Do you wonder how to fill out the W-4 form if you’re married and both of you have jobs? Does it feel confusing or hard to figure out?

Don’t worry, you are not alone! Many couples find it tricky to manage their tax withholding.

It is important to fill out the W-4 form correctly. This helps you avoid paying too much or too little taxes during the year.

In this article, we will explain everything step-by-step. You will learn how to fill out the form using UPDF, include both incomes, and set up your taxes correctly.

Let’s dive in and get started by clicking the button below to download UPDF for free!

Windows • macOS • iOS • Android 100% secure

Step 1. Download W4 Form

Before we enter the filling process, you must have one thing in mind right now: "Where can I get a W-4 form?" Well, you are supposed to download it. You can get it directly from the official IRS website based on your location and law compliance.

All you have to do is just visit the website and find the W-4 form. It should be available in the forms section. If not, you can search for it. This form is also labeled as "Employee's Withholding Certificate."

On the contrary, you can also ask your employer for this form. Most companies provide this form to their employees. Once you have this form, you will be all set to fill it.

Also Read: What are the Differences Between W-2 vs. W-4 & How to Fill Them

Step 2. Choose One Tool to Fill Out the W4 Form

Next, to make filling out the W-4 form easy and hassle-free, you need a reliable tool. Since most forms are in PDF format, you need a tool that supports PDF editing. One great option is UPDF, which allows you to open (simply drag and drop the from into UPDF) the W-4 PDF form and fill it out quickly. UPDF is user-friendly and includes an AI assistant that makes the process even smoother.

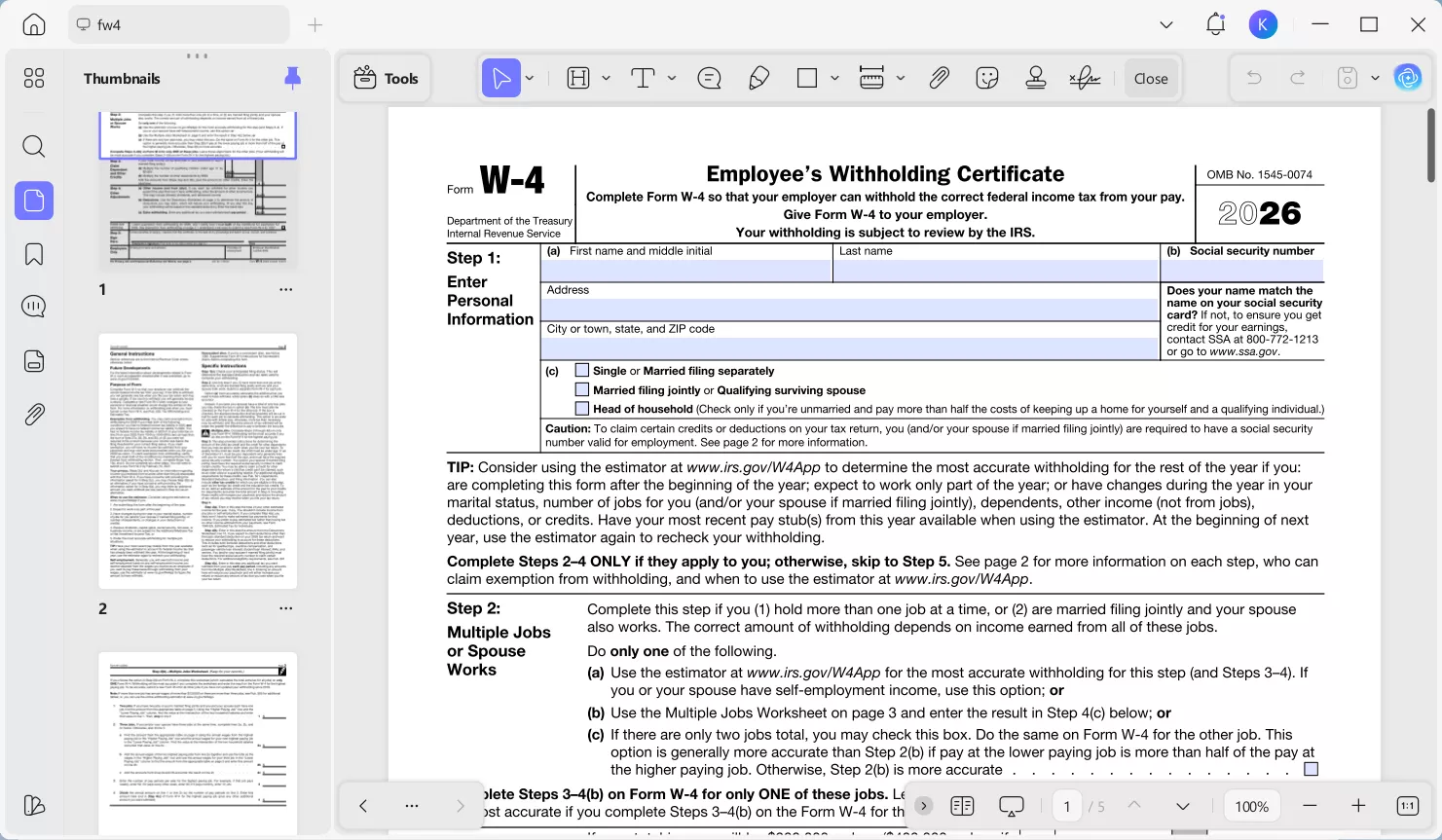

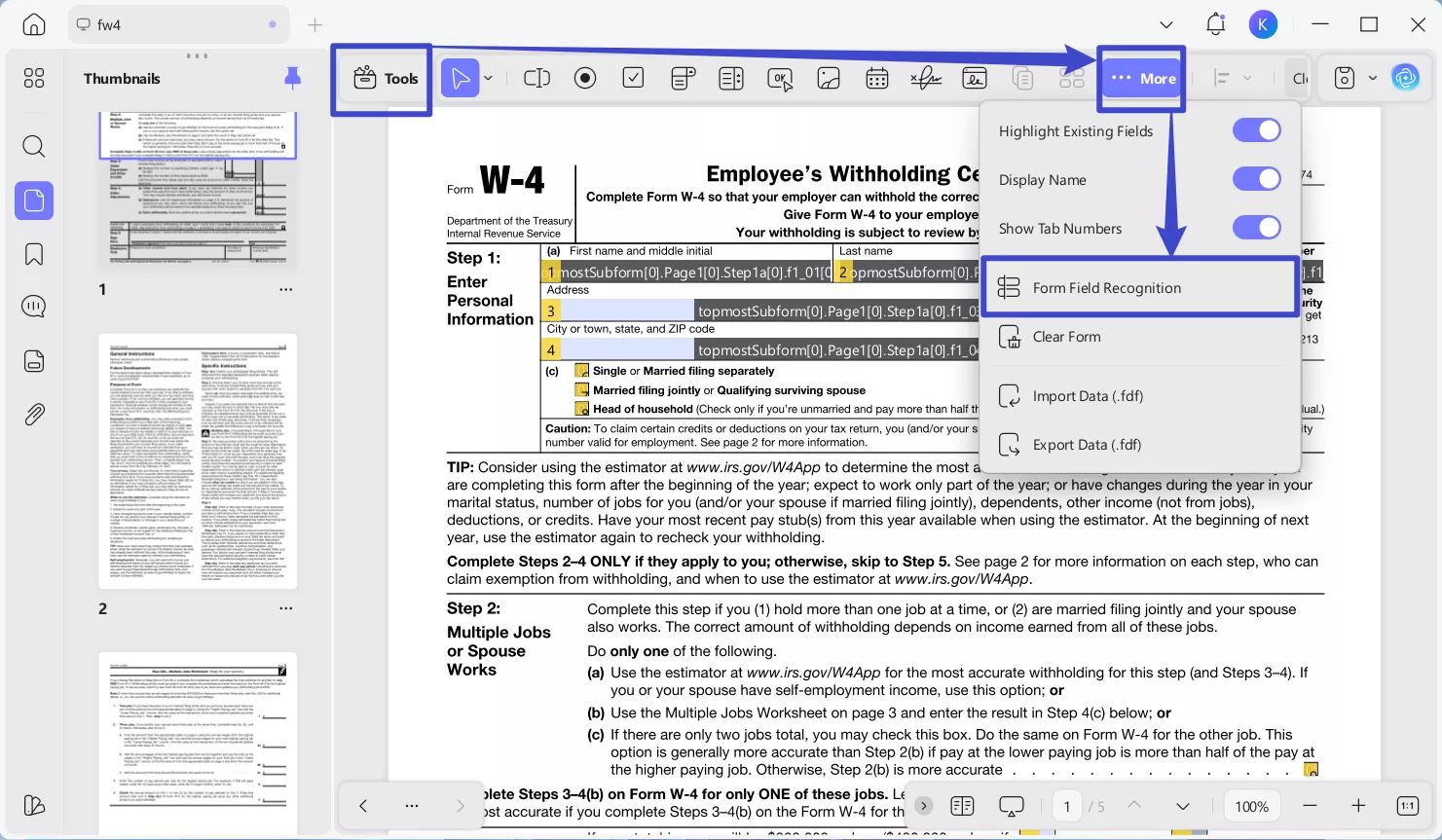

After you open the W‑4 form with UPDF, UPDF will automatically highlight the existing fields for you, helping you quickly locate the sections that need to be filled out.

If some form fields are not automatically recognized, you can click Tools at the top of the screen, select Form Mode, and in More, click Form Field Recognition to run the recognition process manually. This will detect any remaining fields so you can fill them in without missing any part of the form.

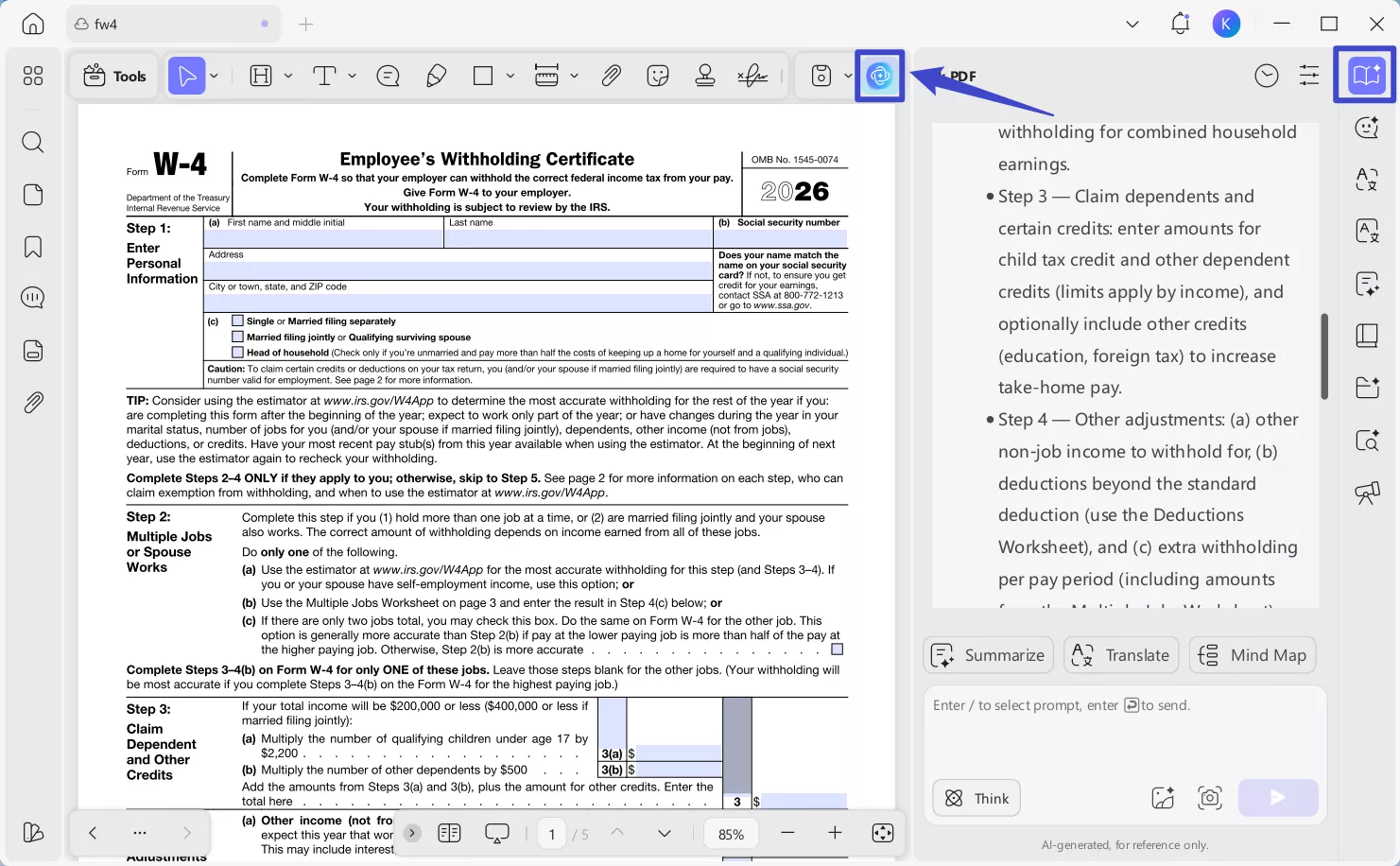

Moreover, If you don't know what to write in a particular section, you can ask UPDF AI. It will provide you with the clear answers. The AI can also review your information to check and make sure there are no mistakes or typos. You can easily fill out the form digitally without needing to print or scan it first.

Beyond helping with the W-4, UPDF has other great features like editing PDFs, converting files, organizing pages, and adding annotations. So, download UPDF now to get started.

Windows • macOS • iOS • Android 100% secure

If you’d like to know more, watch this video or read this review article to learn about all its features.

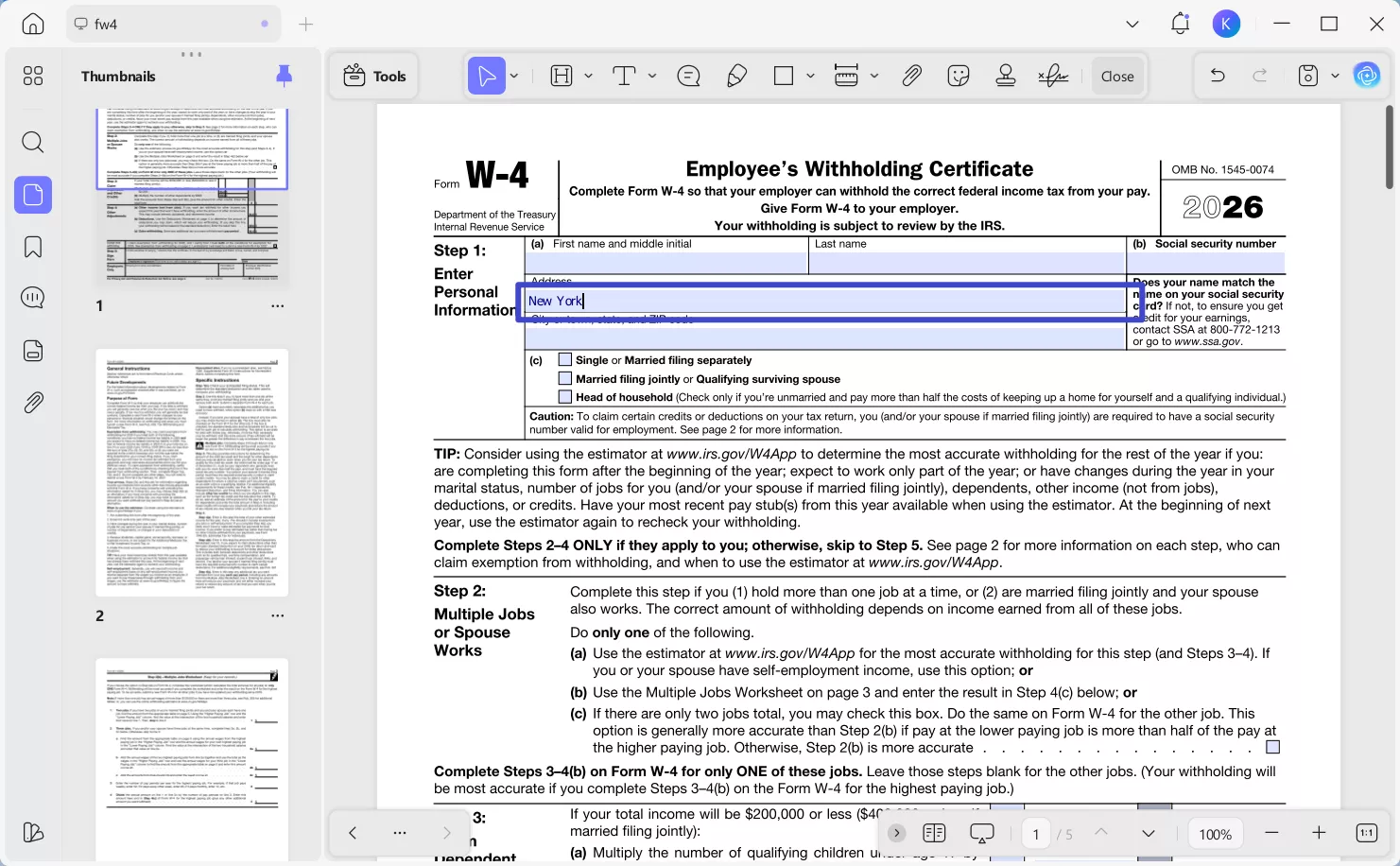

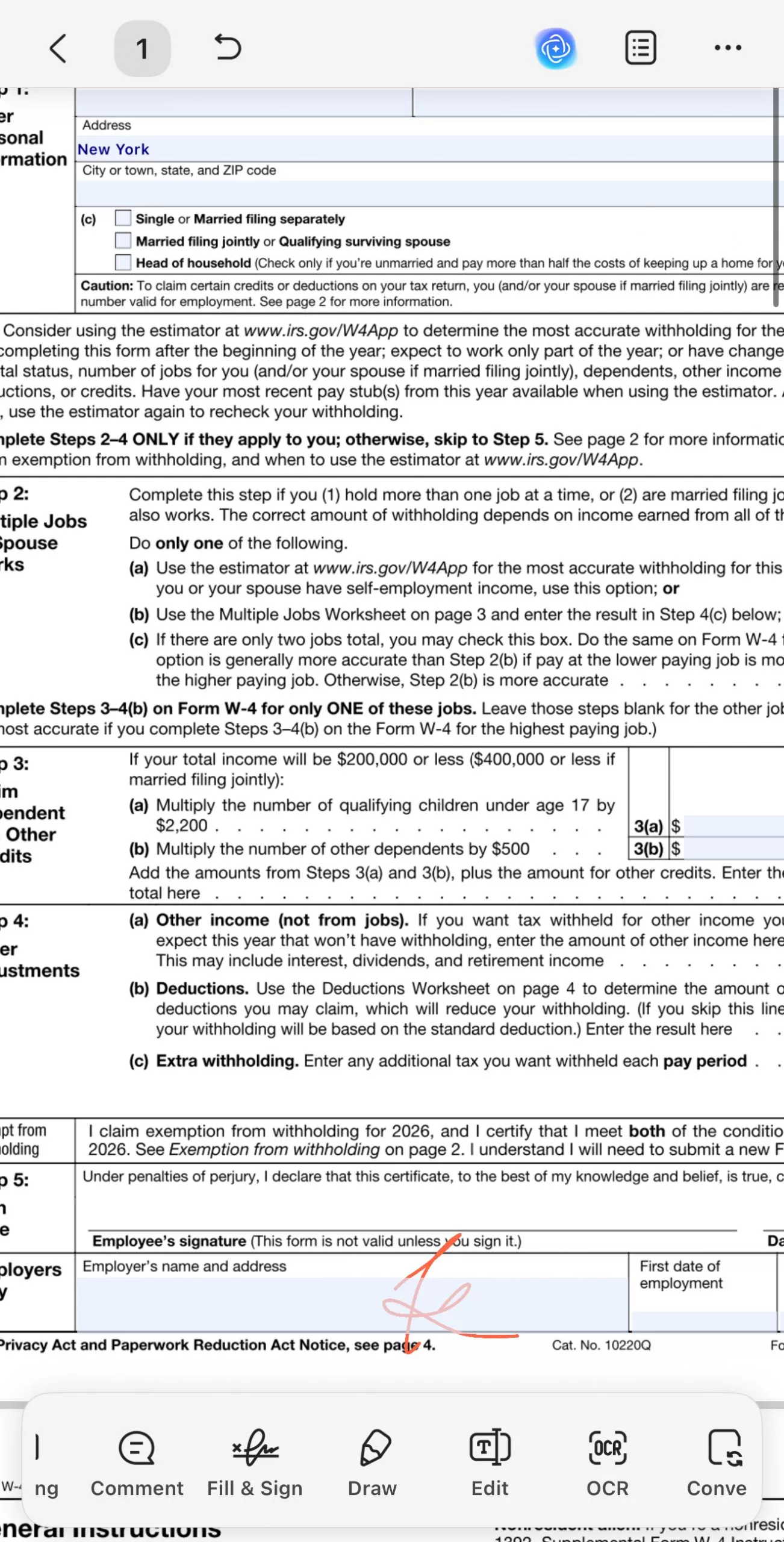

Step 3. Enter Personal Information for Married and Both Work

Now, you are supposed to enter your personal information on the W-4 form. The good is, with UPDF, you can do it quickly and easily. Just click on the fillable text field and enter your required details under Comment mode, like your name, address, and Social Security Number. You can also use the drop-down menus and checkboxes to fill out the relevant options. As you are married and both work, you can select the correct options in (C) part.

Step 4. Complete Step 2 to Step 4 If it Applicable

For married couples where both work, Steps 2 to 4 of the W-4 form help adjust tax withholding based on combined income.

Let’s go over what needs to be filled in these sections:

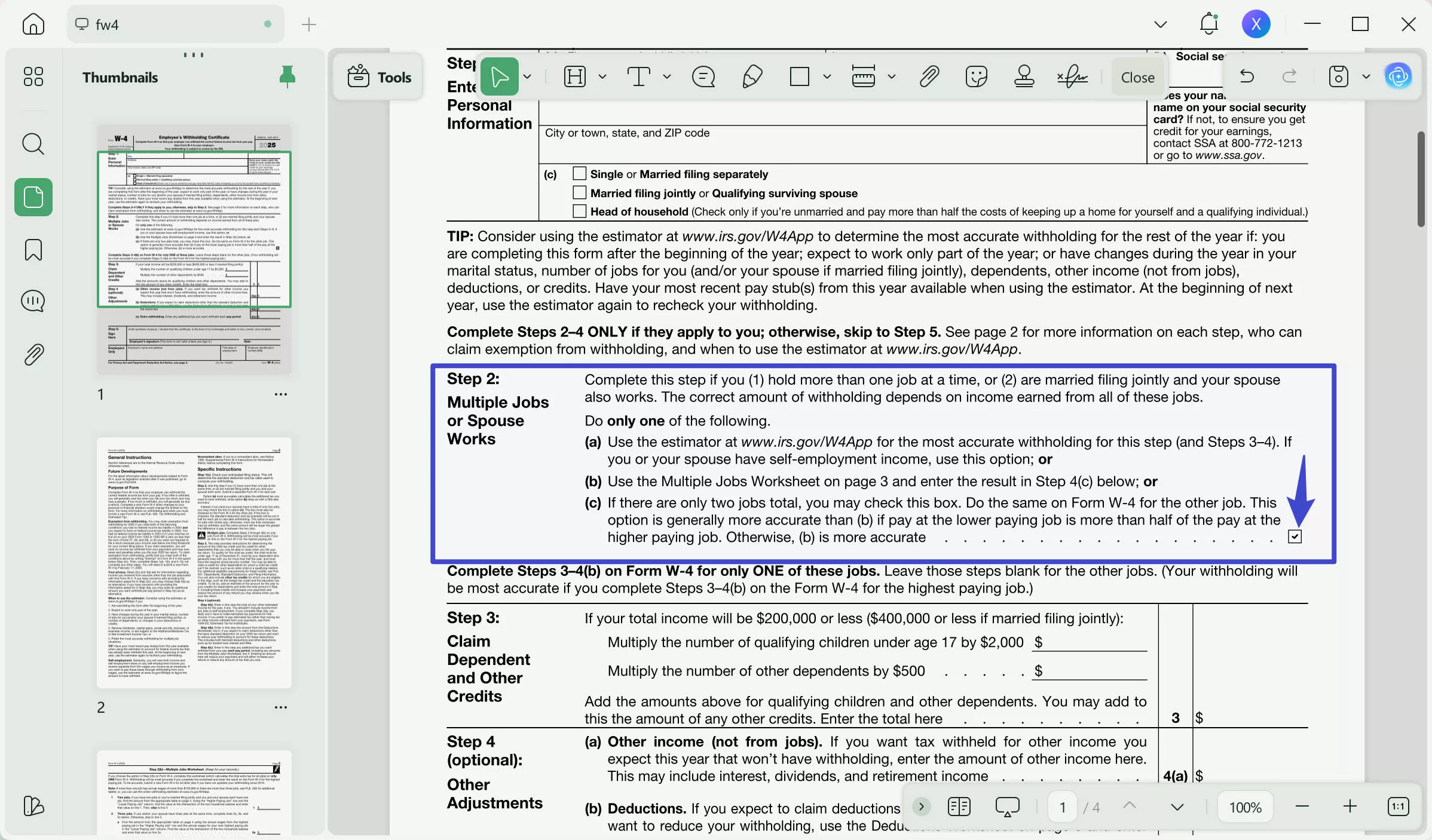

Step 2: Account for Multiple Jobs

If you and your spouse work or have multiple jobs, it makes a difference.

● Check the box if you and your spouse each have one job with comparable wages.

● If your jobs vary in pay, use the IRS’s Multiple Jobs Worksheet or the IRS Tax Withholding Estimator to calculate adjustments.

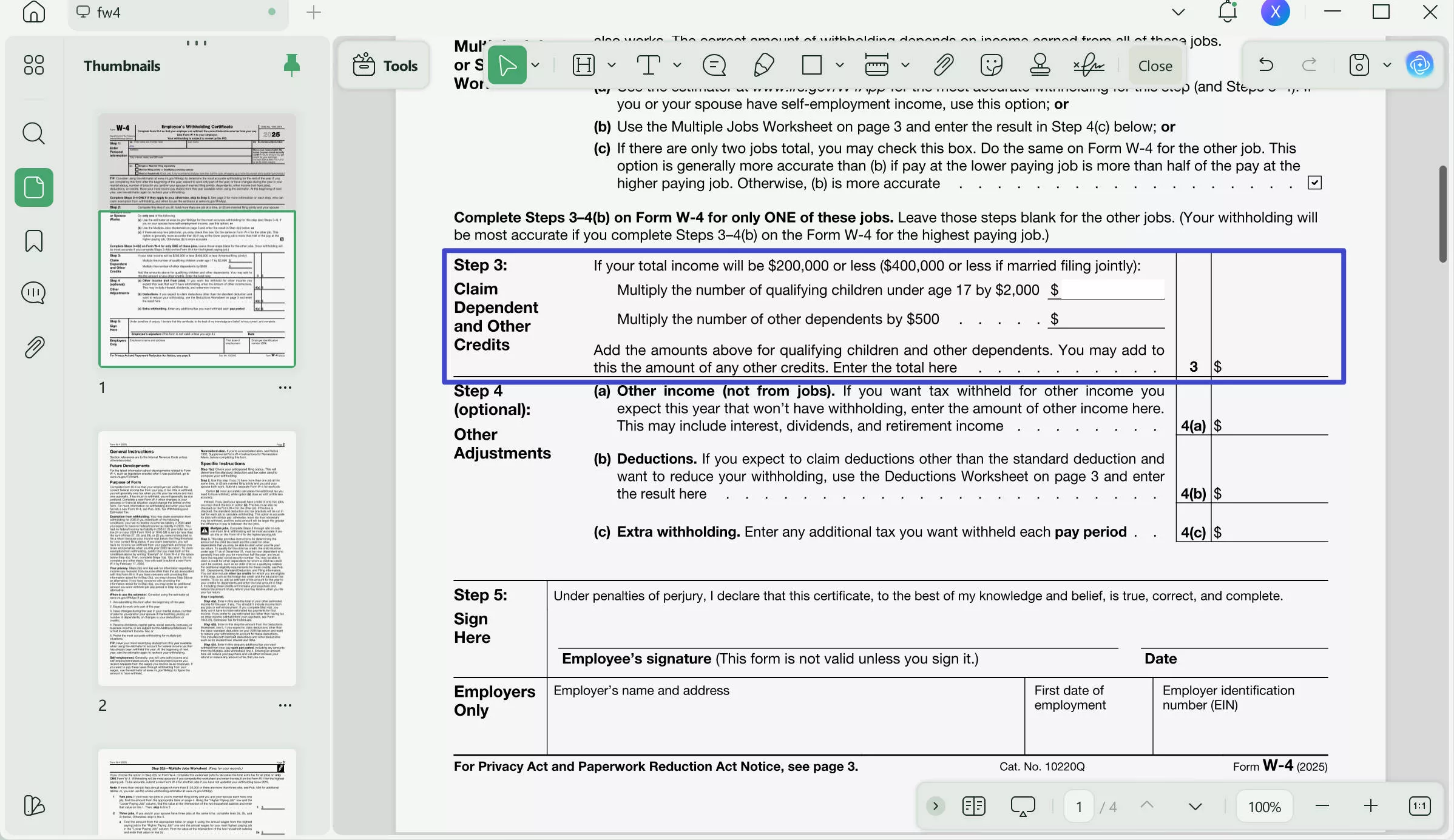

Step 3: Claim Dependents

If you have dependents (for example, children under 17), enter the number and multiply it by the allowed credit currently: $2,000 per child. For other dependents, use a credit amount of $500 per person.

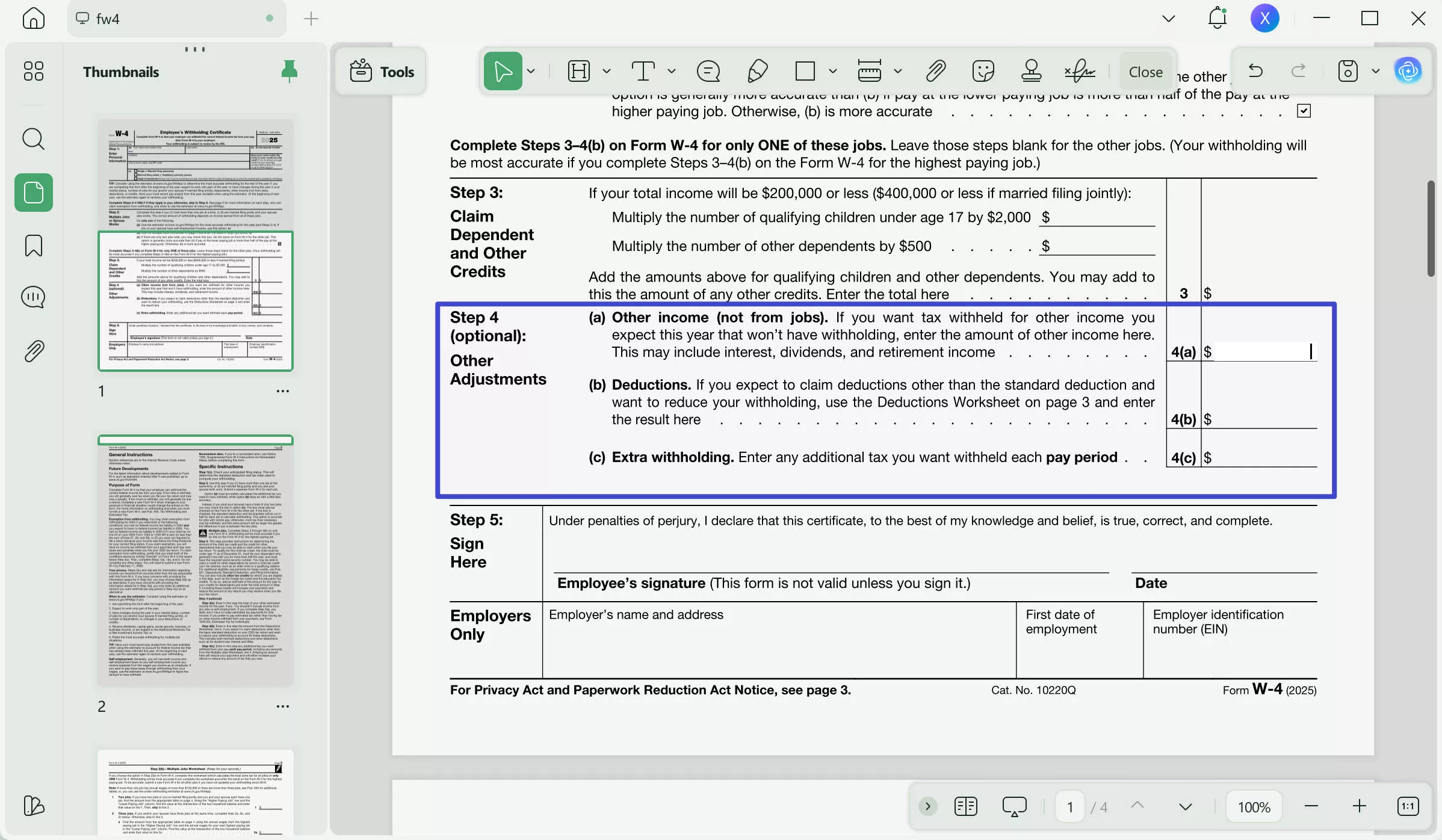

Step 4: Other Adjustments (Optional)

This section is optional but can help customize your withholding:

● Extra Withholding: Write an extra amount to be deducted from each paycheck (If needed).

● Other Income: Mention income that is not subject to withholding. They include interest or dividends. It will help you avoid owing taxes at the end of the year.

● Deductions: If you expect to claim item-based deductions, which are higher than the standard ones, don't forget to note the difference.

Step 5. Sign

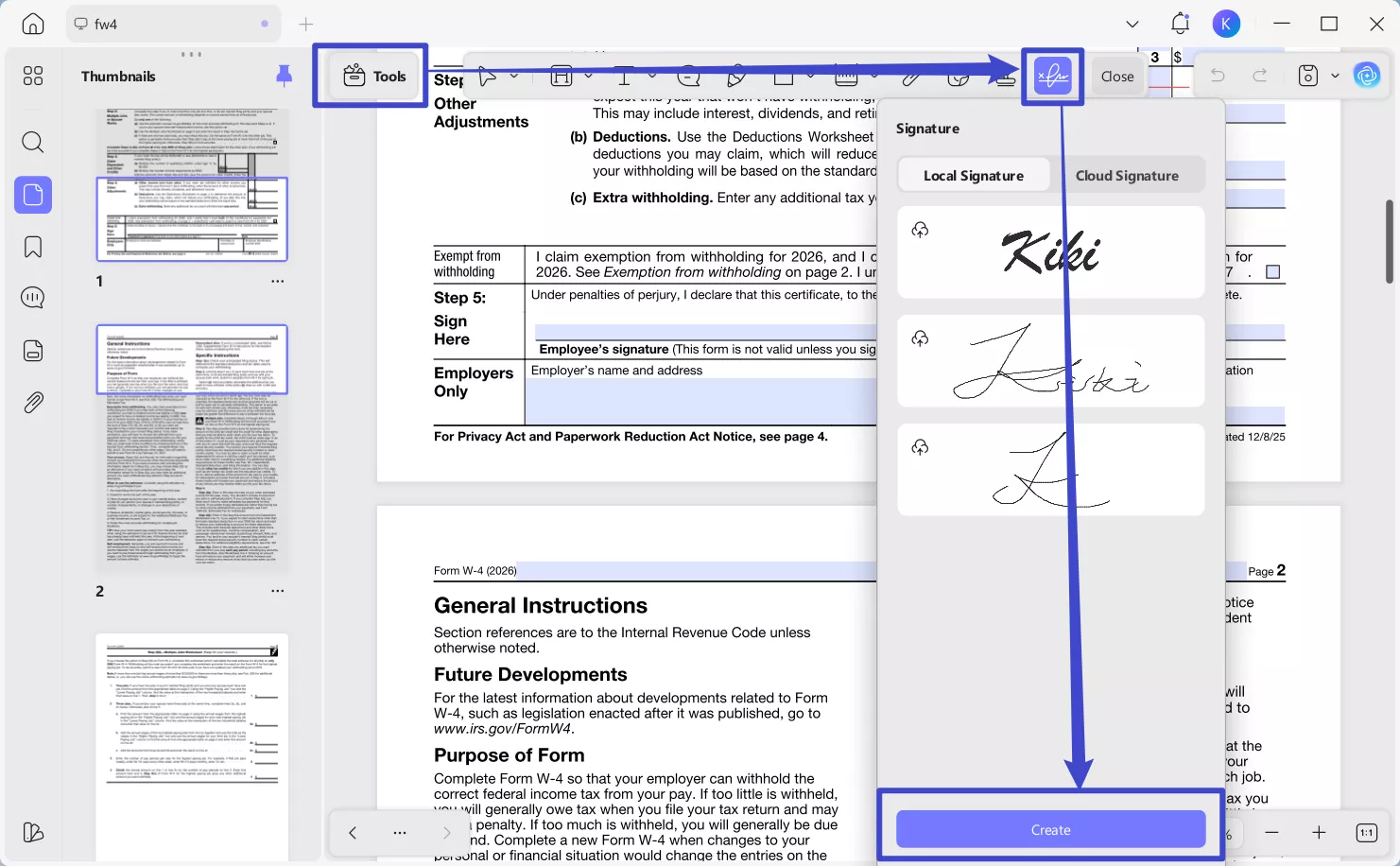

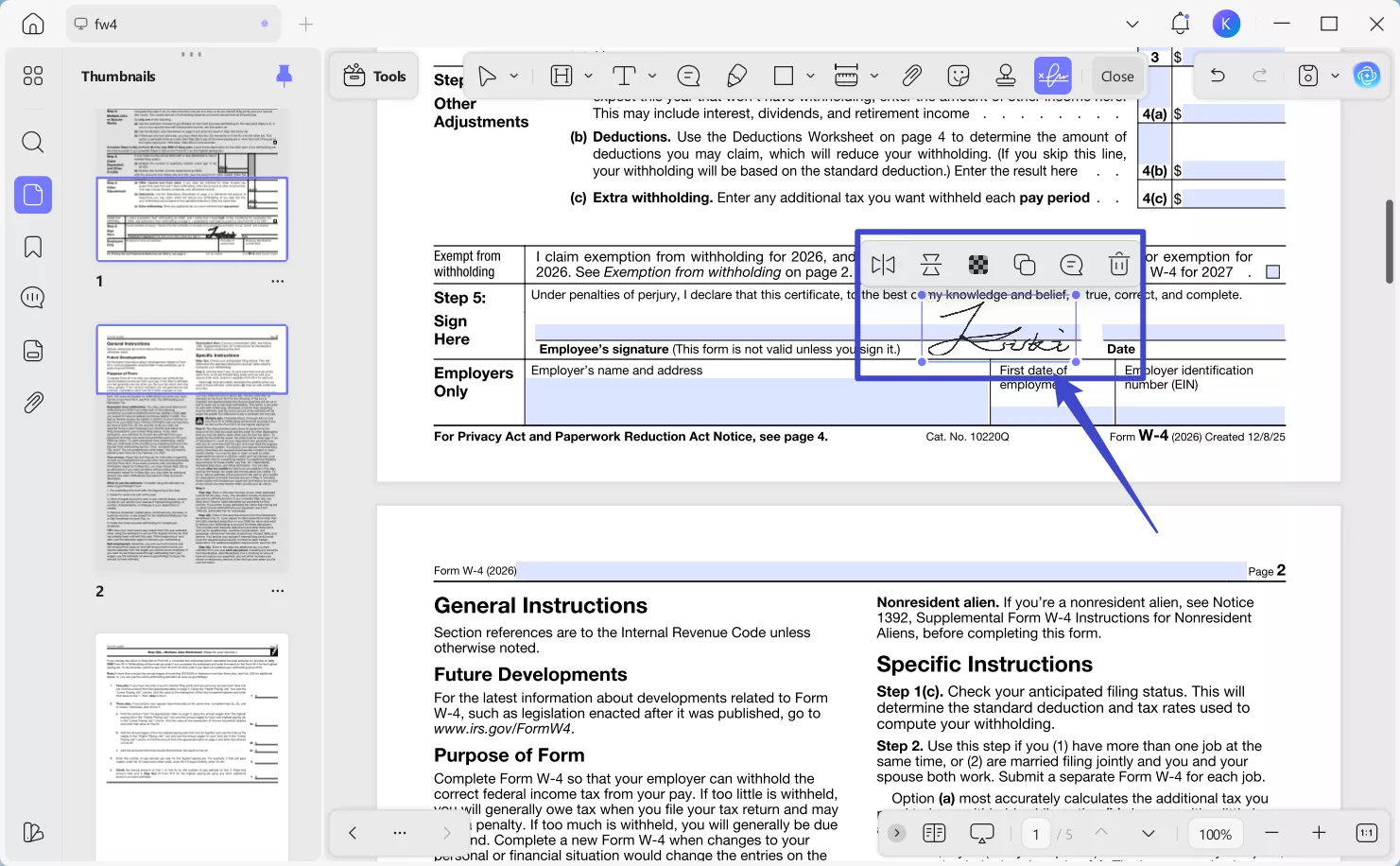

Adding your signature to the W-4 form is the final and most important step. UPDF makes signing the form simple and professional. Here’s how to do it:

- Click "Comment" in "Tools" on the UPDF left-side menu, and select the "Signature" option from the top menu. Then, click "Create" to create the signature.

- You can create your signature in of three ways:

○ Draw: Use your mouse, stylus, or finger to draw your signature.

○ Type: Type your name, and UPDF will convert it into a signature style.

○ Upload: Upload an image of your handwritten signature if you have one saved.

- Place the signature in the designated field on the form. You can also adjust the size, position, opacity and more of the signature to fit perfectly.

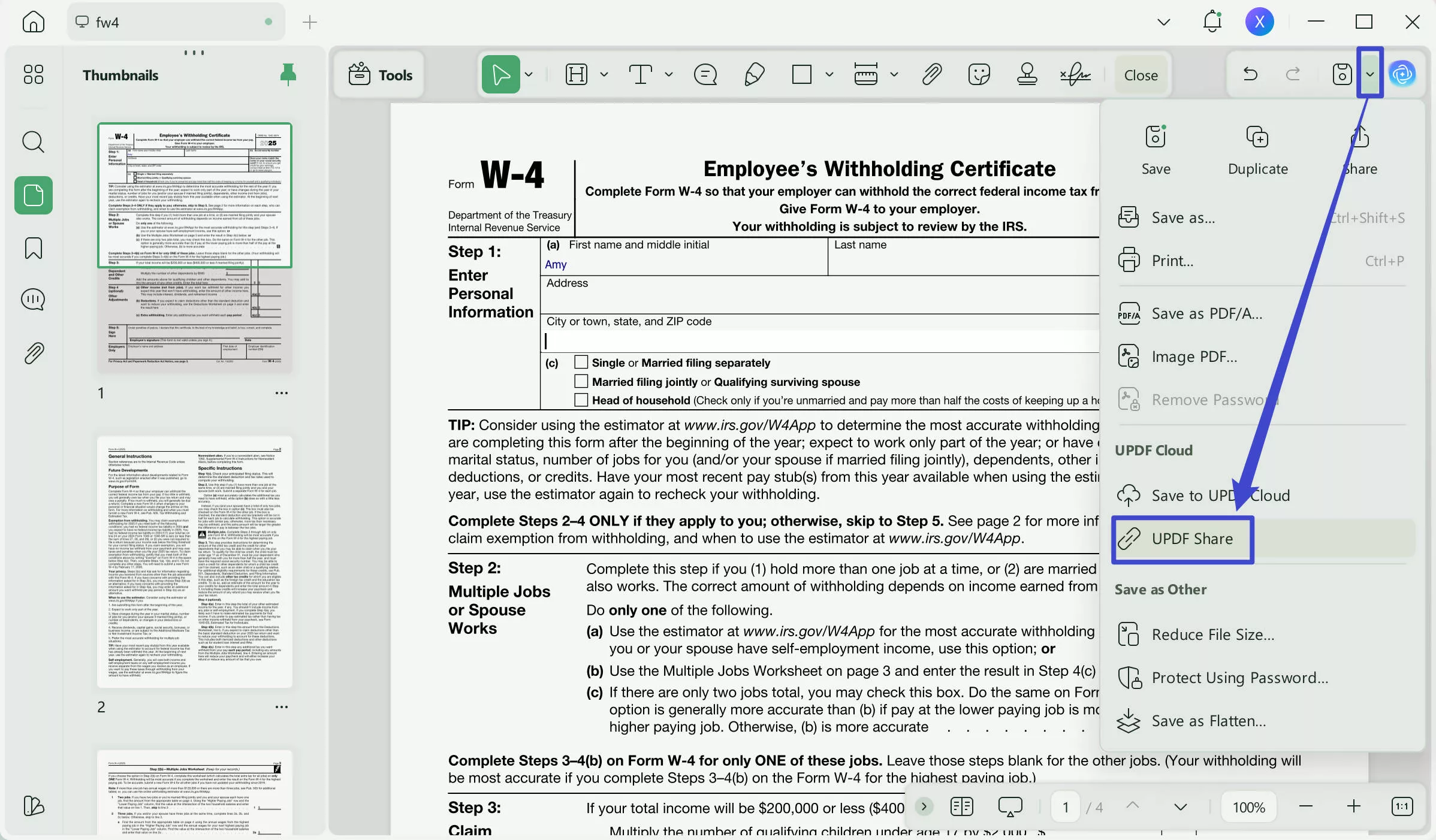

Step 6. Save and Send

Once done and signed, the last step is sending your W-4 form to your employer or saving the form on your device. Here is what needs to be done:

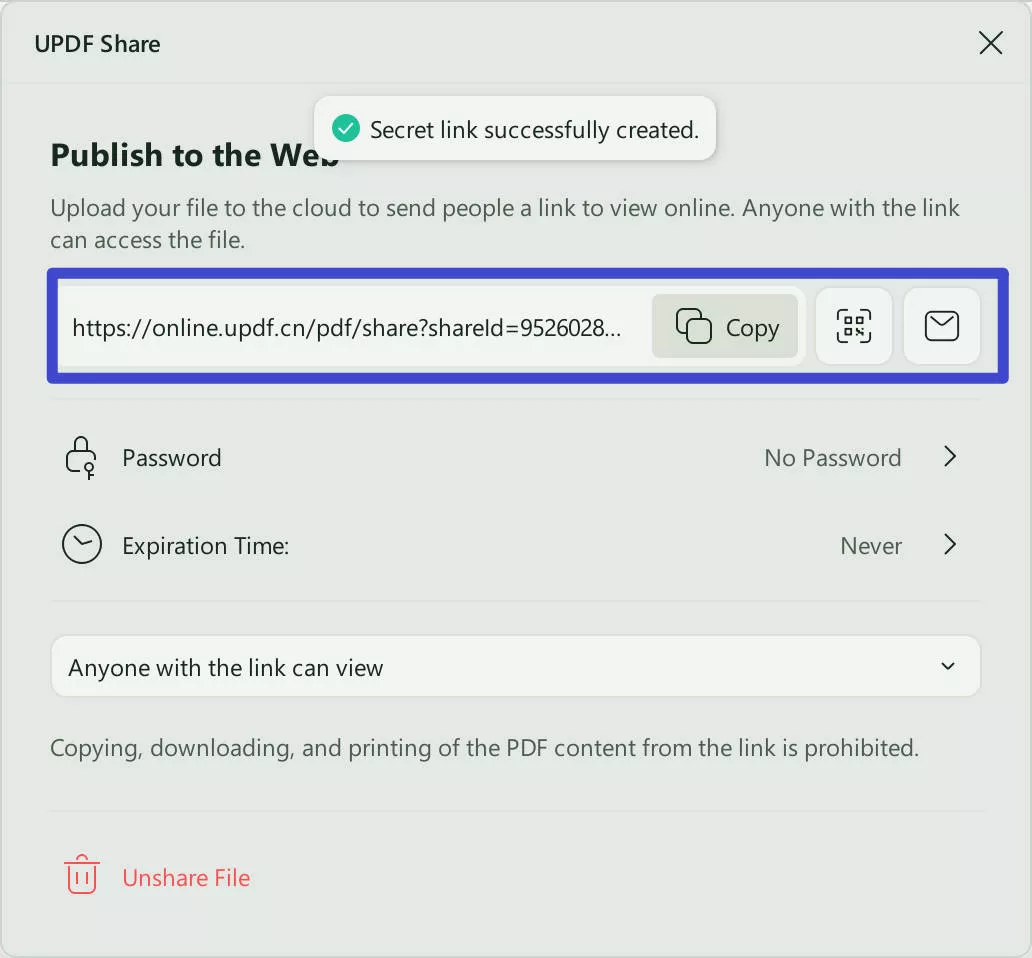

- To save the form, click the "Save" icon on the top right corner. To share the form, click on the narrow next to "Save" and choose the "UPDF Share" button from the right menu to send the file.

- After create a link, you can click the "Copy" to share the link. You can also click on "Email" icon to share by emails, or click on "QR code" to share your file.

That's all! These are the steps for how to fill out the W-4 form. UPDF has made the process smooth and hassle-free. You can use this tool to edit your PDF files and forms.

Tips:

Also Read: How to Fill Out W-2 Form for an Employee

FAQs About Filling Out W-4 Form

Q1. What is a W-4 Form?

A W-4 form is basically made for the employees. It is also known as "Employee's Withholding certification." All employees in the professional scope of work are required to fill out and submit this form. The form informs the employer about how much income tax should be kept or payable from the employee's salary.

Q2. What is the Purpose of the W-4 Form?

The main purpose of the W-4 form is to calculate accurate tax amounts. With this form, employees are able to pay fair tax amounts based on their financial situation, income, and filing status. This helps prevent underpayment or overpayment of taxes.

Q3. When to Fill Out W-4 Form?

You should complete or update your W-4 Form when starting a new job, experiencing changes in income, getting married or divorced, or having dependents to adjust tax withholding.

Q4. Do I claim 0 or 1 on my W4?

Claiming 0 ensures maximum tax withholding and may result in a larger tax refund. Claiming 1 allows less withholding, giving you more take-home pay but possibly a smaller refund at tax time.

Q5. How Do I Fill Out a W4 to Get the Most Money Back?

You should claim fewer allowances on your W-4 form in case you want to get a good refund. You can use the IRS calculator to ensure you don't pay less taxes. You can also ask your employer to deduct extra money from your salary to make you owe fewer taxes later.

Q6. Where to Send w 4 Form?

The W-4 is supposed to be sent directly to the employer. You can submit it to the HR or payroll departments. They are responsible for analyzing and processing your tax and withholding information.

Final Words

Wrapping it up! In this article, we have explored how to fill out the W-4 form the right way. If you are married and working, keep following the steps with extra care. Using UPDF makes filling out the W-4 form quick and easy. Its simple tools let you complete, sign, and send the form digitally. You don’t need to worry about printing or scanning. Plus, the AI assistant ensures everything is filled correctly without mistakes. Why wait? Download UPDF now and make filling out your W-4 form stress-free!

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF PDF AI Tools

PDF AI Tools Image AI Tools

Image AI Tools AI Chat Tools

AI Chat Tools AI Writing Tools

AI Writing Tools AI Study Tools

AI Study Tools AI Working Tools

AI Working Tools Other AI Tools

Other AI Tools PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Enid Brown

Enid Brown

Enola Miller

Enola Miller

Engelbert White

Engelbert White