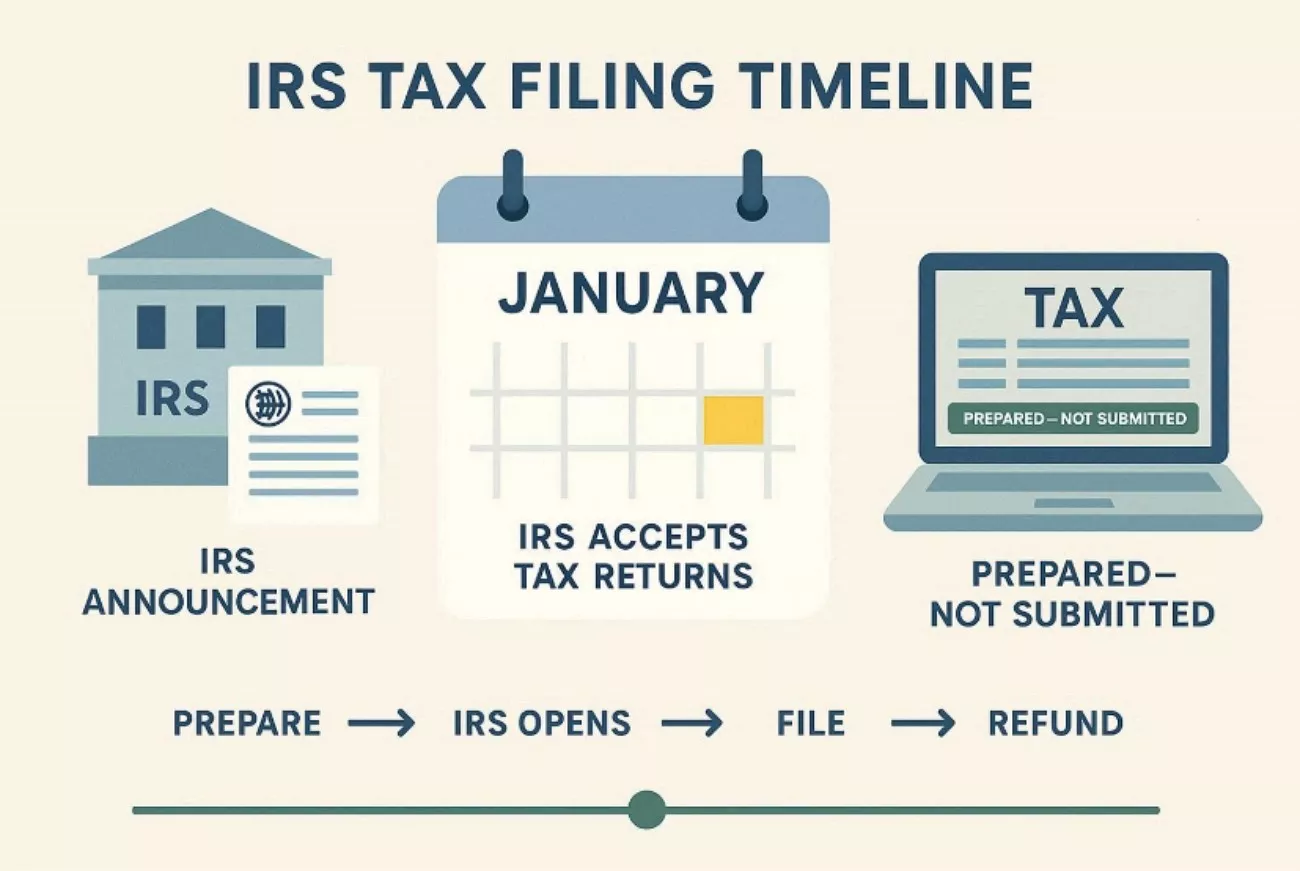

Every year, I ask, “When does the IRS begin accepting tax returns?” This matters because the IRS never uses a single fixed filing date. My tax software allows early preparation, but the returns remain officially unprocessed. Processing starts only after the official opening day announced each filing season. Tracking acceptance timing prevents confusion and supports realistic planning each tax year.

Thus, knowing when the IRS starts accepting returns shapes refund expectations clearly. The tax refund schedule depends on filing accuracy, timing, and volume. I explain dates and show how UPDF simplifies tax form preparation efficiently. Therefore, UPDF works across desktop and mobile to securely complete official IRS PDFs. So, I recommend using the UPDF and reading on for guidance.

Windows • macOS • iOS • Android 100% secure

Part 1. When Does the IRS Begin Accepting Tax Returns Each Year?

For each year’s tax filing season, I expect the IRS to begin accepting tax returns by January. While the date is not confirmed in advance, the pattern has stayed consistent for years. Here is what I have consistently noticed over time while tracking IRS filing announcements:

- The IRS usually announces the official opening day in a press release released in December or early January.

- In recent filing seasons, the opening date has fallen in the second half of January, often during the final full week.

- That opening day is the real answer to when the IRS start accepting returns, not when tax software becomes available.

Even though my tax software allows early preparation, the IRS does not process before the date. That is why I always wait for the official notice instead of guessing. To avoid guessing each year, you can check this IRS tax return dates guide for updated acceptance timelines. This approach helps me estimate the each year’s tax refund schedule more accurately. So, tax season feels predictable instead of stressful each year.

Part 2. How The Tax Refund Schedule Usually Works After Opening Day

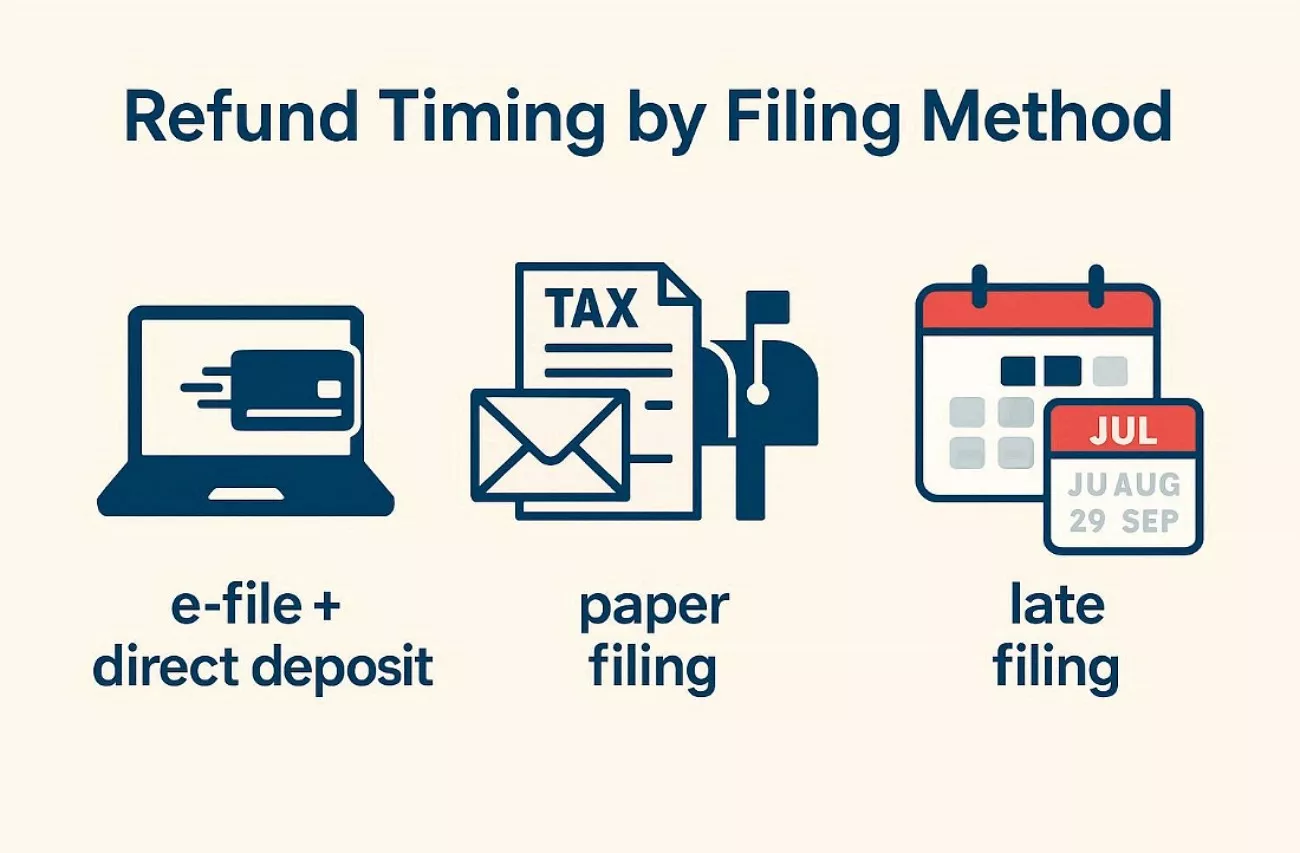

Once the IRS officially begins accepting returns, the refund timeline usually follows a predictable pattern. When I e-file early and choose direct deposit, refunds often arrive within two weeks. However, refund timing still varies depending on filing method, accuracy, and seasonal volume.

Refund Timing By Filing Method

- Early electronic filers using direct deposit usually receive refunds faster than most taxpayers.

- Paper returns and mailed refund checks generally take much longer to process fully.

- Later seasonal filings often push refund delivery into March or even later months.

Example From a Typical Filing Season

If the IRS opens in late January, early filers often receive refunds during February. Returns submitted later usually see refund processing spread across March and April. For the 2026 tax refund schedule, the IRS opened on Monday, January 26, 2026. Early filers during 2026 generally received refunds in mid to late February. Later filers experienced refund timelines extending into March and beyond.

Credits That Affect Refund Timing

I also account for special rules affecting refunds that include certain refundable tax credits. Refunds with EITC or ACTC are legally delayed until late February, regardless. This delay directly impacts the overall tax refund schedule for many households.

Thus, instead of tracking exact calendar dates, I prioritize accuracy, electronic filing, and early submission. That approach consistently places my return within earlier refund processing windows.

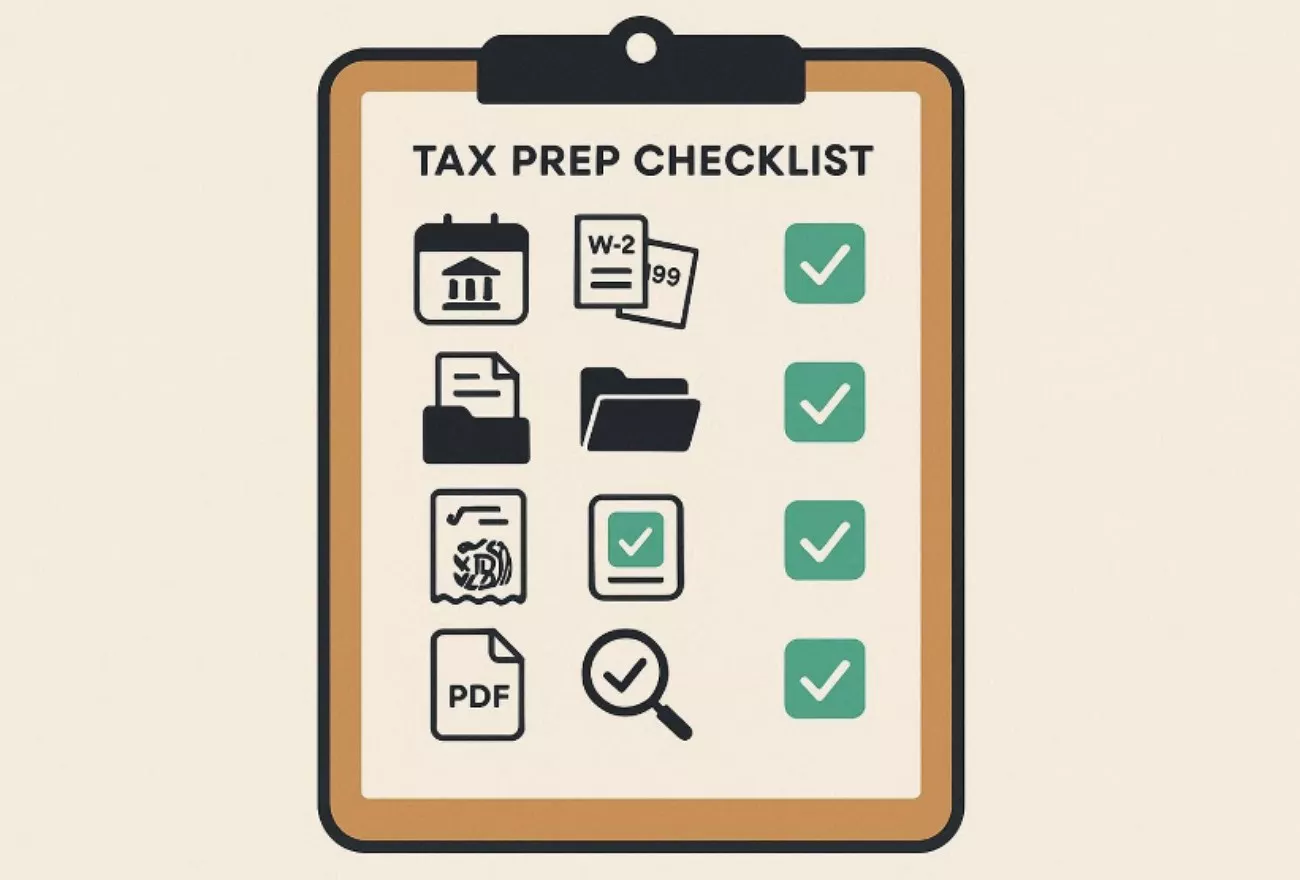

Part 3. My Annual Tax Prep Checklist Before Filing

No matter the year, I follow the same checklist mentioned below before submitting my return:

- I start by confirming “when does the IRS begin accepting tax returns” each filing season. This helps me plan my preparation timeline and avoid finishing returns too early.

- I wait until all income documents arrive before finalizing anything. These include W-2s, 1099s, and any additional income statements I receive.

- I gather receipts and records for deductions and credits I plan to claim. This includes education expenses, childcare costs, medical payments, mortgage interest, and donations.

- I organize all documents in one place to avoid searching during final reviews. Good organization reduces mistakes and speeds up the filing process.

- I download the latest IRS forms as PDFs for the current tax year. These include Form 1040 and any required schedules for my filing situation.

- I review everything carefully before submission to avoid corrections or refund delays. Following this checklist makes tax season smoother and far less stressful.

Part 4. How I Use UPDF on Desktop and Mobile to Fill My Tax Forms

Official IRS tax forms are provided as PDFs, so consistent editing tools matter. A single workflow across devices becomes important during every filing season. This consistency matters most while tracking “when does the IRS start accepting returns” yearly. For this reason, I rely on UPDF for tax preparation tasks. As UPDF is an AI-powered, all-in-one PDF editor built for handling official documents.

Windows • macOS • iOS • Android 100% secure

Moreover, the tool supports reading, editing, annotating, organizing, protecting, and OCR processing. These features cover nearly all essential functions typically required for tax form management. UPDF also includes an AI assistant that explains, summarizes, and translates content. Plus, the interface remains consistent across platforms, reducing errors during form completion. This stability helps when completing tax forms gradually across multiple working sessions.

Both UPDF and UPDF AI can be used for free. Under the UPDF free version, all features are available with trial watermarks added. The UPDF AI free version allows you to ask up to 100 questions.

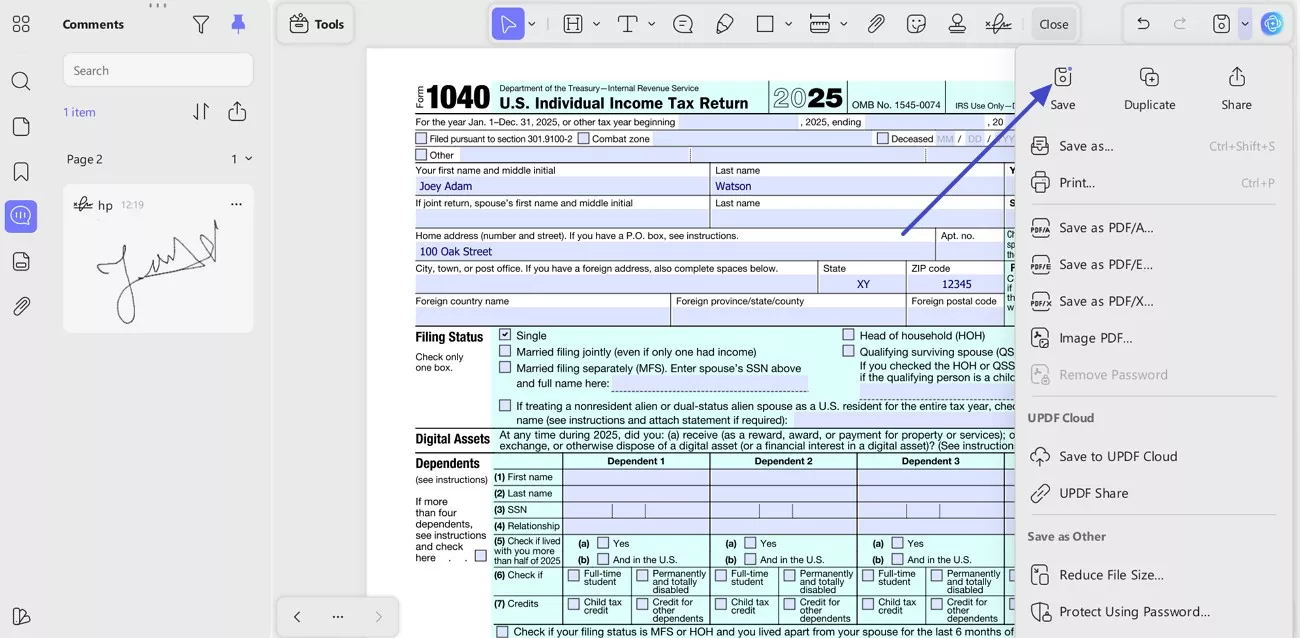

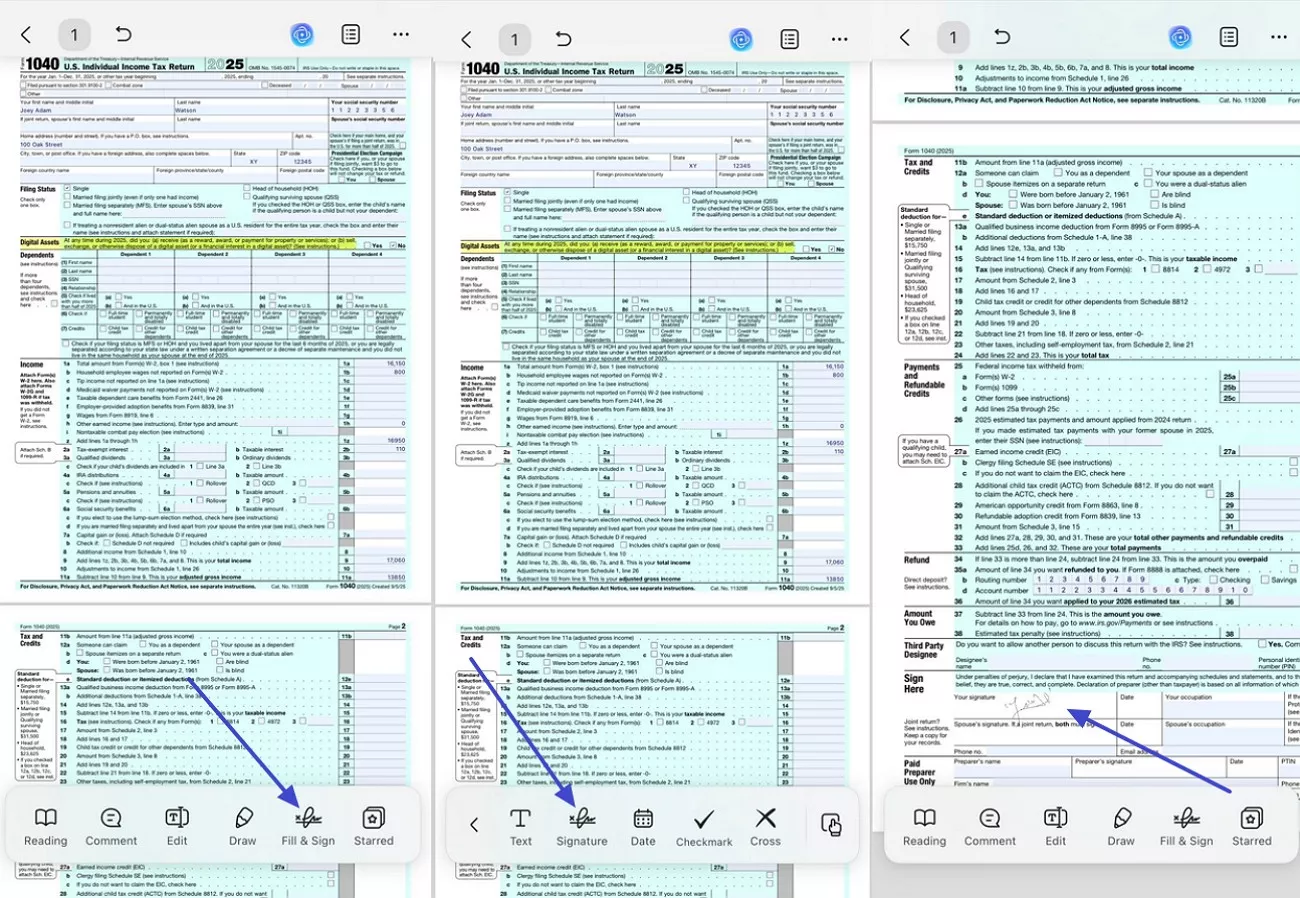

How I Fill IRS Tax Forms on Desktop Using UPDF

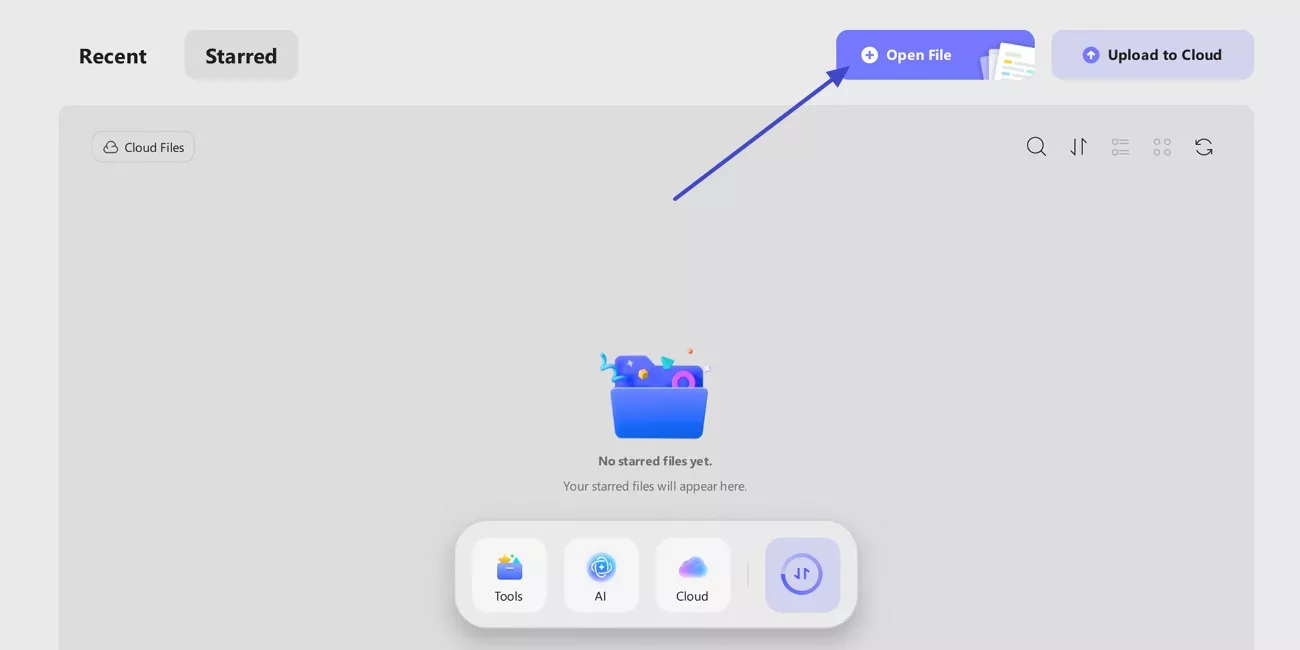

Now, have a look at the steps below that I used to fill IRS Tax form on a desktop using UPDF:

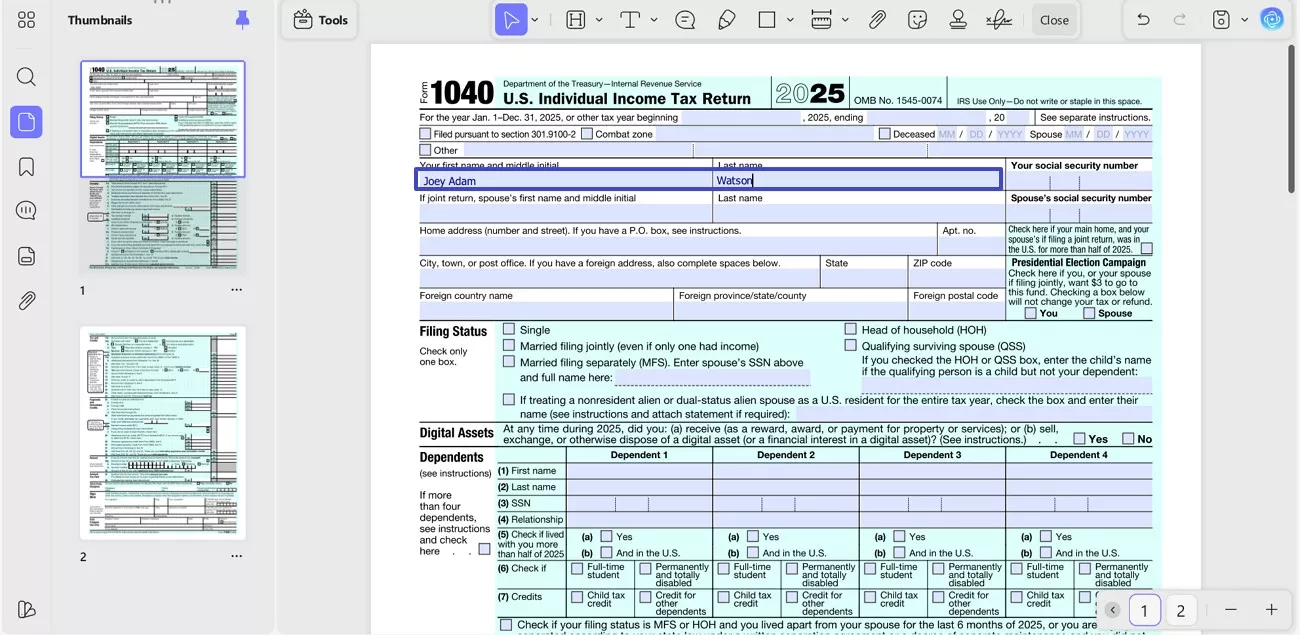

Step 1. Open the IRS Tax Form PDF in UPDF

First, I launch UPDF on my desktop and select the “Open File” button. I then locate and open the official IRS Form 1040 PDF on my computer.

Windows • macOS • iOS • Android 100% secure

Step 2. Enter Information into Fillable Fields

Next, I click inside the fillable fields shown on the IRS Form 1040. I type personal details, addresses, and other required information directly into the form.

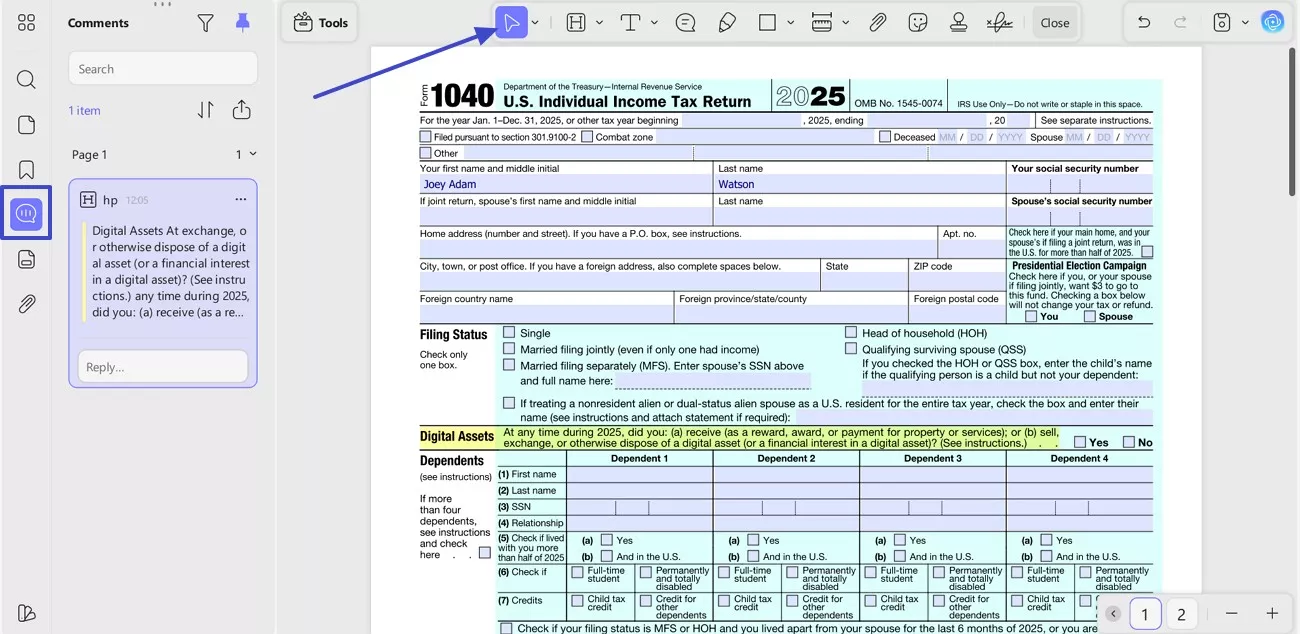

Step 3. Highlight Sections That Need Review

Then, I navigate to the “Comment” option from the left sidebar and pick the “Selection” tool. After that, I highlight lines or sections that I want to review later carefully. Moreover, you can add a comment alongside with highlight text for a reminder.

Step 4. Insert an Electronic Signature

Later, I select the “Signature” icon from the toolbar to continue. I add my electronic signature directly in the designated signature area to further proceed.

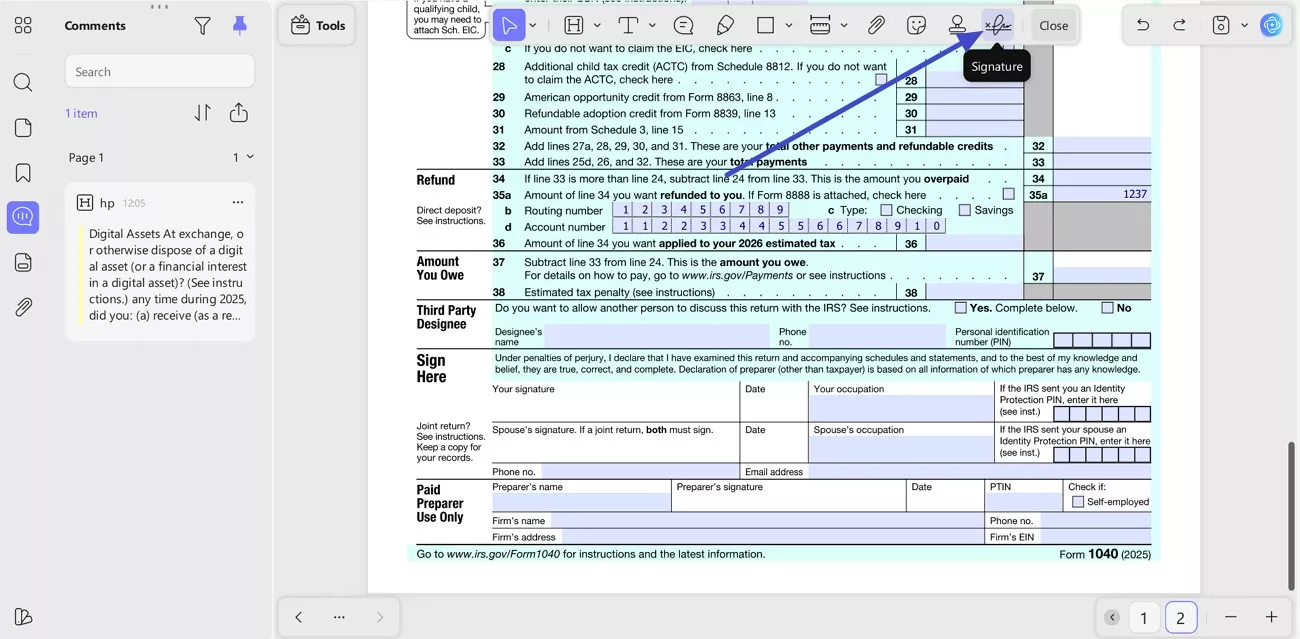

Step 5. Use UPDF AI to Explain Complex Sections

Upon reviewing, I select confusing text and open the “UPDF AI” menu. Afterwards, I chose the “Explain” option to understand the paragraph in simpler terms.

Step 6. Save the Tax Form to Your Device

Lastly, I click the save option from the top-right menu to save the completed tax form locally or to UPDF Cloud if needed

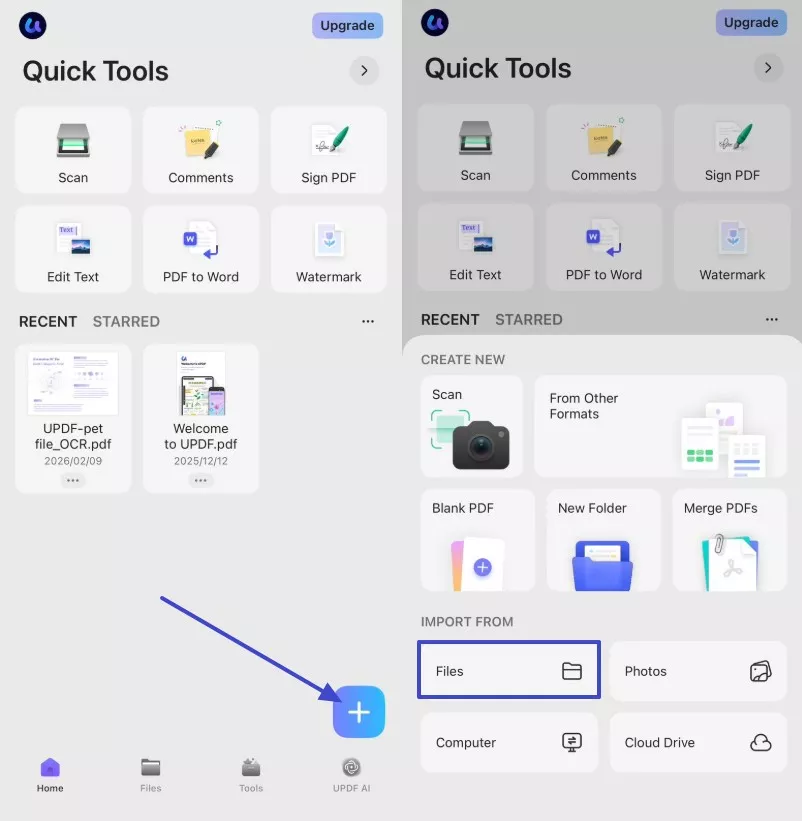

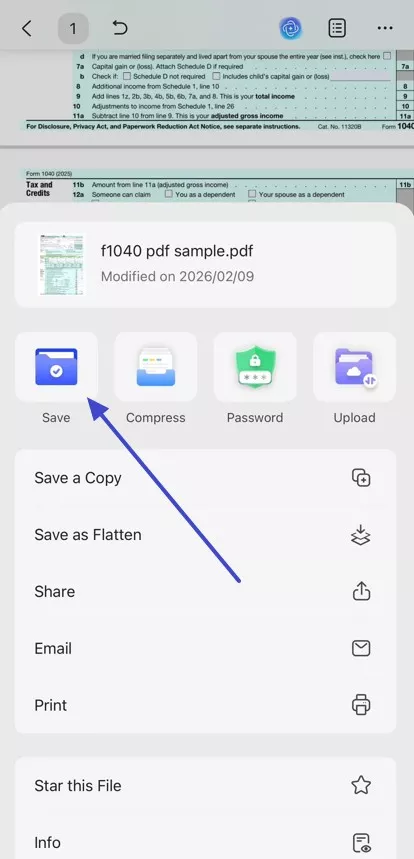

How I Review And Edit IRS Tax Forms On Mobile Using UPDF

Below are the steps that I follow to review and edit the IRS Tax form on mobile with UPDF:

Step 1. Add IRS Tax Form to UPDF App

Before getting started, download the UPDF mobile app from:

Windows • macOS • iOS • Android 100% secure

Upon running the UPDF app on my mobile device, I tap the “+” icon and select the “Files” option to import the IRS tax form.

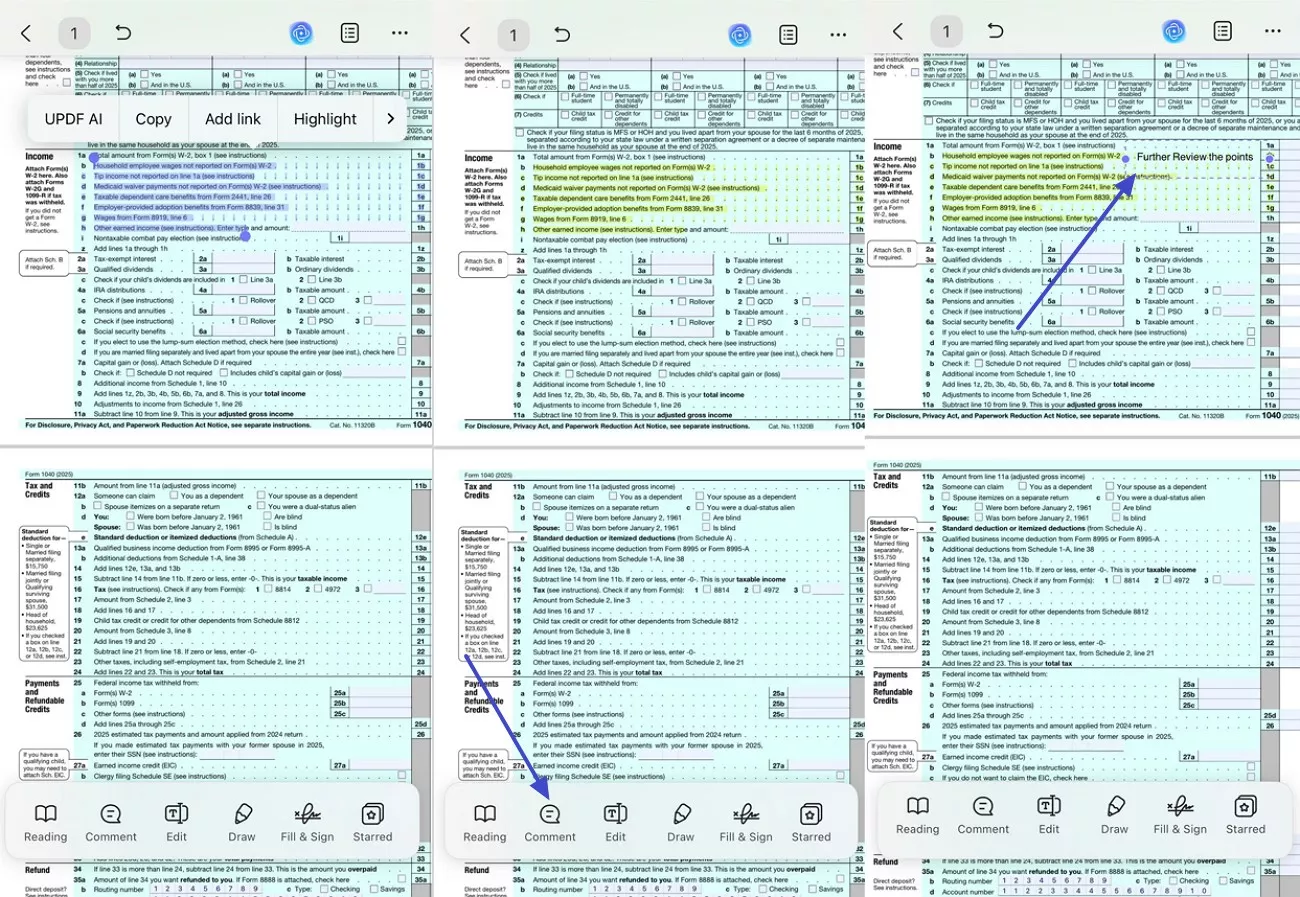

Step 2. Highlight Sections And Add Comments For Review

Then, I press and hold on to specific text within the form. Next, I select the “Highlight” option from the pop-up editing menu to mark important sections. Next, I switch to the ‘Comment” tool from the bottom menu. I add short notes beside highlighted lines that need further verification.

Step 3. Use UPDF AI To Explain Complex Tax Sections

Later, I select the confusing text within the IRS form. Then, I open the “UPDF AI” menu and select the “Explain” option. This provides a simpler explanation of the selected paragraph for understanding.

Step 4. Add Electronic Signatures To IRS Tax Forms

Now, I tap the “Fill & Sign” option from the bottom toolbar to further choose the “Signature” option. Afterwards, I place my electronic signature in the designated signature fields.

Step 5. Render the Tax Form to Your Device

Finally, I chose the “Three Dots” to select the “Save” option to render the updated tax form.

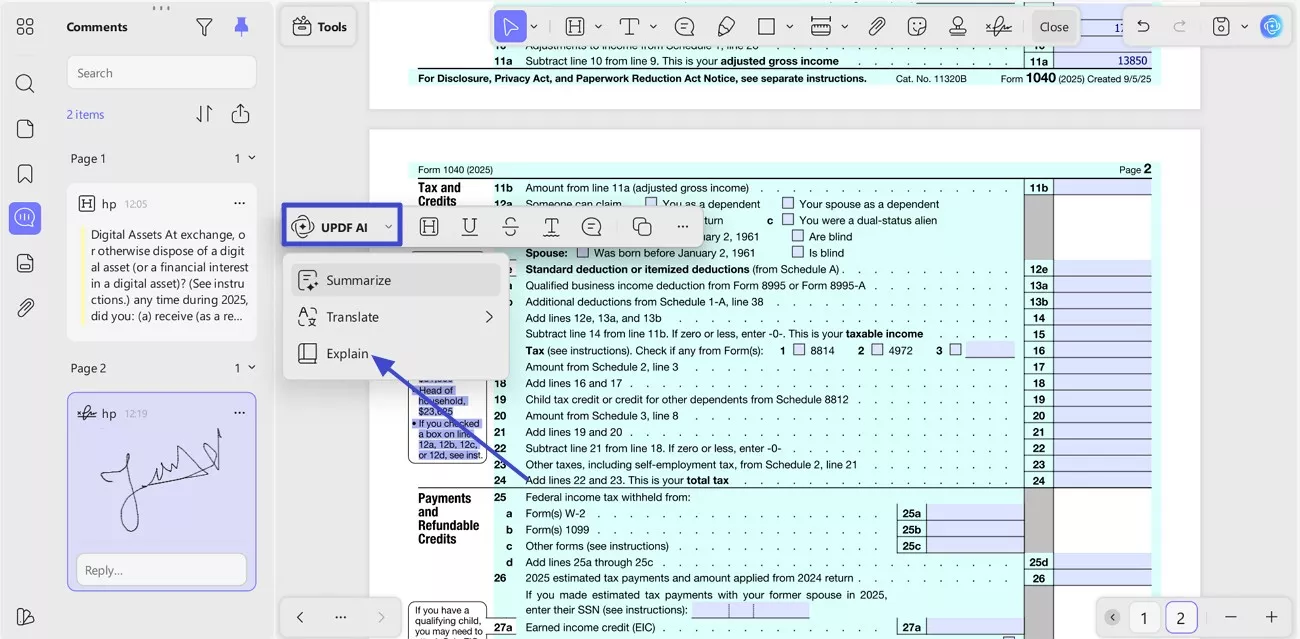

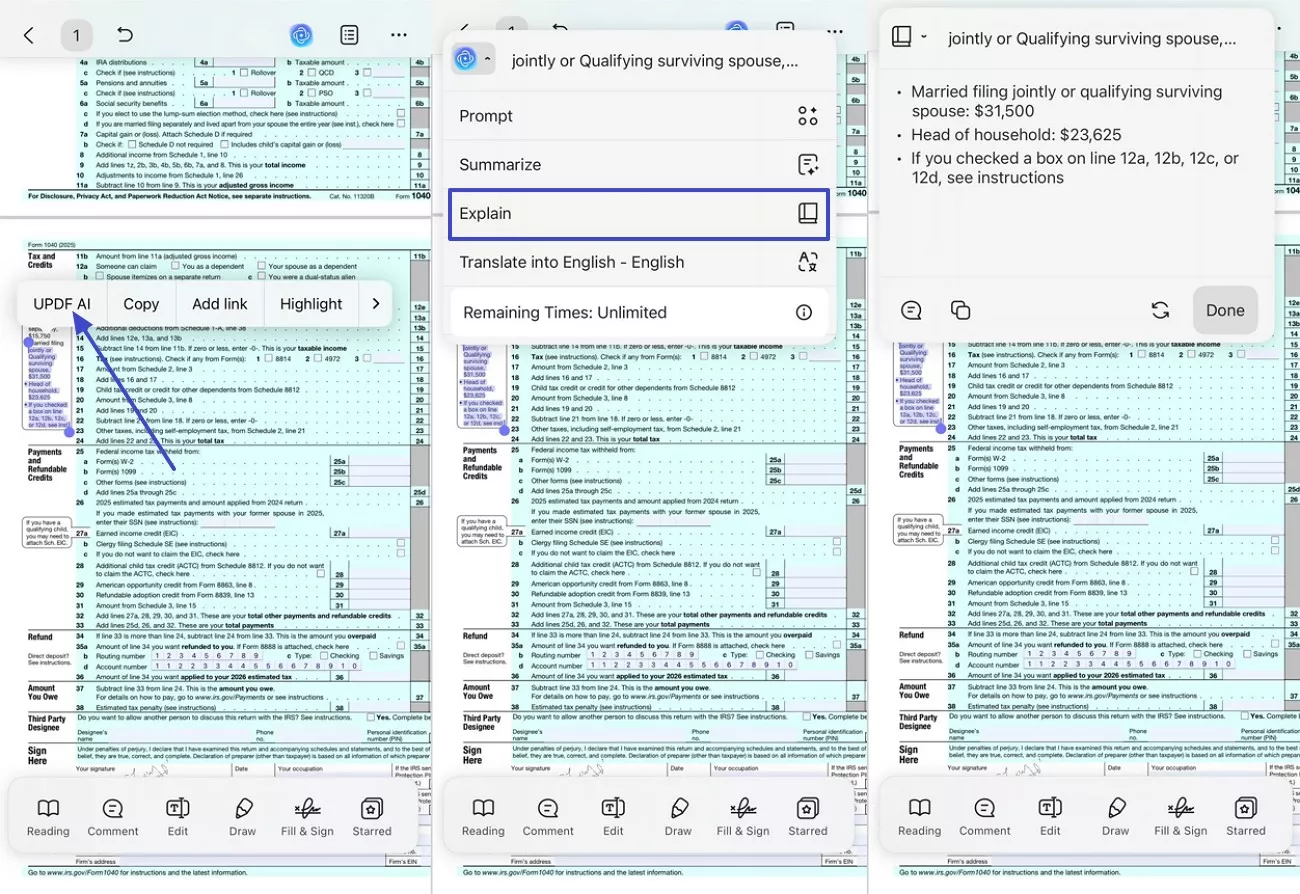

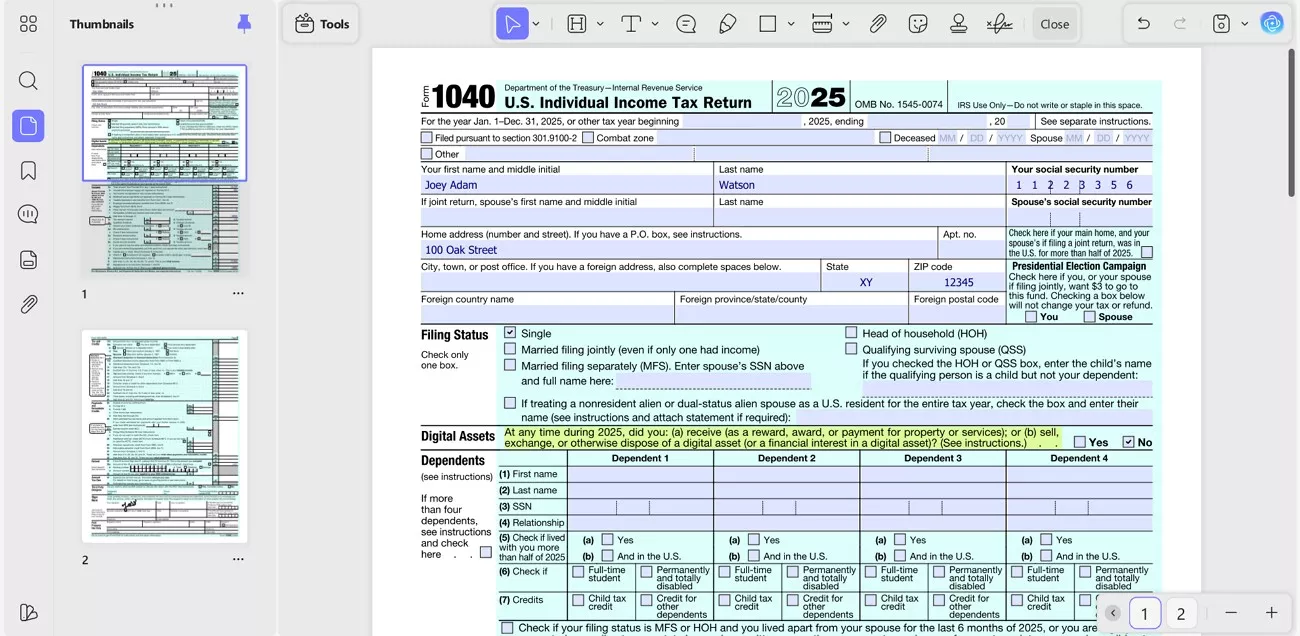

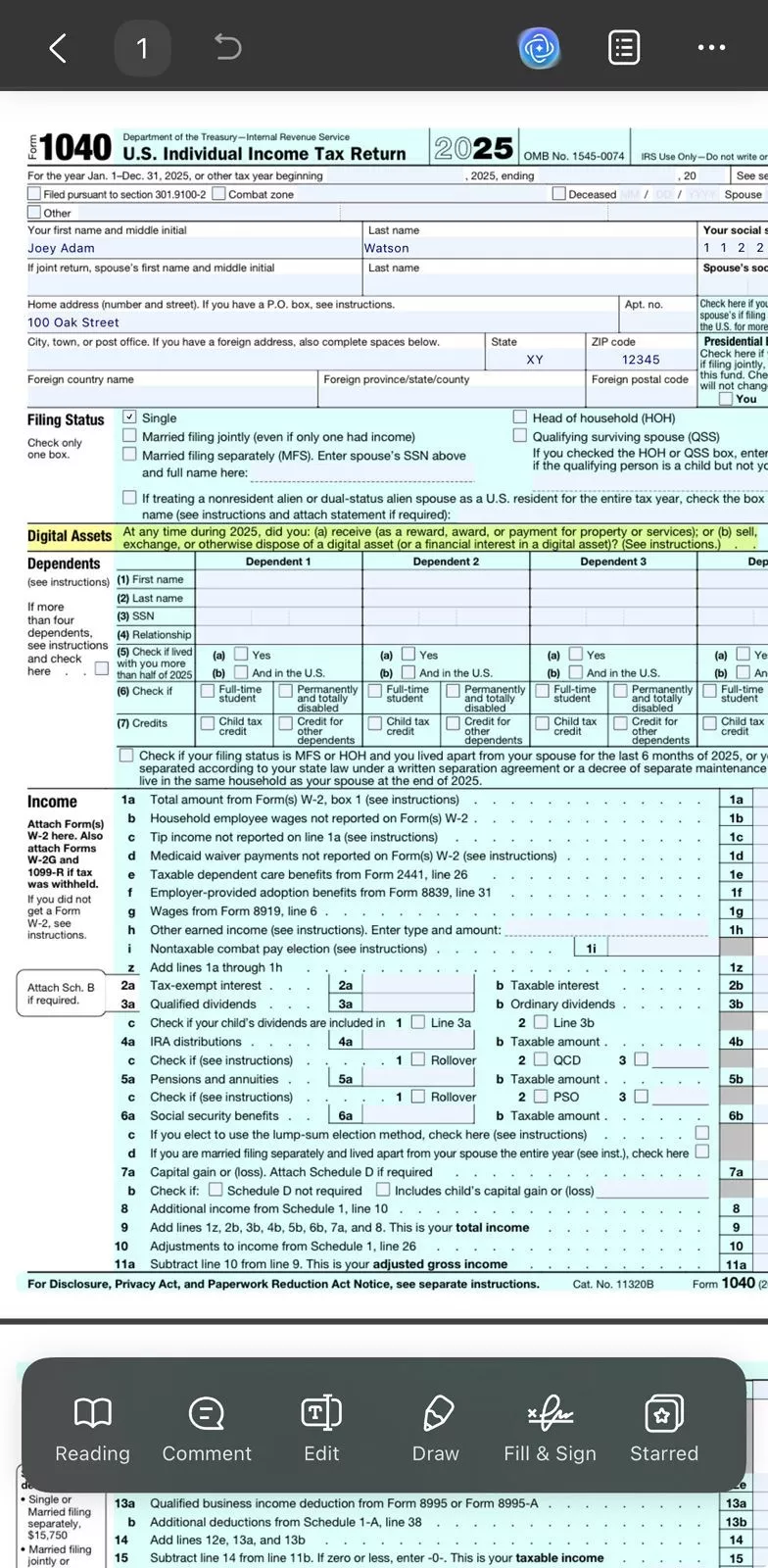

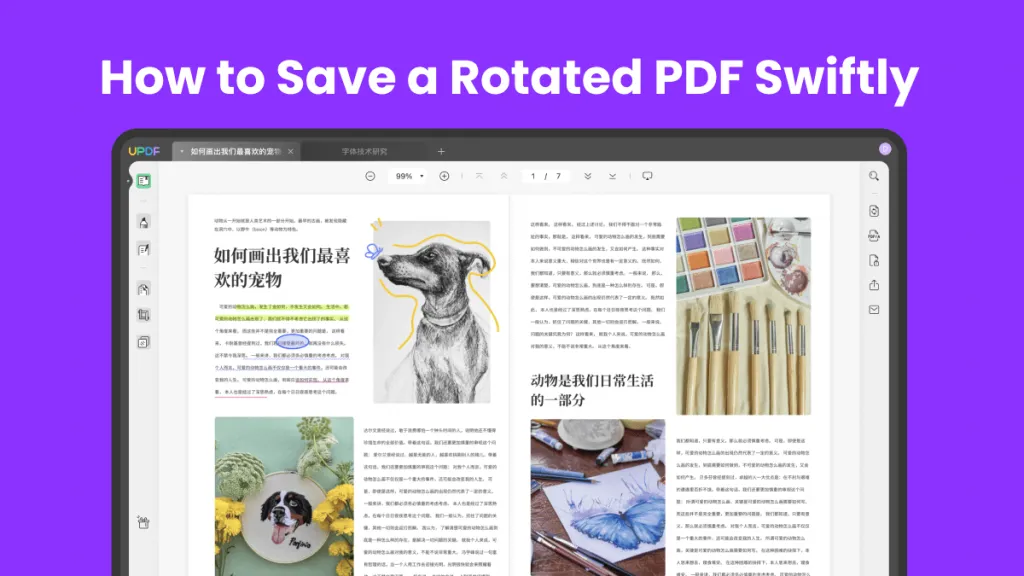

Furthermore, UPDF Cloud keeps the same tax PDF synchronized across desktop and mobile devices. In this image, edits and highlights appear on the desktop version of the IRS form.

In the image below, those same edits appear on mobile in the exact positions. This visual consistency helps maintain context when switching devices during multi-day tax preparation. As a result, I can continue working over several days without losing progress or orientation.

Windows • macOS • iOS • Android 100% secure

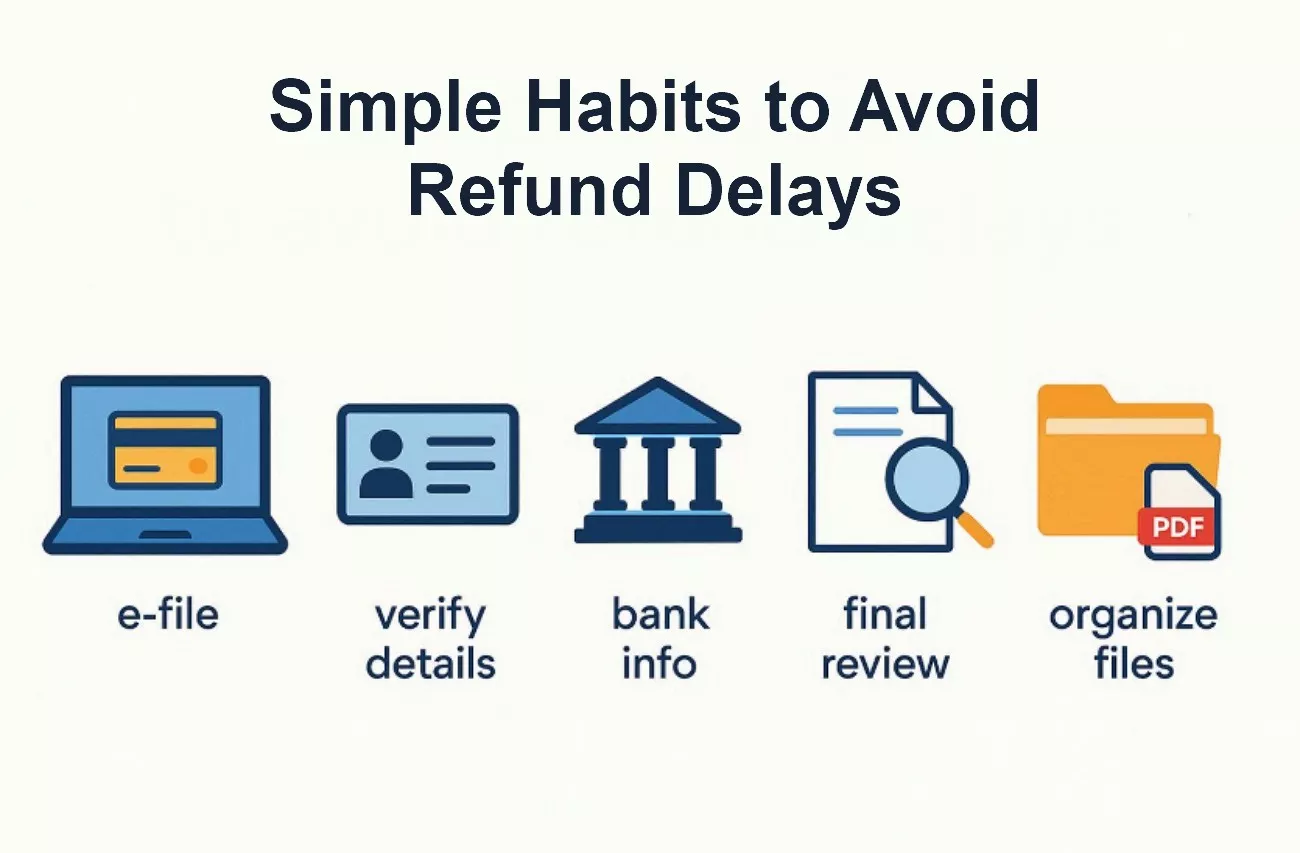

Part 5. Simple Habits I Use to Avoid Refund Delays

As filing season moves forward, I rely on repeatable habits instead of exact dates. The following habits help me prevent delays and support smoother tracking of the 2026 tax refund schedule:

- E-File Method: Choosing e-file with direct deposit helps me receive refunds faster. This method saves me from postal delays and slower IRS processing times.

- Personal Details Check: Reviewing names, Social Security numbers, and addresses protects me from filing errors. Incorrect personal details often cause delays that affect my refund timeline.

- Bank Information Review: Confirming routing numbers and account numbers prevents refund delivery issues for me. Incorrect banking information frequently causes refunds to be delayed or returned.

- Final Form Review: A final review inside UPDF helps me catch mistakes before submission. This step reduces the chance of corrections slowing down my refund.

- Document Organization: Storing tax PDFs and proof documents together keeps everything accessible for me. Using the UPDF portfolio feature helps me respond quickly to IRS requests.

Frequently Asked Questions

- How long does it usually take for the IRS to accept a tax return?

The IRS usually accepts electronically filed tax returns within 24 hours of submission. Paper filed returns take longer, and acceptance confirmation may require several weeks sometimes.

- How do I know if the IRS has accepted my tax return?

Acceptance is confirmed through software alerts or the IRS Where's My Refund tool. A confirmation message usually appears within hours after a successful electronic submission to the IRS.

- What is the maximum time for refund processing?

Most refunds are issued within 21 days for electronically filed returns, generally. Reviews, errors, or identity checks can extend processing well beyond that timeframe period.

- How do you know if the IRS doesn't accept your return?

A rejected return triggers an electronic notice explaining the error and required correction. Tax software dashboards or IRS messages clearly indicate rejection status and next steps.

Conclusion

To conclude, knowing “when does the IRS start accepting returns” helps me plan filing without unnecessary stress. As a result, clear awareness of IRS timing improves refund expectations significantly. Accurate preparation and early electronic filing place returns into earlier processing windows. Therefore, focusing on accuracy matters more than guessing exact calendar dates. To simplify preparation across devices, I rely on UPDF for completing IRS PDFs.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF PDF AI Tools

PDF AI Tools Image AI Tools

Image AI Tools AI Chat Tools

AI Chat Tools AI Writing Tools

AI Writing Tools AI Study Tools

AI Study Tools AI Working Tools

AI Working Tools Other AI Tools

Other AI Tools PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Enola Davis

Enola Davis

Lizzy Lozano

Lizzy Lozano