Tracking tax deadlines can be stressful for individuals and small business owners when multiple forms and receipts need micro-management. Errors in documents may lead to delays, which are an added burden in the tax season. Tax return dates change each year, and 2025 deadlines are only a reference while 2026 dates require updated planning.

In this guide, we discover tax return dates 2026 and compare them with last year for easy planning reference. As a bonus, we'll also share how UPDF can simplify document management by allowing users to edit, annotate, and secure all tax files in one place.

Windows • macOS • iOS • Android 100% secure

Part 1. Tax Return Dates 2026: Key Deadlines by Country

Tax deadlines are different in 2026 depending on the country and may change. Let's review the key 2026 tax deadlines by country so readers can plan ahead.

1. United States

The IRS usually opens filing season in late January 2026, with the main individual deadline around mid‑April and an extended deadline in mid‑October if a timely extension is filed. Quarterly estimated payments typically fall in April, June, September 2026, and January 2027.

2. Canada

Most individuals must file and pay 2025 Canadian income tax by about April 30, 2026, while many self‑employed taxpayers can file until mid‑June but still must pay by April. Electronic filing with direct deposit usually results in faster refunds than paper returns.

3. United Kingdom

Self-Assessment paper returns are generally due by 31 October, while online returns and most payments are due by 31 January following the tax year. A large number of the taxpayers pay in two instalments on 31 January and 31 July, with an equal payment the following January.

4. Australia

Australian financial year starts on 1 July and ends on 30 June. The year 2025-26 ends on 30 June (2026), and individual returns that are self-prepared are normally due in and around 31 October. Many individuals use registered tax agents, who often have later lodgment dates if clients join the agent's program on time.

Important Reminder

Part 2. Tax Return Dates 2025 vs 2026: What Changed and What Stayed the Same

Tax deadlines in 2025 and 2026 are broadly similar, with only specific calendar days shifting slightly each year. Now, we will compare the tax return dates 2025 with expected 2026 timelines and highlight any notable changes.

2025 Deadlines in Major Regions

Let's look at a quick snapshot of the main 2025 filing, payment, and extension dates in major regions.

| Region | Main Filing Deadline (2025) | Instalment/Payment Deadlines (2025) | Extensions/Special Options (2025) |

| United States | Mid‑April 2025 individual filing. | Quarterly estimates in April, June, September, January. | File extension to mid‑October. |

| Canada | Around 30 April 2025 for most individuals. | Instalment dates during the year for some taxpayers. | Self‑employed can file later but pay by 30 April. |

| United Kingdom | 31 January 2025 online Self-Assessment. | 31 July 2025 payment on account. | 31 October paper‑return deadline; separate PAYE/VAT cycles. |

| Australia | 31 October 2025 self‑prepared returns. | PAYG and other payments throughout the year. | Later lodgment dates via registered tax agents. |

2025 vs. 2026 Tax Dates

In most major countries, 2026 tax deadlines follow the same annual pattern as 2025, including the usual filing, payment, and extension windows. The main differences are small shifts in exact dates when due days fall on weekends or public holidays. Dates can also move when tax authorities issue new guidance or introduce temporary relief measures.

Why Dates Can Shift

Before looking at specific schedules, remember that the tax return dates 2026 will not be fixed. Let's explore the reasons why these dates shift year to year.

- Deadlines move when the original due date falls on a weekend or holiday.

- New tax laws or budget changes can slightly alter filing and payment schedules.

- Administrative needs, like processing capacity or system upgrades, may shift key dates.

- Governments sometimes delay deadlines to support taxpayers during crises or disasters.

Part 3. How Long Does a Tax Return Take in 2026?

After filing, many taxpayers ask, “How long does tax return take?” before any refund arrives. Let's break down the key timelines and what can speed things up.

E‑Filing vs. Paper Filing Timelines

To see how filing method affects processing speed, look at the table below comparing electronic and paper filing methods.

| Filing Method | Typical Speed and Notes |

| E‑file + Direct Deposit | Fast, many simple returns finish within weeks. |

| E‑file + Mailed Check | Slower; time added for printing and mailing. |

| Paper Return + Direct Deposit | Slower processing, but quicker payment than a check. |

| Paper Return + Mailed Check | Slower processing, but quicker payment than a check. |

Typical Refund Processing Times by Country

Having compared both filing methods, let's look at how long refunds typically take in different countries.

- United States: Many accurate e‑filed returns with direct deposit are issued within a few weeks.

- Canada: Simple electronically filed returns are often processed in roughly one to two weeks.

- United Kingdom: Straightforward online Self-Assessment returns are commonly finalized within a few weeks.

- Australia: Many online individual returns are processed within several weeks after successful lodgment.

Factors That Slow Down Refunds

After looking at average timelines, look at the factors that can affect tax return dates 2026.

- Errors in names, addresses, identification numbers, or bank account details.

- Missing forms, mismatched income information, or unreported income items.

- Large or unusual credits that need extra checks by the tax authority.

- Suspected identity theft, fraud concerns, or other security‑related reviews.

Differences Between Personal and Business Returns

Business returns are usually more complex than individual returns and often take longer to process. They may include multiple income sources and detailed deductions. Simple personal returns are typically reviewed and refunded more quickly.

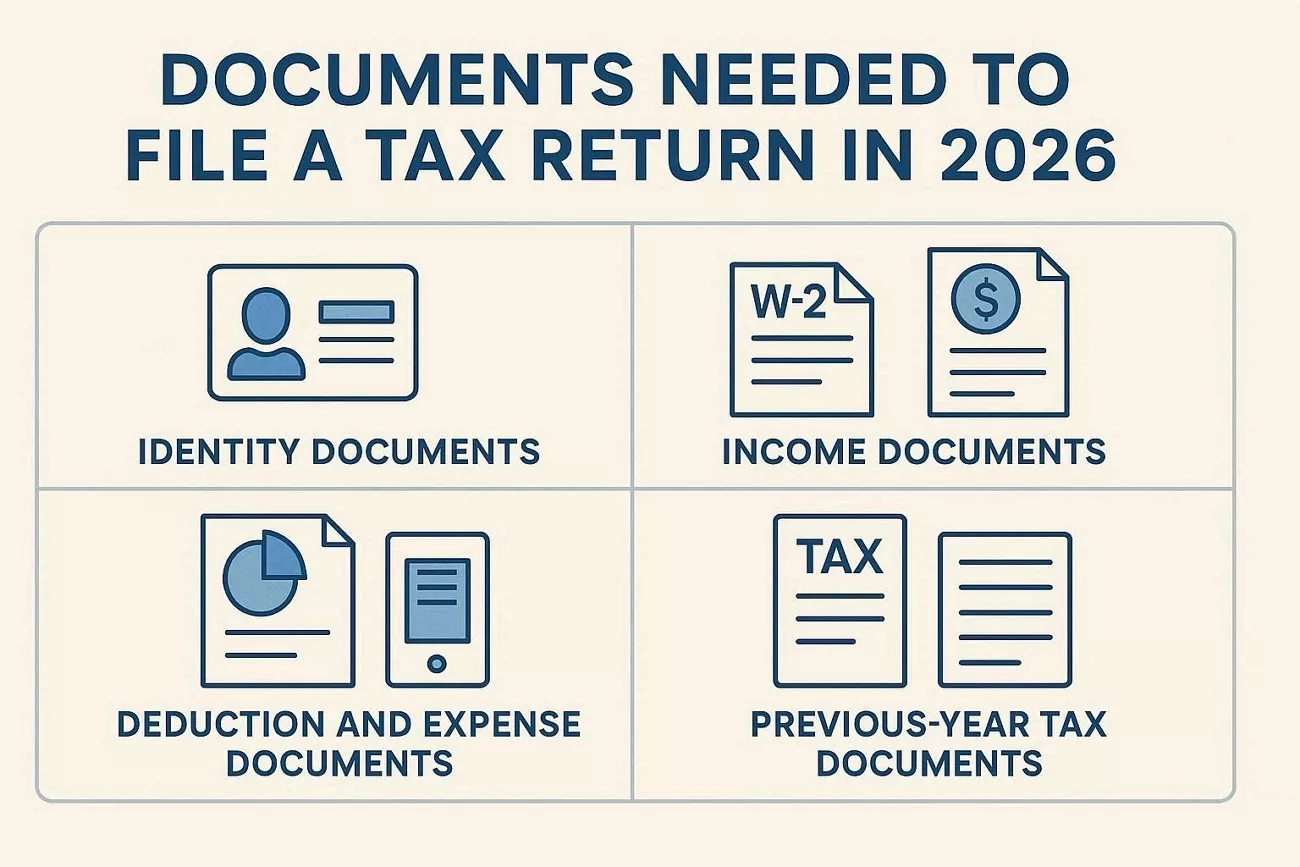

Part 4. Common Documents Needed to File a Tax Return in 2026

Once you know how long does tax return take to process, having all documents ready saves time and prevents errors.

- Identity Documents: Official ID and a matching tax number confirming your identity and registered personal details.

- Income Documents: Salary slips and rent receipts showing all taxable earnings for the year.

- Bank and Investment Documents: Bank statements and investment reports summarizing interest and capital gains received.

- Deduction and Expense Documents: Receipts for donations and business expenses claimed as deductions.

- Previous‑Year Tax Documents: Last year's return and tax authority notices used for carryovers, comparisons, and verification.

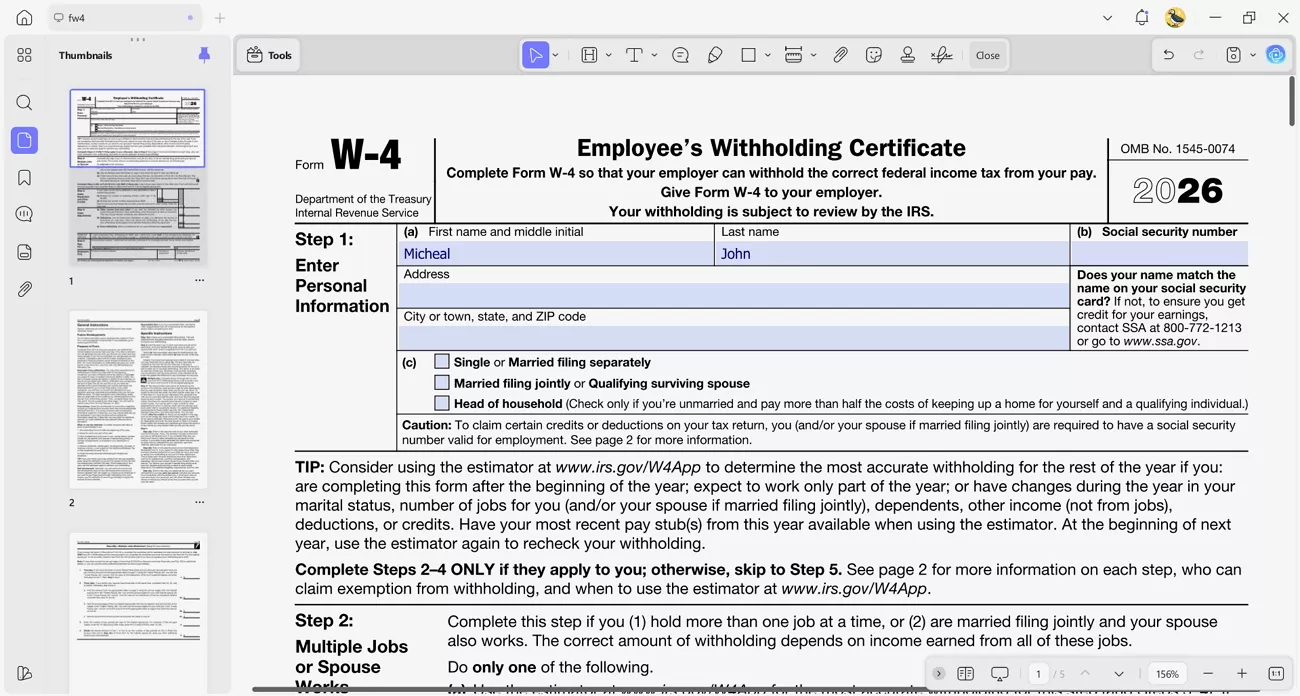

Part 5. How UPDF Helps You Prepare and File Tax Returns Efficiently

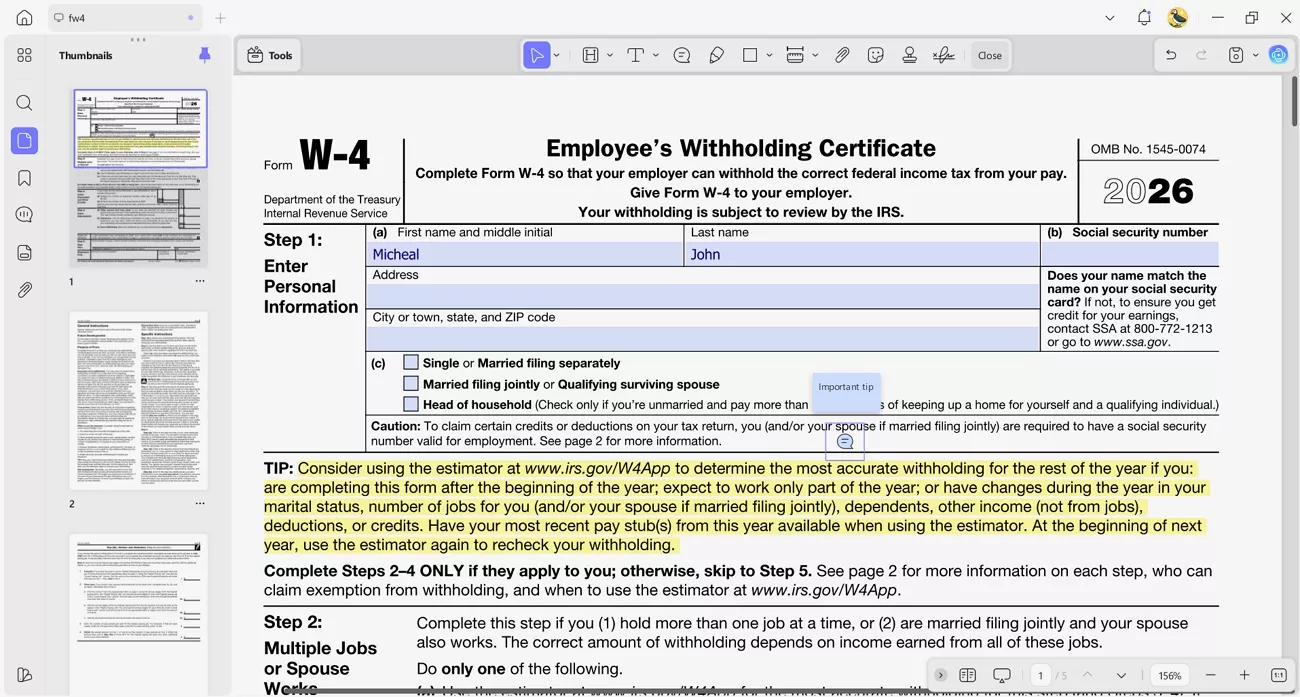

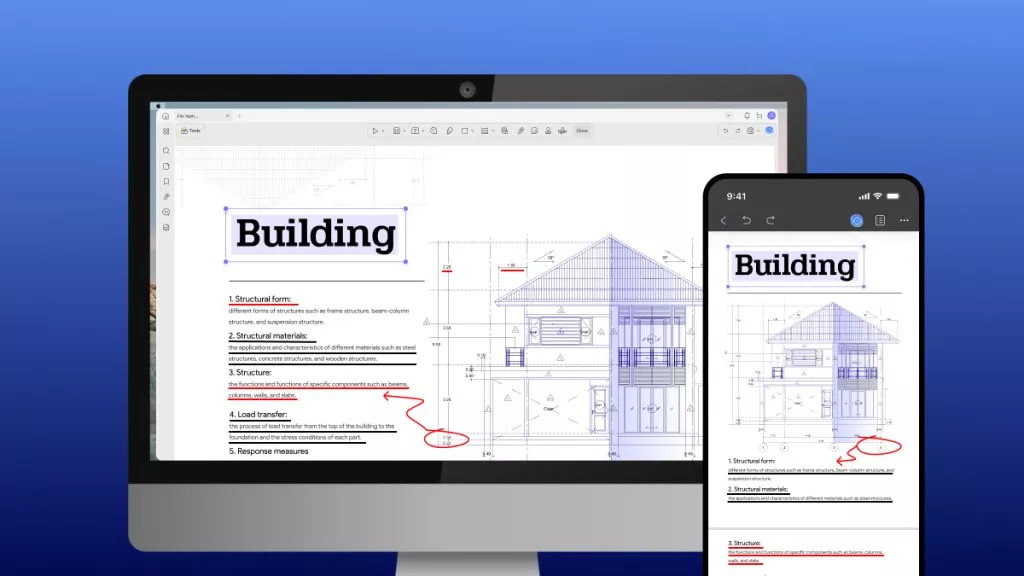

When preparing tax returns, many individuals and small business owners struggle to keep all their forms and receipts organized. This is where UPDF comes in to solve this problem by providing a single workspace where users can annotate and manage all PDF tax documents. It allows highlighting important fields and navigating multiple pages without printing to help users stay on top of tax return dates 2026.

Moreover, users can combine multiple PDFs and secure sensitive information with passwords. UPDF is available on Windows, macOS, iOS, and Android, which saves time during the tax season.

Windows • macOS • iOS • Android 100% secure

UPDF Key Features

Now, let's look at the unique features of UPDF that make it an incredible PDF management tool.

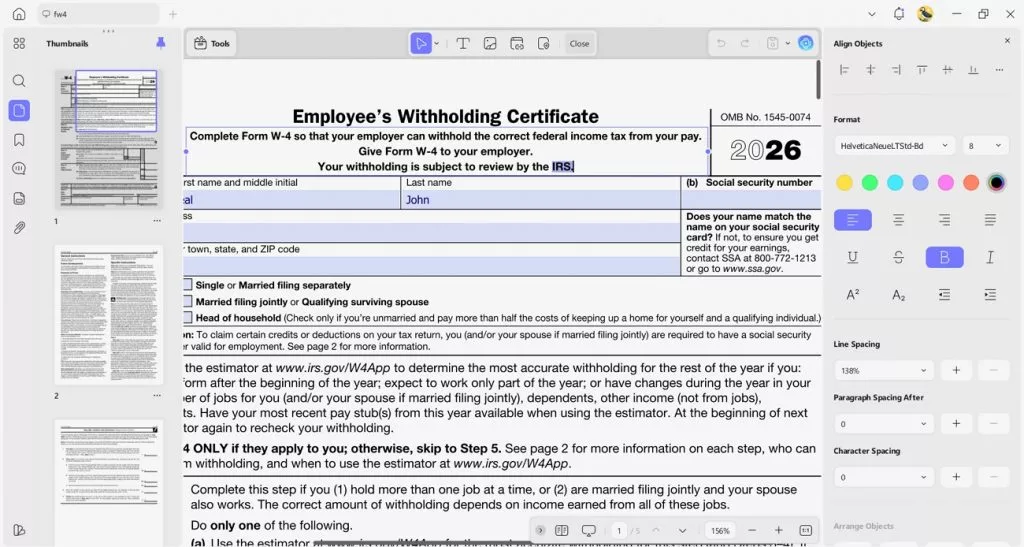

1. Fill PDF Forms: UPDF allows users to fill out tax documents directly on the PDF. Users can enter text, check boxes, and complete forms without printing.

2. Edit PDFs: UPDF allows editing text and images in PDF files. Users can change font, color, size, and adjust or move images as needed.

3. Annotate PDFs: This tool enables highlighting text, adding comments, or sticky notes for instructions.

It also allows inserting shapes and adding signatures to PDFs.

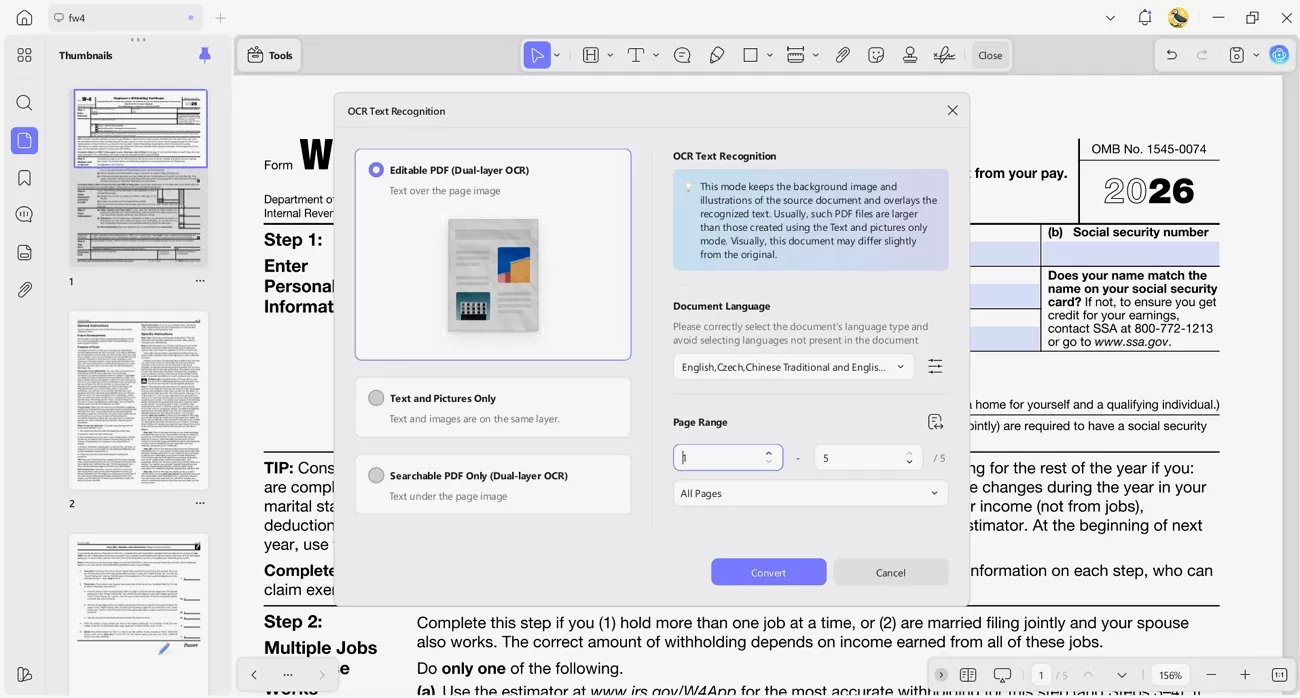

4. OCR PDF: UPDF can extract text from scanned or image PDFs. Multiple languages are supported for recognition.

5. Organize PDFs: Users can insert, replace, extract, and split pages to manage PDF documents.

If you want to stay on top of tax return dates, try UPDF to fill and edit your tax documents in one workspace. Download it today to simplify your filing, reduce mistakes, and save valuable time during tax season.

Part 6. Business and Corporate Tax Considerations in 2026

Business taxes in 2026 bring extra complexity compared to individual returns for companies managing payroll and multiple statutory filings. Let's explore how clear deadlines and organized documents help keep everything compliant.

Why Tax Deadlines Matter More for Businesses

Once you know how long does tax return take to process, deadlines become a strategic planning tool. Meeting those deadlines protects cash flow and keeps stakeholders confident.

Handling Multiple Employees and Filings

Managing 2026 business taxes means coordinating data from employees and many vendors. Accurate records ensure payroll and reported deductible expenses all match the final return.

Common Document Challenges For Finance And Accounting Teams

For finance and accounting teams, document‑related issues often create avoidable tax‑season stress.

- Tracking missing invoices from scattered departments and external vendors.

- Reconciling differences between accounting reports and bank statements before submission.

- Maintaining consistent naming and folder structures so documents are searchable during reviews.

- Preventing version conflicts when several colleagues update the same tax spreadsheets.

UPDF Enterprise for Tax and Finance Teams

For teams managing heavy tax, finance, and HR workflows, UPDF Enterprise Plan provides a centralized PDF workspace across departments. It combines editing, reviewing, and sharing in one place to help teams keep all key tax documents consistent. Now, look at the key highlights that matter most for tax and finance teams:

- Admin Console centralizes user and license management, letting admins assign, reassign, and deactivate seats for each team.

- Secure document control adds role‑based access, managed cloud storage, and controlled sharing to protect confidential financial and HR files.

- Professional PDF toolkit covers editing, converting, OCR, forms, batch processing, and AI review for complex tax and finance documents.

Part 7. Common Tax Filing Mistakes to Avoid in 2026

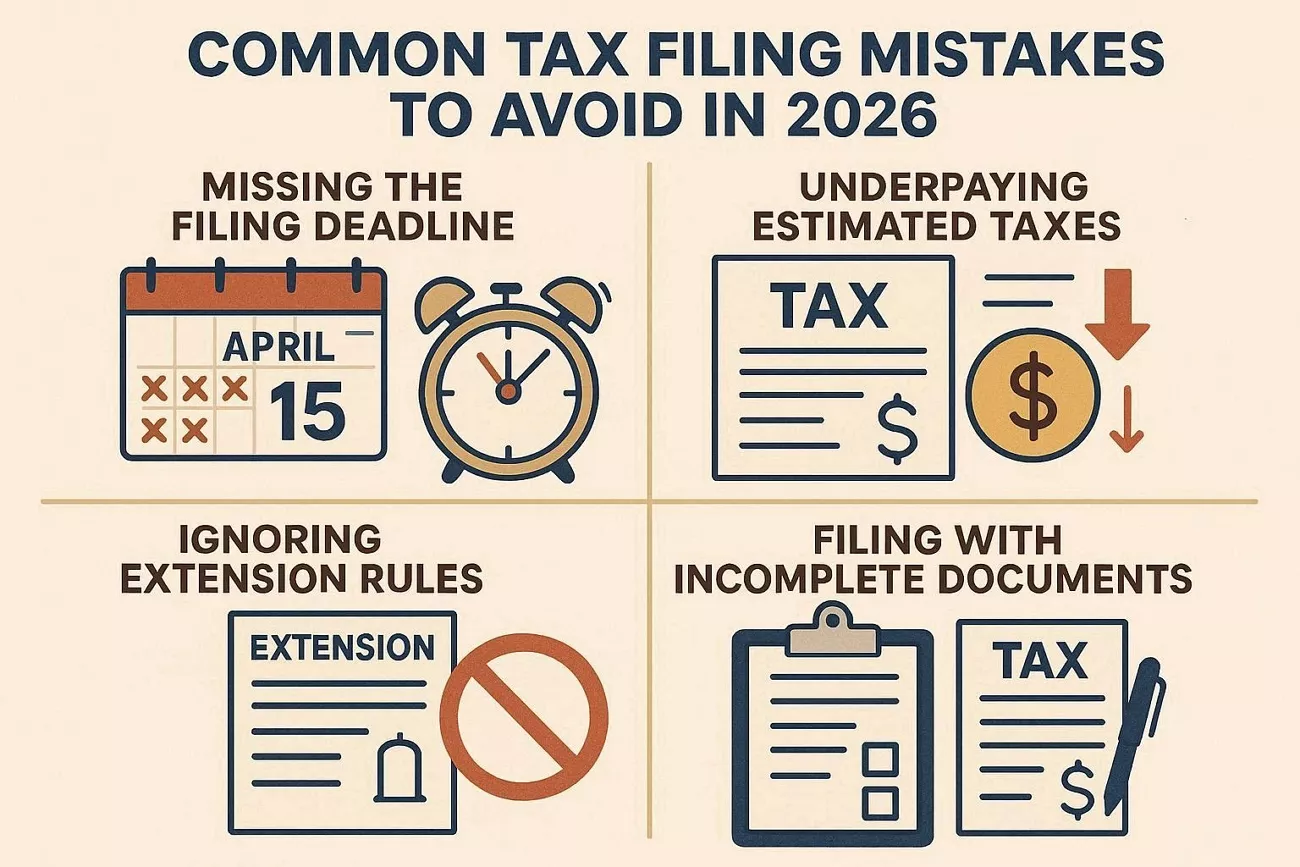

Lastly, look at the common mistakes many taxpayers made around tax return dates 2025, so you can avoid repeating them in 2026.

- Missing the Filing Deadline: This happens when taxpayers submit returns after the due date and face late‑filing penalties and interest.

- Underpaying Estimated Taxes: Multi‑income taxpayers sometimes pay too little during the year and incur underpayment penalties.

- Ignoring Extension Rules: Some people file an extension and wrongly assume it delays payment, leading to unexpected interest and penalties.

- Filing With Incomplete Documents: Missing forms and schedules can cause processing delays, extra notices, or the need to amend returns later.

Conclusion

In this guide, you learn how tax return dates 2026 affect filing timelines, refund expectations, and preparation requirements. It highlights common delays and planning tips to help avoid penalties and stress. If you want to manage tax forms, receipts, and records more easily, try UPDF to organize documents, reduce errors, and stay prepared throughout tax season.

Windows • macOS • iOS • Android 100% secure

UPDF

UPDF

UPDF for Windows

UPDF for Windows UPDF for Mac

UPDF for Mac UPDF for iPhone/iPad

UPDF for iPhone/iPad UPDF for Android

UPDF for Android UPDF AI Online

UPDF AI Online UPDF Sign

UPDF Sign Edit PDF

Edit PDF Annotate PDF

Annotate PDF Create PDF

Create PDF PDF Form

PDF Form Edit links

Edit links Convert PDF

Convert PDF OCR

OCR PDF to Word

PDF to Word PDF to Image

PDF to Image PDF to Excel

PDF to Excel Organize PDF

Organize PDF Merge PDF

Merge PDF Split PDF

Split PDF Crop PDF

Crop PDF Rotate PDF

Rotate PDF Protect PDF

Protect PDF Sign PDF

Sign PDF Redact PDF

Redact PDF Sanitize PDF

Sanitize PDF Remove Security

Remove Security Read PDF

Read PDF UPDF Cloud

UPDF Cloud Compress PDF

Compress PDF Print PDF

Print PDF Batch Process

Batch Process About UPDF AI

About UPDF AI UPDF AI Solutions

UPDF AI Solutions AI User Guide

AI User Guide FAQ about UPDF AI

FAQ about UPDF AI Summarize PDF

Summarize PDF Translate PDF

Translate PDF Chat with PDF

Chat with PDF Chat with AI

Chat with AI Chat with image

Chat with image PDF to Mind Map

PDF to Mind Map Explain PDF

Explain PDF Scholar Research

Scholar Research Paper Search

Paper Search AI Proofreader

AI Proofreader AI Writer

AI Writer AI Homework Helper

AI Homework Helper AI Quiz Generator

AI Quiz Generator AI Math Solver

AI Math Solver PDF to Word

PDF to Word PDF to Excel

PDF to Excel PDF to PowerPoint

PDF to PowerPoint User Guide

User Guide UPDF Tricks

UPDF Tricks FAQs

FAQs UPDF Reviews

UPDF Reviews Download Center

Download Center Blog

Blog Newsroom

Newsroom Tech Spec

Tech Spec Updates

Updates UPDF vs. Adobe Acrobat

UPDF vs. Adobe Acrobat UPDF vs. Foxit

UPDF vs. Foxit UPDF vs. PDF Expert

UPDF vs. PDF Expert

Engelbert White

Engelbert White

Italo Rossi

Italo Rossi

Delia Meyer

Delia Meyer

Enola Davis

Enola Davis