The IRS 1120 tax form is an official document that United States corporations use to report income, losses, and credits. It's an essential form and part of the U.S. tax system that ensures people fulfill their tax obligations. Moreover, filling out the form allows the IRS to access and collect the corporate income that maintains the overall federal law compliance. There are various requirements for this form, different for each.

Plus, these forms need to be timely and accurately filled, and in case of inaccurate reporting, it can lead to audits, penalties, and even legal actions. This article will provide an easy way to fill out this form, and that is by using UPDF as a form filler. You can click the button below to download.

Windows • macOS • iOS • Android 100% secure

Part 1. What is Form 1120 Used For?

Generally speaking, all U.S. corporations must file this form under any circumstances. From a business standpoint, C corporations are the main entities required to file 1120 US tax forms. This can include publicly traded companies and small and medium-sized businesses. Moreover, it serves as the primary tax form that communicates a corporation's financial activity throughout the year.

1. Purpose of the Form

One of the primary purposes of the IRS 1120 U.S. tax form is to enable C corporations to report their financial information to the IRS. Some of its other main purposes are given below:

- Reporting Business Income & Activity: By reporting sales revenue, investment income, and capital gains reports of corporations, the IRS can understand how much a company makes in a year.

- Deductions: With this form, a fair deduction of business expenses can be calculated as corporations fill out their employee wages, office rent, travel, and more.

- Calculating and Paying Federal Income Tax: Once the income deduction is reported, the form is used to compute the company's tax liability, and it is generally 21%.

- Complying with IRS Regulations: Another purpose of this form is to maintain the corporation's good standards with the IRS and avoid penalties.

Direct Answer

2. Filing Deadlines and IRS Requirements

You can look up the timeline for filling out the tax form 1120 as the tax year ends on 31st December. After that, every corporation has a deadline of the end of March. As for fiscal year corporations, the tax year ends on the last day of any month except December. Also, the filing deadline is the 15th day after 4 months of the last tax year. It's crucial to meet this filing deadline to avoid interest on late payments.

Note

3. Key Sections of the Form

Users need to understand the key sections in the tax form 1120 include various critical areas of different corporations' financial situations, given as such:

- Income

- Deductions

- Tax Computation

- Credits

- Other taxes

- Payments and refundable credits

- Schedule L - Balance Sheets

- Schedule M-1 - Reconciliation of income

4. Who Must File

- Entities electing to be taxed as corporations.

- Limited liability companies (LLC).

- Corporations engaged in farming.

- Ownership interest in a Financial Asset Securitization Investment Trust (FASIT).

- Foreign-owned domestic disregarded entities.

- Qualified opportunity fund.

- Qualified opportunity investment.

- Special Returns for Certain Organizations.

Part 2. What Do You Need to Prepare Before Filing?

The IRS posts the instructions for the 1120 tax form on its website every year. Every corporation needs to compile a number of financial statements and details regarding its activity to ensure smooth filing. You would need to prepare the following basic information:

- Business Financial Records

- Employer Identification Number (EIN)

- Previous Tax Returns

- Supporting Documents

- Income Statements

- Shareholder Information

Part 3. How to Fill Out Form 1120 Electronically

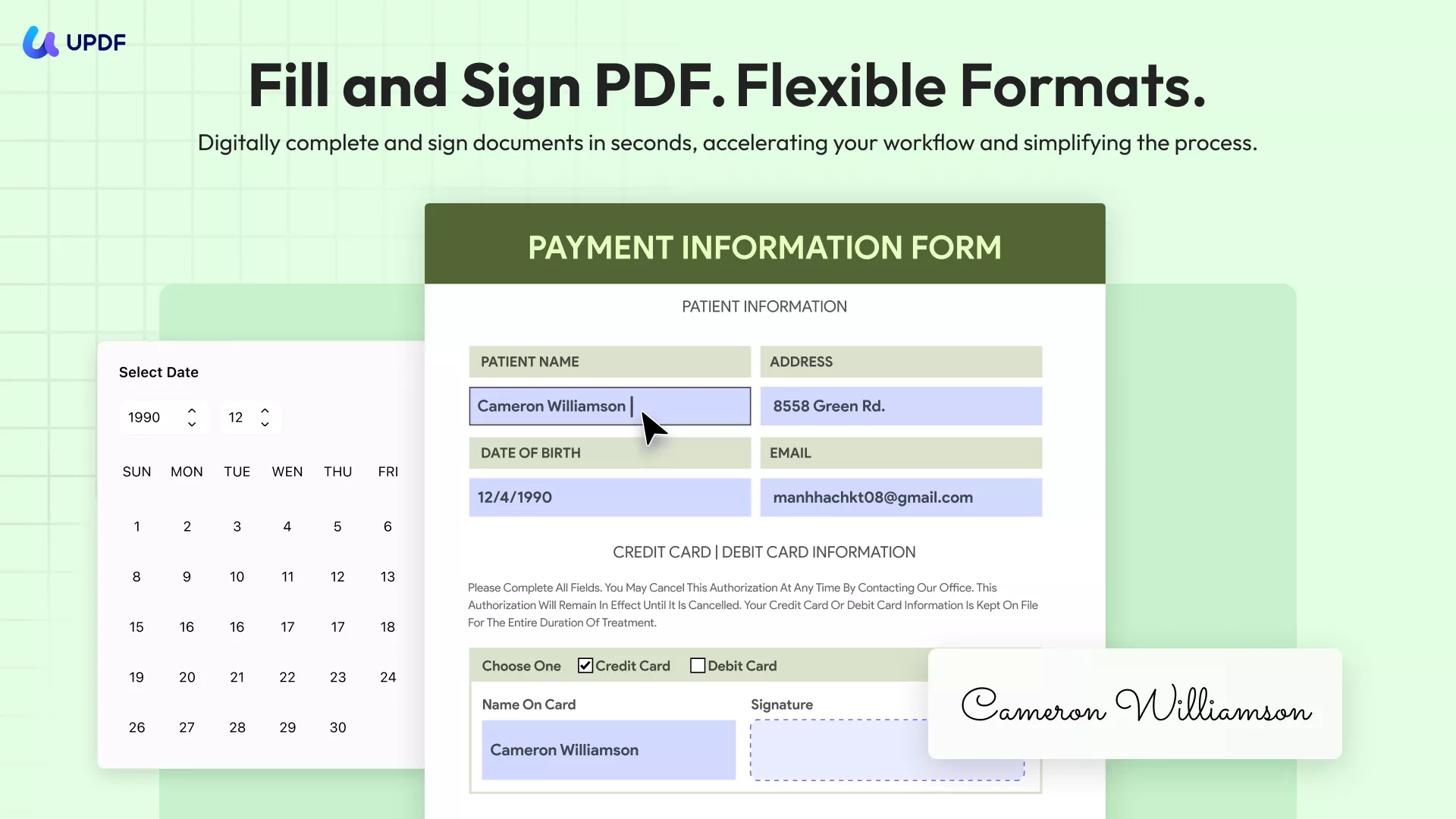

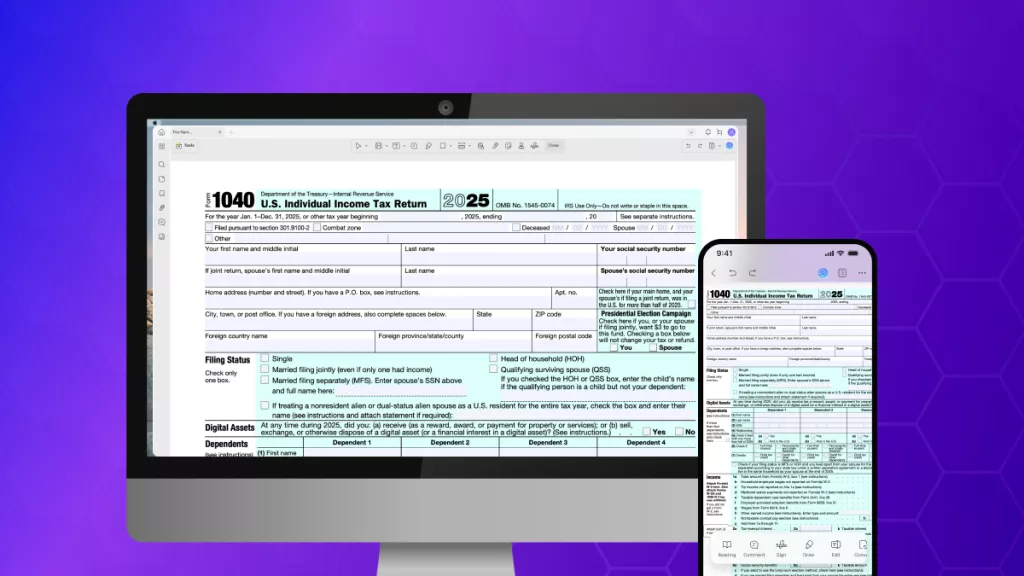

Corporations can generally electronically file (e-file) Form 1120, related forms, schedules, and attachments. However, the major issue is to fill it out correctly and accurately. To make the process easy, it is recommended to use the UPDF Editor for effortlessly filling out any PDF form on your desktop and mobile. This tool uses form field recognition to convert any non-fillable forms into fillable ones. It helps visualize all pre-existing fields for a convenient form-filling experience.

Windows • macOS • iOS • Android 100% secure

Moreover, fill out each section of the form separately with formatting, styling, and security options. Users can check spellings, scroll long text, allow rich text formatting, and many more with this form-filling feature. To keep the form safe for further editing, apply the Read-Only feature, along with a password. Companies can easily export the filled form data in various formats for submission on the IRS website.

About UPDF

Having learned how UPDF makes it 10 times easier to fill out the 1120 U.S. tax form, download it, and make this process seamless.

Steps on How to Fill Out Form 1120 with UPDF on Desktop

Follow the given set of instructions on how to fill out the form with these steps:

Step 1. Install UPDF and Import the Tax Form 1120

When the PDF editor is installed, open its main interface and click the "Open File" button to insert the PDF 1120 tax form.

Windows • macOS • iOS • Android 100% secure

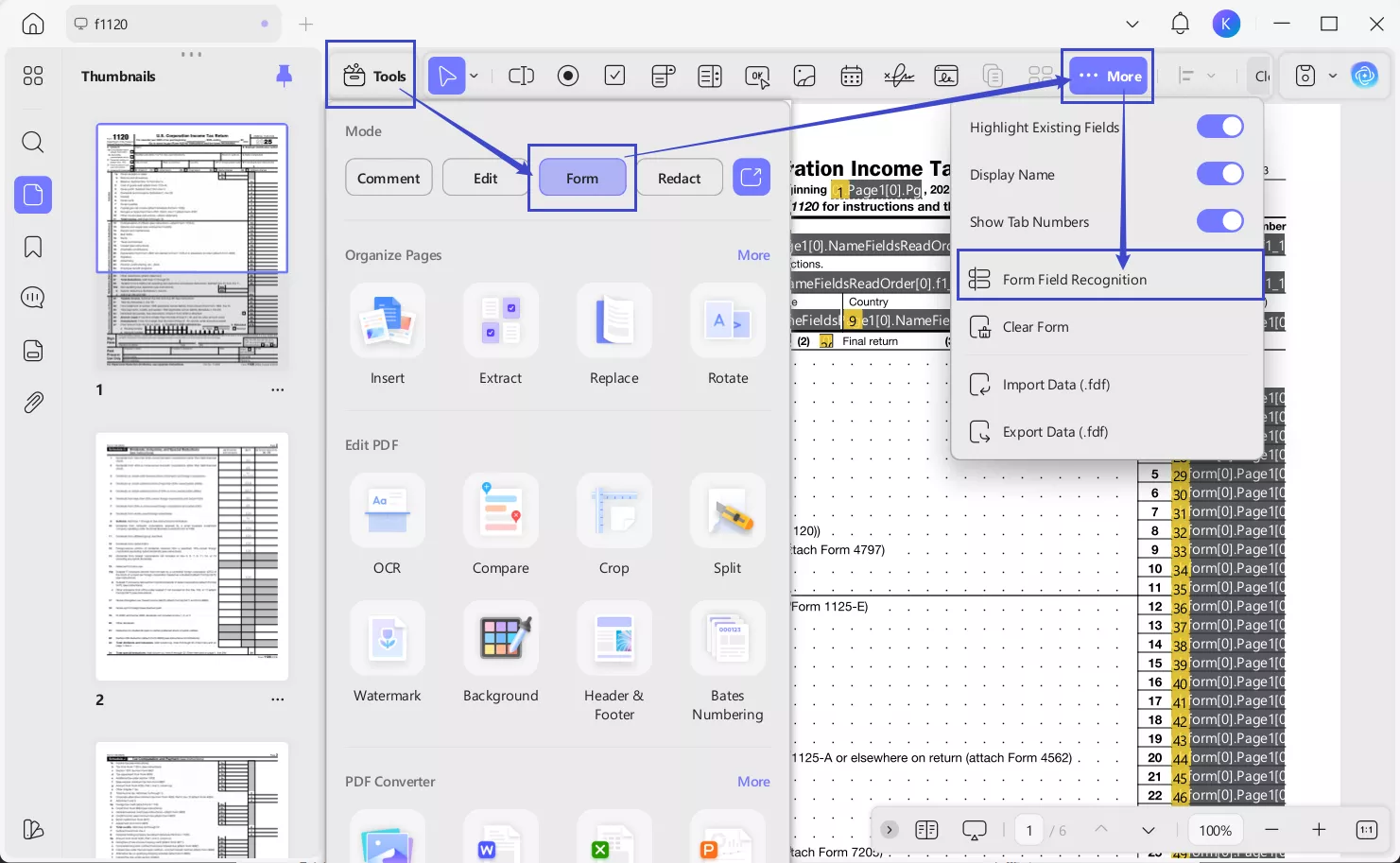

Step 2. Access the Form Field Recognition

Next, click on the "Form" section from the "Tools" icon at the top left. From the toolbar at the top, access the menu for "…More" and choose the "Form Field Recognition" option to convert your non-fillable form into a fillable PDF.

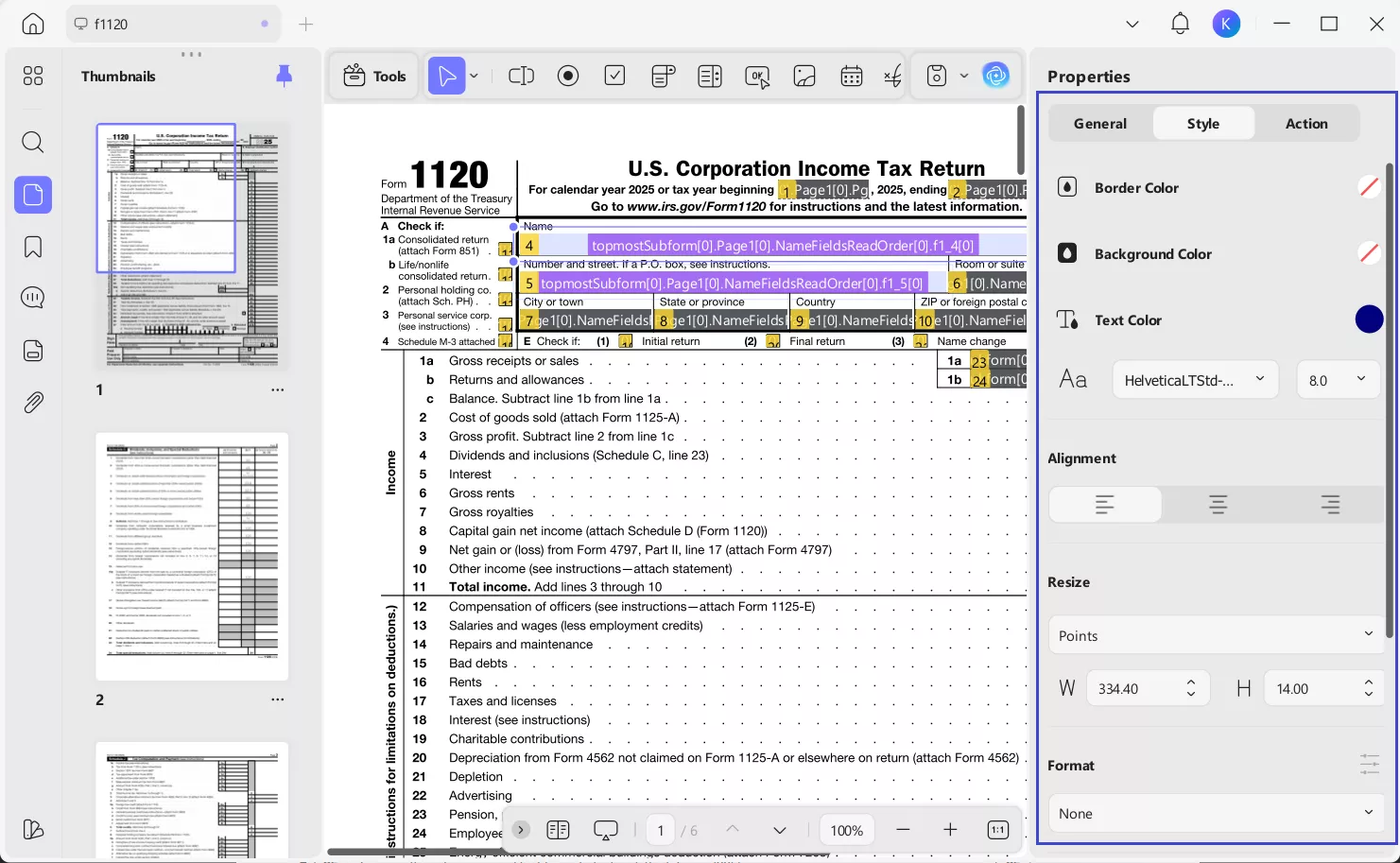

Step 3. Customize the Form

After that, double-click any box to open the right-side "Properties" panel. In the "Style" tab, personalize the formatting of the text, like color, alignment, and size.

Step 4. Fill Out the Form

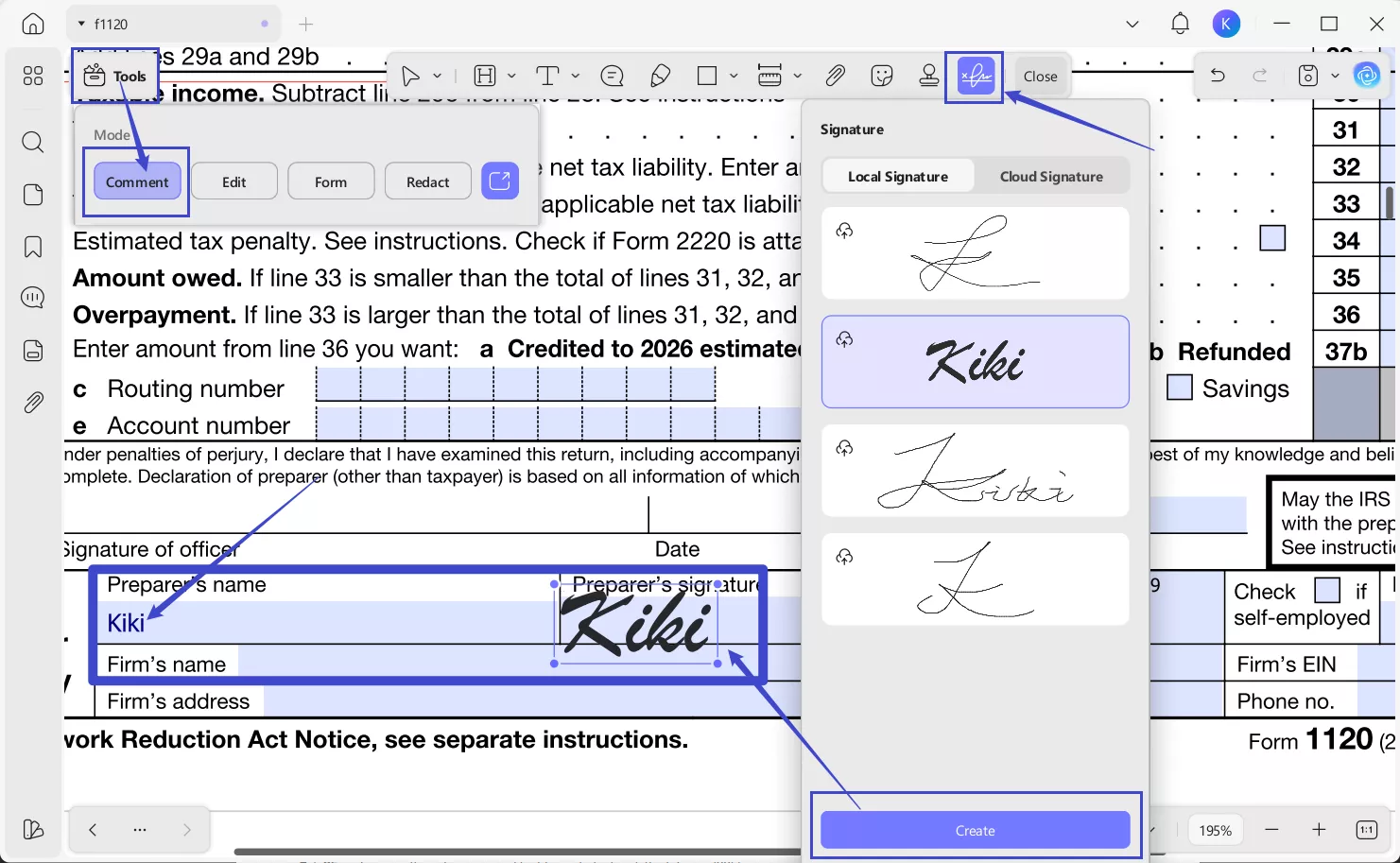

After that, switch to the Comment mode from "Tools", click the form fields and fill out them using UPDF. If you want to add signature to the form, just click the "Signature" icon under "Comment" mode and select "Create" to create one.

Step 5. Export the Filled Form

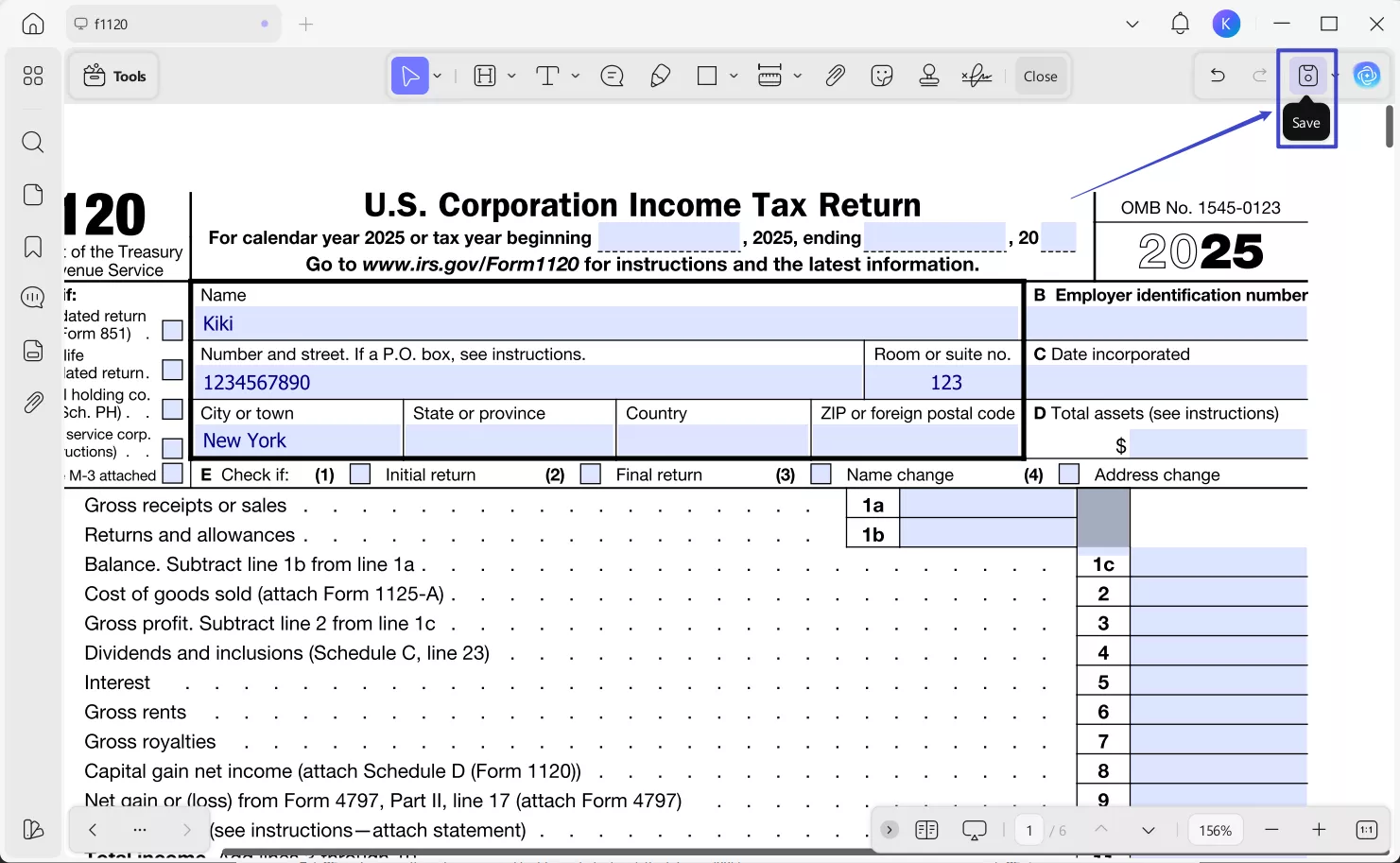

Upon doing so, tap the "Save" icon to save the final filled form on your desktop.

Steps on How to Fill Out Form 1120 with UPDF on Mobile

Step 1. Import your form into UPDF and open.

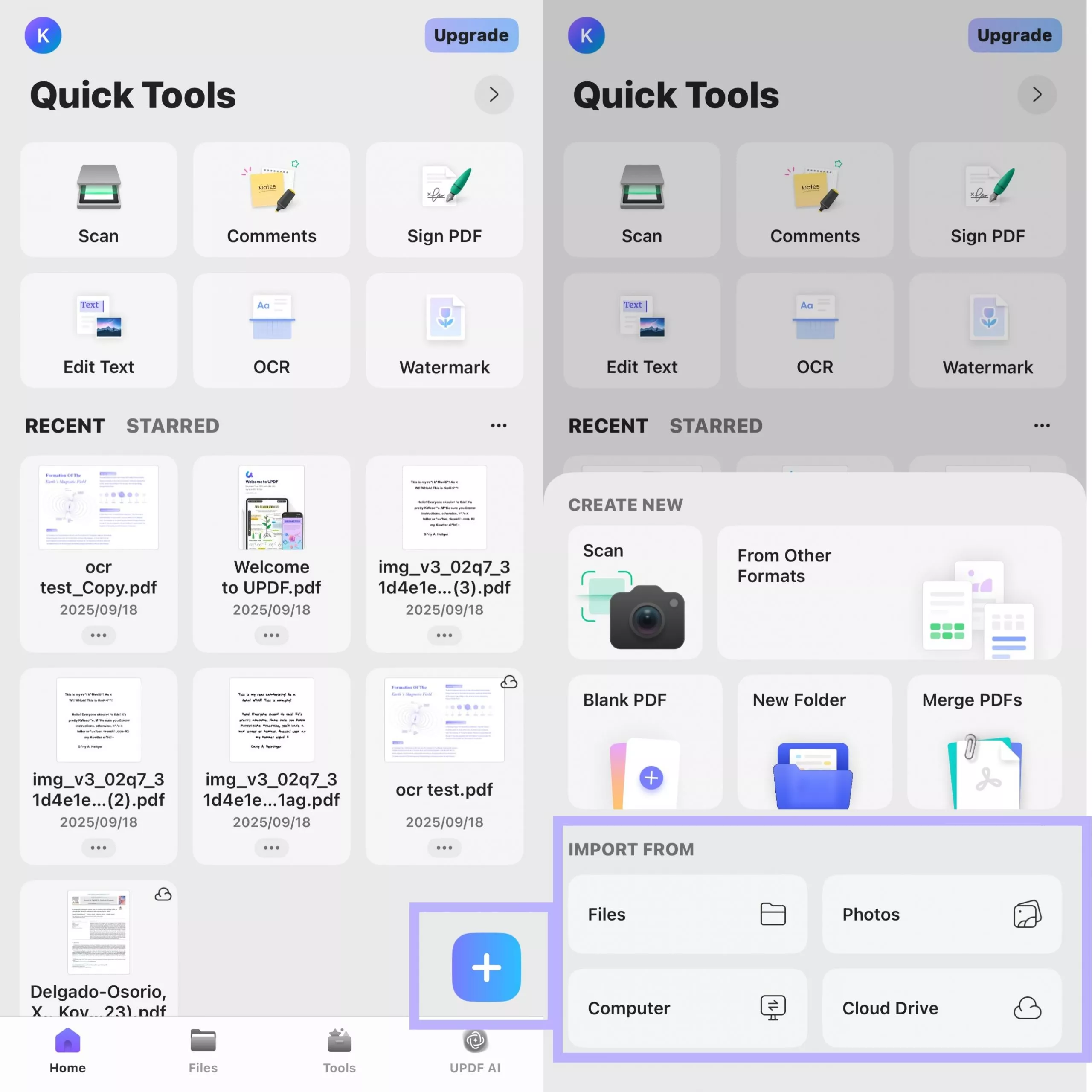

- Download UPDF mobile app from App Store or Google Play. Then, import your PDF form 1120 by tapping the "+" symbol in the bottom-right corner or choosing any existing PDF files.

Windows • macOS • iOS • Android 100% secure

- After you open the form with UPDF, UPDF will automatically highlight the existing fields for you, helping you quickly locate the sections that need to be filled out.

Step 2. Tap to fill out the form.

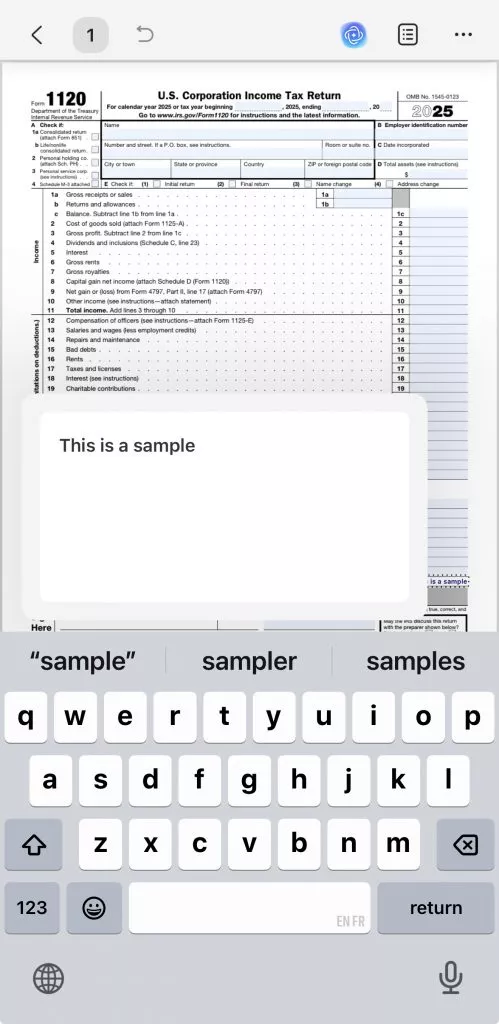

- Tap directly on a form field that needs to be filled out. A pop-up window will appear, allowing you to enter your information.

- After entering the text, tap a blank area of the form to exit the current field. Then, tap another form field to continue entering information. Repeat this process until all form fields are completed.

Windows • macOS • iOS • Android 100% secure

Also Read:

Part 4. Final Tips Before Submitting

In this part, you can find some of the best tips that you can follow before submitting Form 1120, given below:

1. Double-Check Information

You need to double-check all the information in the 1120 form, including spelling before you file it. You need to review closely the major numbers, like income, expenses, and deductions, as a single mistake can result in improper tax calculation. You need to double-check the corporation name, address, and EIN as well.

2. Review IRS Guidelines

The IRS always updates its instructions and requirements regularly, so it's important to consult the most recent instructions before filing. These guidelines provide details on how to correctly fill out the form, align with scheduled dates, and handle special tax situations. These include international income, consolidated group filings, and deductions with specific limits.

3. Keep a Copy of the Records

After you've filled out the form and sent it, you should keep a complete copy of the mailed 1120 tax form and accompanying documents. This should include attached schedules, supporting statements, and financial documents that could be useful in the event of a return. You should also keep these documents in a neat and readily accessible fashion for future reference, be it for an IRS audit or the filing of state taxes.

Conclusion

In conclusion, this article learned about the meaning of the 1120 tax form, its importance, and what type of requirement is necessary. Users can also find all the deadlines and preparation needed to fill out the form. To make the filling process easy, use the UPDF form-filling features.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF Scholar Research

Scholar Research Paper Search

Paper Search AI Proofreader

AI Proofreader AI Writer

AI Writer AI Homework Helper

AI Homework Helper AI Quiz Generator

AI Quiz Generator AI Math Solver

AI Math Solver PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Enola Miller

Enola Miller

Enola Davis

Enola Davis

Enid Brown

Enid Brown

Italo Rossi

Italo Rossi

A Question Many Ask

What is the safest risk free route I should take?

omsharp