The Internal Revenue Service (IRS) requires businesses to fill out the W-2 and W-4 forms. Both these tax forms serve different purposes. For the W-2 form, an employer needs to fill out the form using the personnel data and payroll record. In contrast, the W-4 form is completed by the employees to provide their withholding information. As the names of these tax forms resemble a lot, many employers and employees remain confused about it. Therefore, this guide provides a detailed comparison of W-2 vs. W-4 and how to fill them with UPDF.

W-2 vs. W-4 – A Quick Overview

Before we dive deep into the differences between W-2 vs. W-4, it is important to clarify their basics.

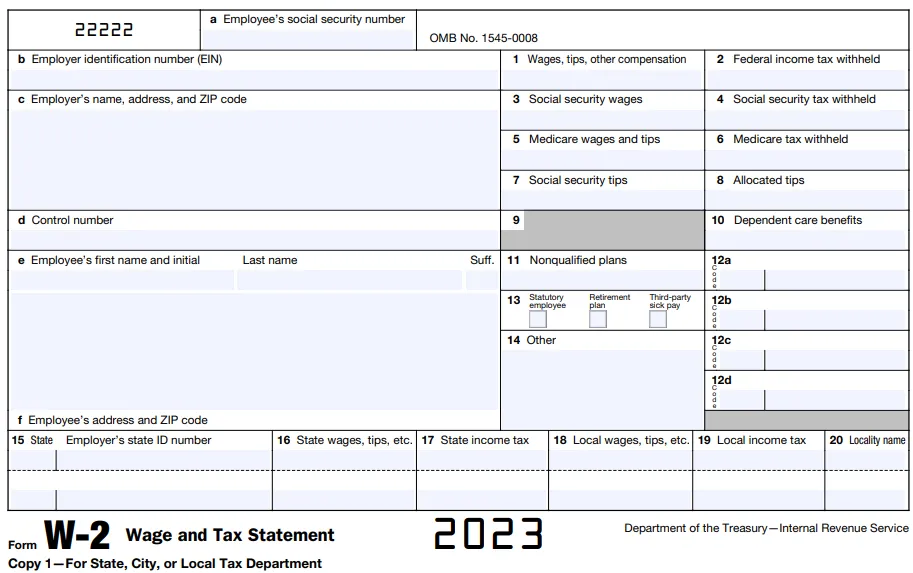

What is W-2?

W-2 is a tax form that the employer fills in to mention employee earnings and tax withholdings to the Social Security Administration (SSA) and state government agencies. The tax form reflects the gross earnings of employees and all the deductions from income, such as Medicare or Social Security taxes, dependent care, etc.

The employer must fill out a W-2 tax form using personnel data and payroll records. Below are the key points to fill in a W-2 form:

- The employee's Social Security number (SSN).

- The employer's name, address, zip code, and employer identification number (EIN).

- Wages

- Tips

- Withheld Social Security and federal income taxes

- Withheld Medicare, state, and local income taxes

- Employer-sponsored health coverage

- Dependent care benefits

- Allocated tips

- Nonqualified plans

- Deferred compensation

Employers are required to provide employees with a filled W-2 form no later than January 31 of the following year. The copies of the W-2 form are also submitted to the Social Security Administration (SSA) and state and local authorities.

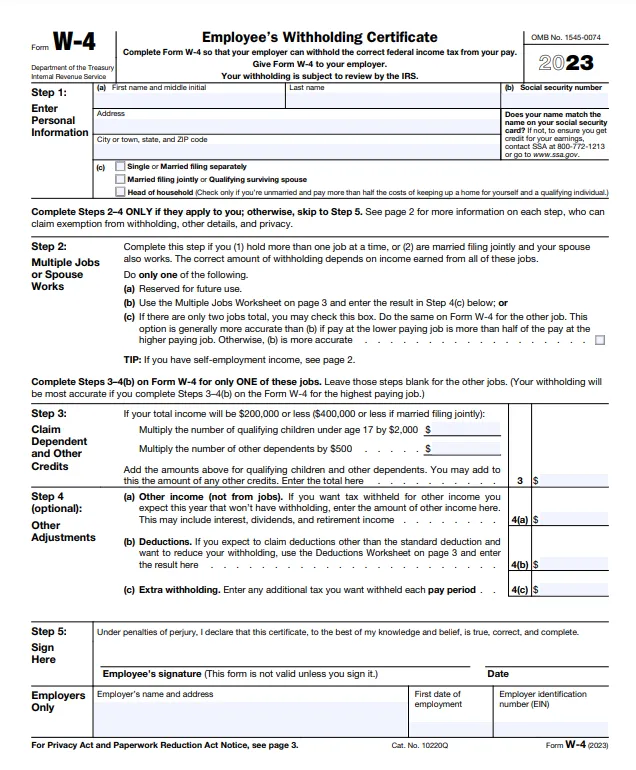

What is W-4?

W-4 is the employee's withholding certificate that helps the employer withhold the correct federal income tax from the employee's paycheck. The key points to fill in a W-4 form include:

- Name, address, and marital status of the employee

- Multiple jobs or spouse works

- Claim dependents

- Withholding adjustments

- Employee signature

The employees are usually asked to fill out the W-4 form at the time of their hiring so that the employer can adjust the payroll accordingly. However, employees can make changes to the W-4 form at any time.

W-2 vs. W-4 – 5 Key Differences

The above overview of W-2 and W-4 tax forms reflects that they are a lot different from each other and come with different purposes. So, below are the five key W-2 vs. W-4 differences worth knowing:

1. Purpose

The purpose of the W-2 form is to get the employees' earnings and tax withholding information. In contrast, the purpose of the W-4 form is to create an employee's withholding certificate so that the employer withholds the required tax.

2. Information Filled

The W-2 form contains multiple boxes that require the employee to fill in proper details about the employee's complete earnings. This includes salary, tips, compensation, etc. Besides that, the W-2 form also requires proper details on taxes withheld, Medicare and Social Security contributions, etc.

The W-4 form contains a few boxes and mostly asks for information related to the employee's tax withholding preferences. It requires the employees to add the number of allowances, filing status, and other withholding they want. So, there is no information about the earnings or tax deductions.

3. Filled By

The employer fills out the W-2 form, and copies are sent to the employee, Social Security Administration, and state/local agencies. In contrast, employees fill out the W-4 form during the onboarding day or before the first salary.

4. Submission Time

The W-2 form should be provided to employees no later than January 31 of the following year. On the other hand, the W-4 form is not submitted to any external entity. It should be filled and given to the employer before the employees receive their first salary.

5. Submission Frequency

The employer fills out the W-2 form once per year for each employee. In contrast, employees first fill out the W-4 forms on the first day of the job. Afterward, employees fill out the W-4 form again when they face any personal or financial changes.

How to Fill W-2 and W-4 Tax Forms

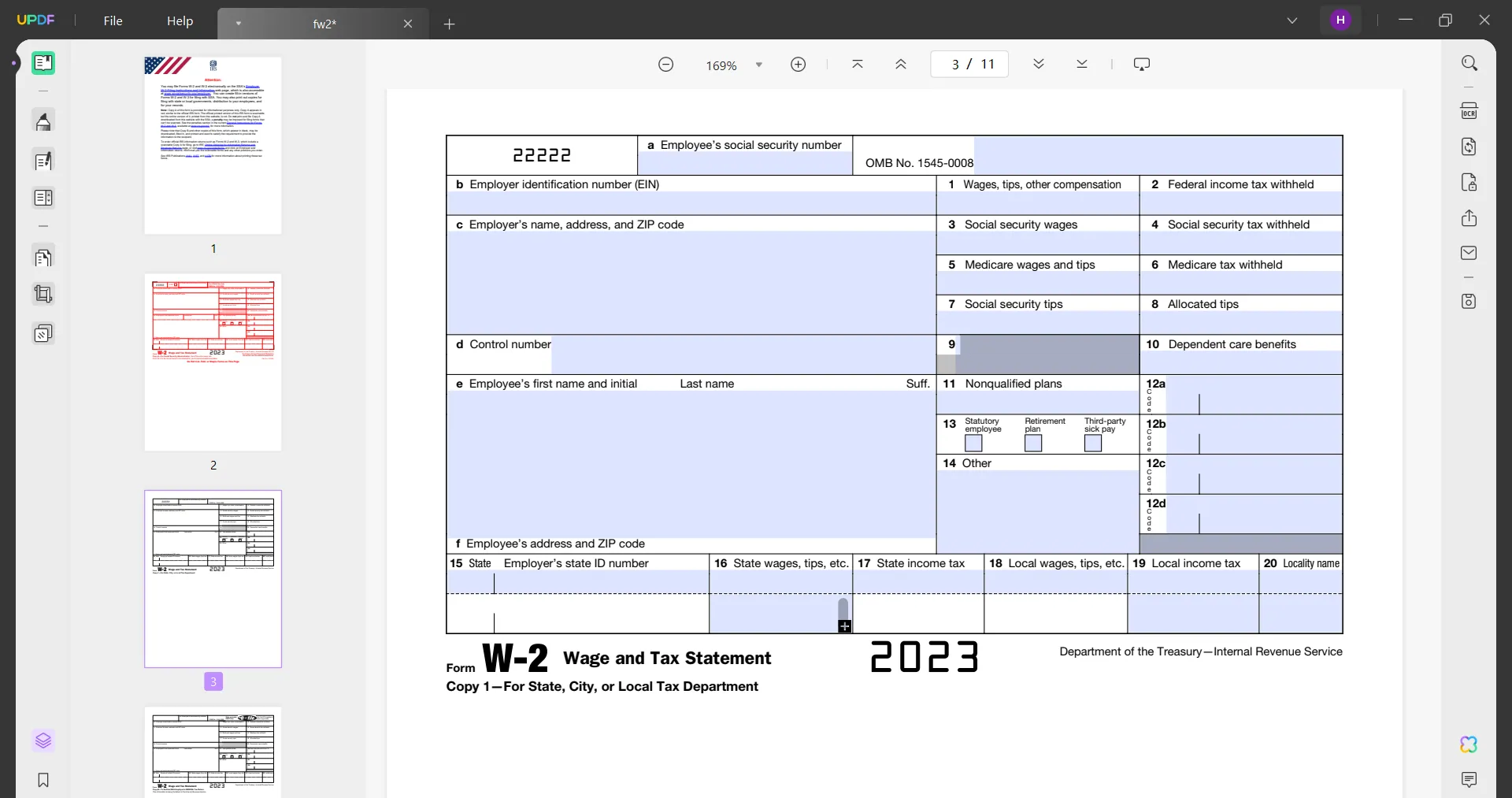

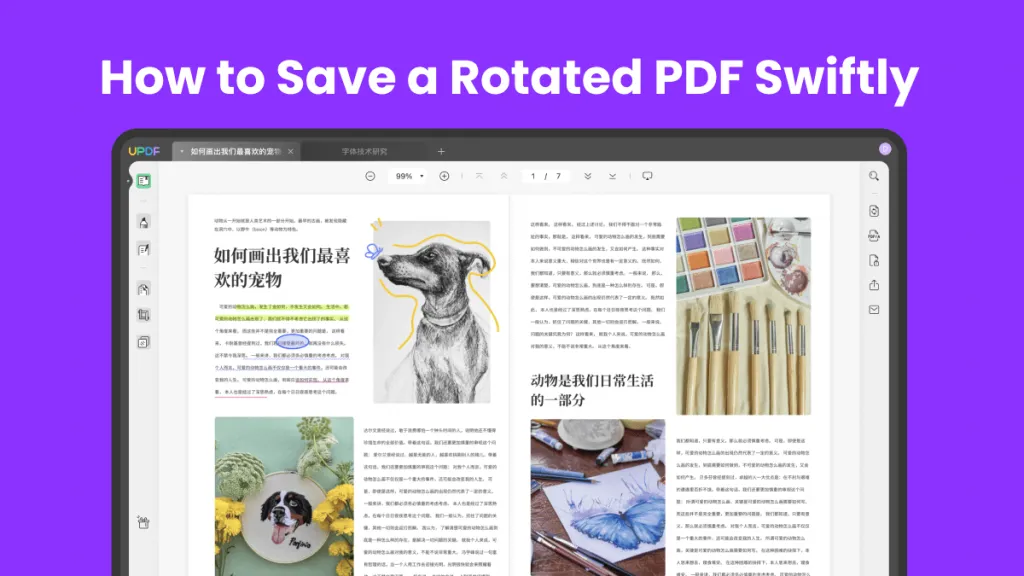

The W-2 and W-4 tax forms are accessible from the IRS website. It also provides detailed instructions on how to fill the various boxes in these tax forms. Once you have downloaded the W-2 and W-4 tax forms, you need a PDF form-filling tool to easily fill all the boxes. This is where UPDF comes into action.

UPDF is an advanced and powerful PDF editor and form-filling tool that provides the most intuitive interface to easily and instantly fill forms. It intelligently identifies all the fillable boxes in the form and allows you to fill the entries easily. Besides that, it also allows you to draw or upload your sign for the W-4 form.

Follow the below steps to learn how to fill W-2 and W-4 tax forms with UPDF:

- Download W-2 and W-4 tax forms from the IRS website.

- Download and launch UPDF.

Windows • macOS • iOS • Android 100% secure

- Open either W-2 or W-4 form with UPDF.

- Click the "Prepare Form" option from the left sidebar and choose "Form Field Recognition" from the "Settings" tab on the top. Now, the tool will detect all the fillable entries in the form. Once done, click the "Read" icon from the left sidebar.

- Start filling in the entries one by one.

- Once all the entries are added, you can click the "Share" icon from the right sidebar and share the document instantly via link or email.

That's it! This way, UPDF provides a one-stop platform to fill the boxes in W-2 and W-4 easily. To know more details about what to add in the field boxes, UPDF also provides a detailed guide on all the entries of W-2 and W-4. So, simply download UPDF and quickly fill out the tax form without any hassle.

Windows • macOS • iOS • Android 100% secure

Wrapping Up

W-2 and W-4 are essential tax forms companies must fill in to comply with the IRS regulations. Therefore, this guide talked in detail about all the key information you need to understand the basics and differences between W-2 vs. W-4. Besides that, this guide also recommends installing UPDF to have a seamless way to fill and sign tax forms. So, keep this guide as your reference and download UPDF to easily fill out tax forms anytime.

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF Scholar Research

Scholar Research Paper Search

Paper Search AI Proofreader

AI Proofreader AI Writer

AI Writer AI Homework Helper

AI Homework Helper AI Quiz Generator

AI Quiz Generator AI Math Solver

AI Math Solver PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Enid Brown

Enid Brown

Enola Miller

Enola Miller

Delia Meyer

Delia Meyer