the essential functions you’d expect from Acrobat Pro, but at a more affordable and cost-effective price. This tool uses form field recognition to convert any non-fillable forms into fillable ones. It helps visualize all pre-existing fields for a convenient form-filling experience on your mobile and desktop. Under the UPDF free version, all features are available with trial watermarks added.

Here's how you can use it to fill out form 1099:

Step 1: Open the Form

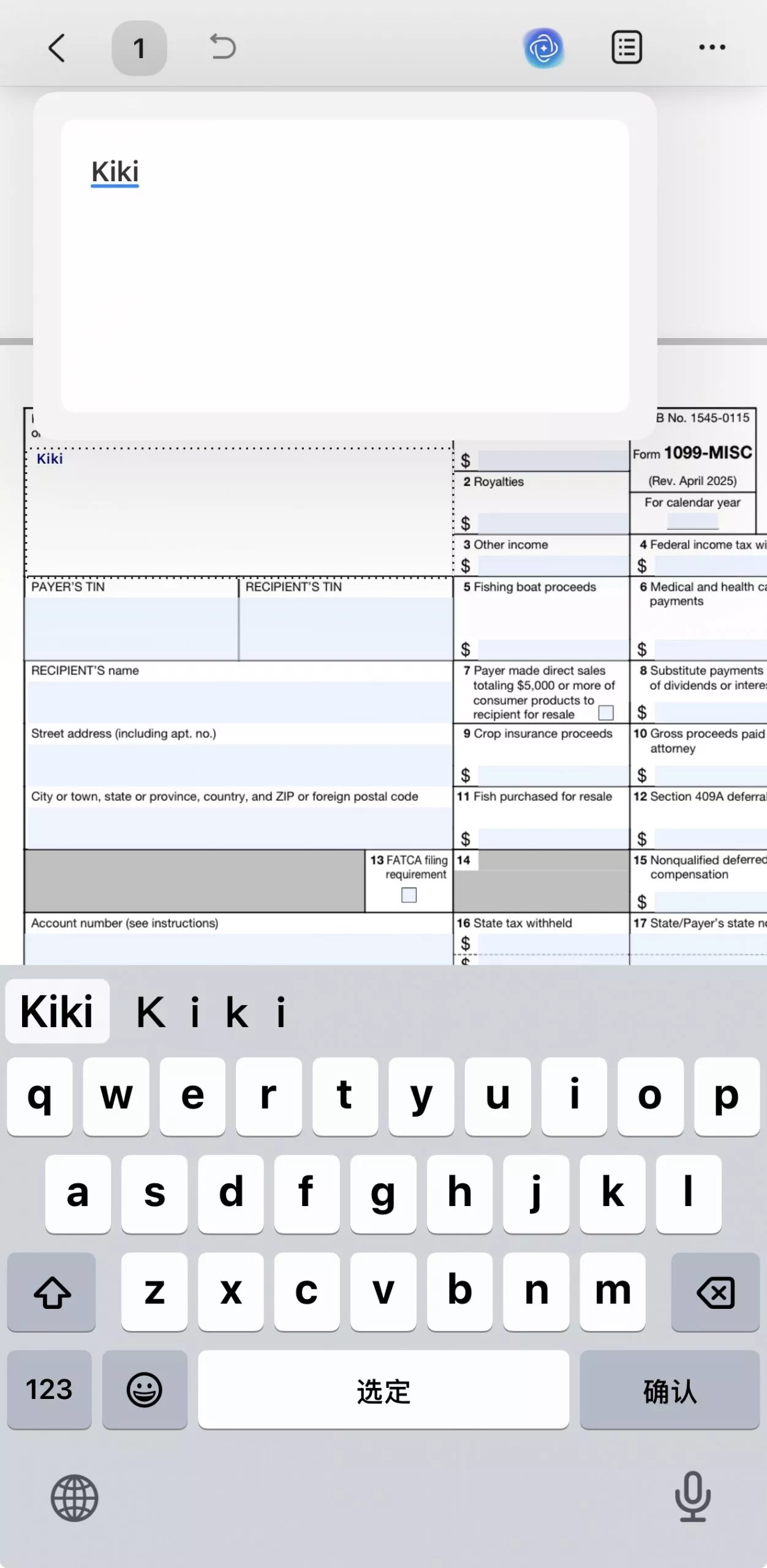

Start by downloading the correct form 1099 that you want to fill out. Dwonload UPDF and open it in UPDF.

Windows • macOS • iOS • Android 100% secure

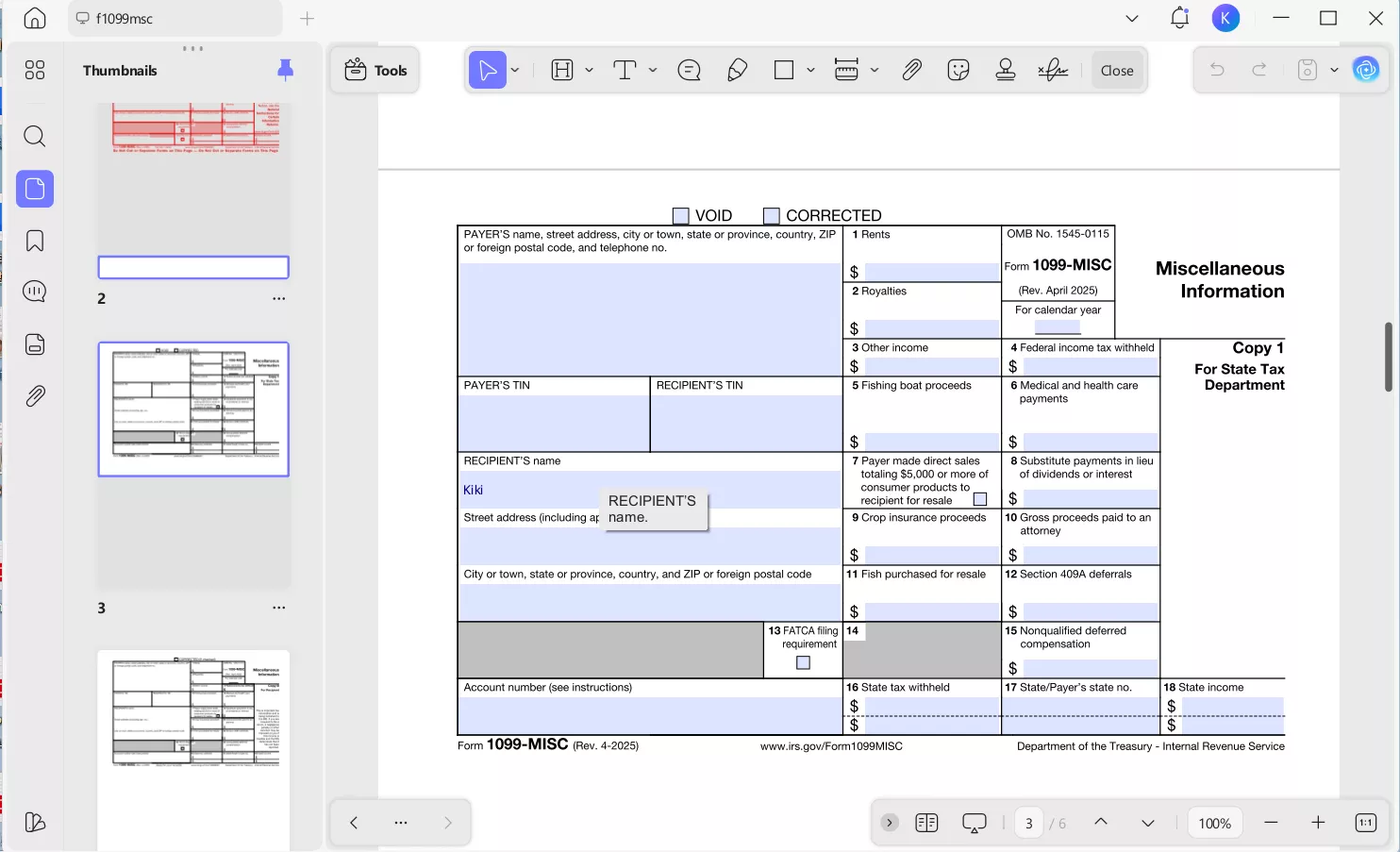

Step 2: Fill out the Form 1099

Click the required fields to enter the necessary information, and be sure to select the correct checkboxes. Before proceeding to the next step, double-check that all the details on the form are accurate.

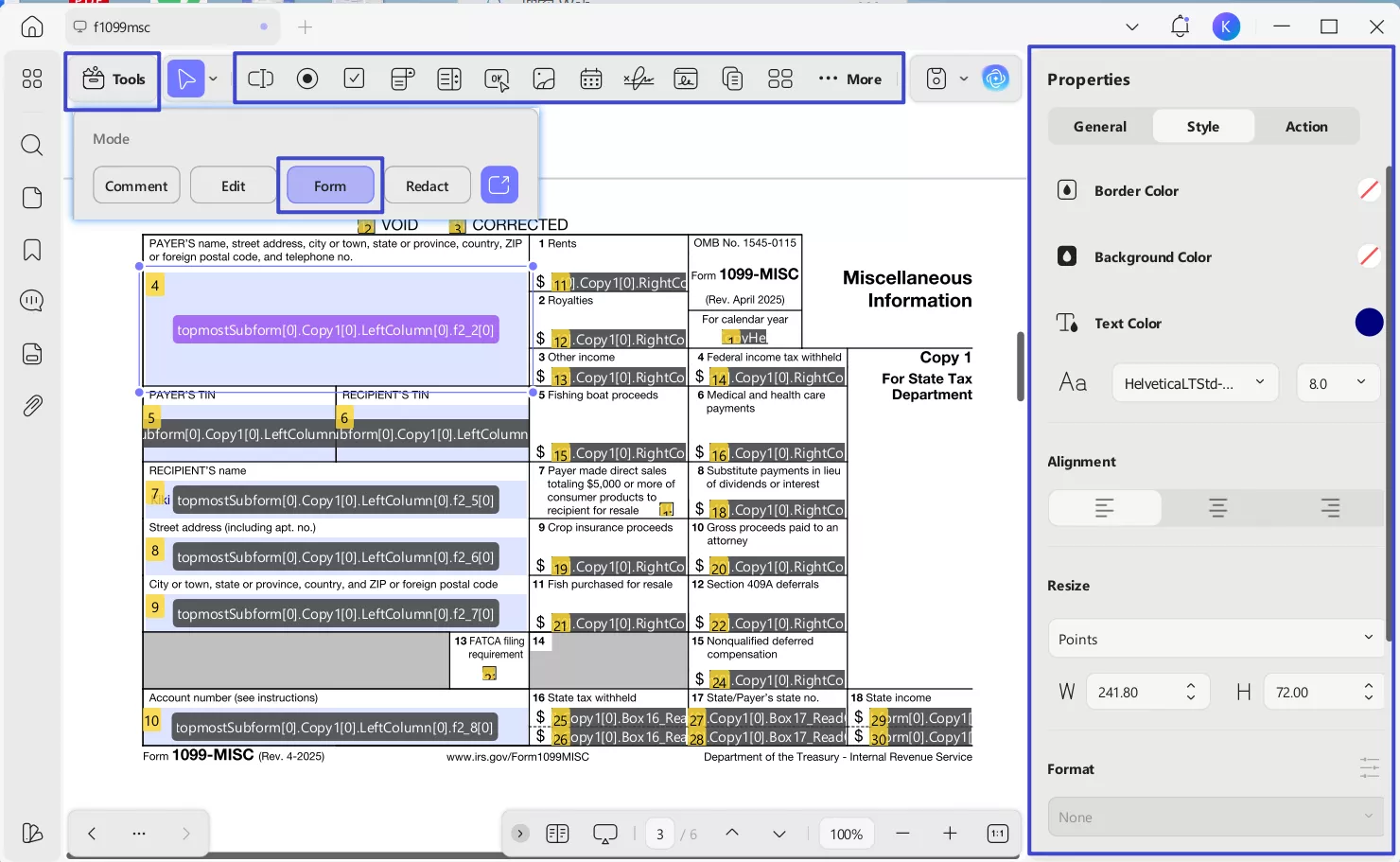

Step 3: Edit the Form 1099

If you want to supplement other content, please turn to Form mode under Tools section. Then, kindly check the top menu. It can add Text Fields, Check Boxes, Radio Buttons, Dropdowns, List Boxes, Buttons, etc. Double-click the existing form fields to change the properties.

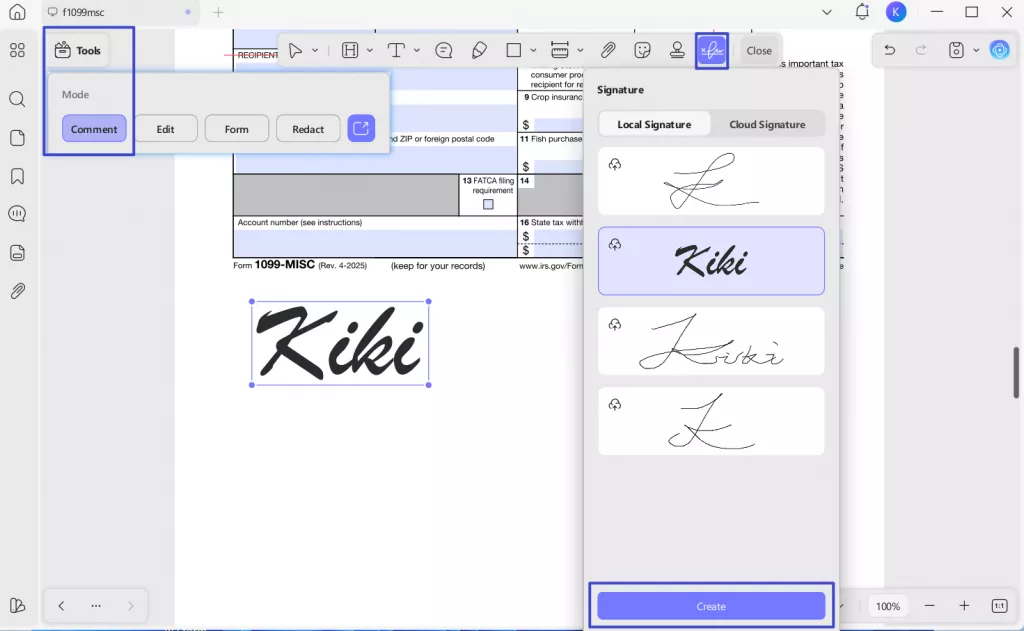

Step 4: Sign the Form 1099

Click the “Comment” icon on the left toolbar. After completing the form, go to the “Signature” tool to add your signature. Select “Create” to generate your signature, then choose it and place it onto the form.

You can also import the form 1099 into UPDF mobile app and click to fill the form easily. Start from downloading UPDF from App Store or Google Play!

Windows • macOS • iOS • Android 100% secure

Video Tutorial on How to Fill Out a PDF Form

The Best All-in-one PDF Editor and Converter

UPDF is a revolutionary new and highly effective PDF editor and converter that is designed to make all PDF functions including filling out PDF forms that much easier. This is thanks to its very simple user interface that you can use in various ways even if you have never used a PDF program before. This will be the most cost-effective tool on the market. You can download it to try and check its price here.

Windows • macOS • iOS • Android 100% secure

It has very useful features that all work together to create, edit, annotate, and convert PDFs. These features and pros include the following:

- It is the most complete PDF form filler in the market, allowing you to add text and edit the text in the 1099 form or any other PDF file easily and quickly; just as you would when working with a Word processor.

- It also allows you to authenticate the form once it is completed by adding a valid and binding signature to the document.

- It also comes with a lot of cool annotation features that can make collaboration on a document easy, ideal when you're getting help filling out form 1099 and you'd like to share your thoughts.

- The OCR feature lets you convert scanned PDF documents into searchable and editable PDFs.

- It allows you to add passwords and permissions to your PDF documents for protection.

- Its easy document-sharing features mean that you can send the form to others very quickly and without having to exit UPDF.

Common Mistakes to Avoid when Filling Out Form 1099

The following are some of the most common mistakes that we see with users when filling out form 1099;

- Failing to fill out the correct form 1099. It is important to check the variation of form 1099 that you are required to fill out before starting the filing process.

- Failing to file by the due date. This is a common mistake that can be avoided by starting early.

- Reporting the wrong Taxpayer ID Number (TIN) or forgetting to report the TIN.

- Providing incorrect details on the form.

- Filing a paper return when electronic filing is required.

- The improper formatting of name, address, and other personal details. Checking and rechecking the details on the form before submitting it can help you avoid this all-too-common error.

- Failing to ensure that the form 1099 is machine readable. The best way to avoid this problem is to file electronically (unless paper filing is required). The IRS machine reading process will favor forms that are filled in with dark ink and in clearly legible letters.

Conclusion

Filing any kind of IRS form including form 1099 can be quite challenging, especially since you need to make sure that you are selecting the correct form 1099 to file. The key is to start by determining the variation of form 1099 you need to fill out, start the filing process early, and if filing electronically, choose UPDF to simplify the process further. Asking for help when you need it will also help you avoid some of the common pitfalls experienced by many during tax season. Download UPDF today to fill out form 1099.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF Scholar Research

Scholar Research Paper Search

Paper Search AI Proofreader

AI Proofreader AI Writer

AI Writer AI Homework Helper

AI Homework Helper AI Quiz Generator

AI Quiz Generator AI Math Solver

AI Math Solver PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Enola Miller

Enola Miller

Enola Davis

Enola Davis

Lizzy Lozano

Lizzy Lozano